Tag: mortgage origination

Home-Mortgage Lending Declines Again Across U.S. During Third Quarter As Mortgage Rates Climb

Residential Loans Drop 3 Percent After Brief Second-Quarter Surge; Purchase and Home-Equity Lending Both Down 7 Percent Following Earlier Gains; But Refinance Activity Rises for Second Straight Quarter IRVINE, Calif. – Nov. 30, 2023 — ATTOM, a leading curator of land, property, and real estate data, today released its third-quarter 2023 U.S.... Read More »

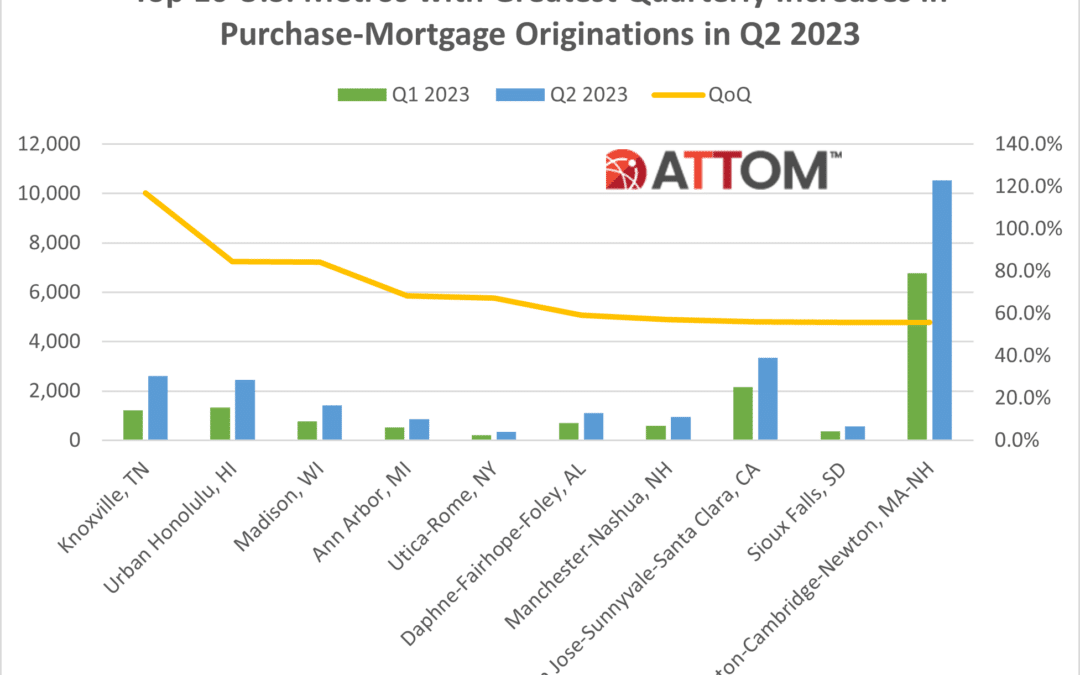

Top 10 U.S. Metros Where Purchase-Mortgage Originations Are On The Rise

ATTOM’s Q2 2023 U.S. Residential Property Mortgage Origination Report shows that the total number of mortgages secured by residential property in the U.S. increased to 1.56 million in Q2 2023. The report noted that while that figure remained down 38 percent annually, it was up 21 percent quarterly – the first such increase in two years. According... Read More »

Home-Mortgage Lending Revives Across U.S. In The Second Quarter Of 2023

Residential Loans Up 21 Percent Following Eight Straight Quarterly Declines; Purchase Lending Leads the Way, Spiking 29 Percent; Refinance and Home-Equity Activity Also Rise IRVINE, Calif. – Aug. 31, 2023 —ATTOM, a leading curator of land, property, and real estate data, today released its second-quarter 2023 U.S. Residential Property Mortgage... Read More »

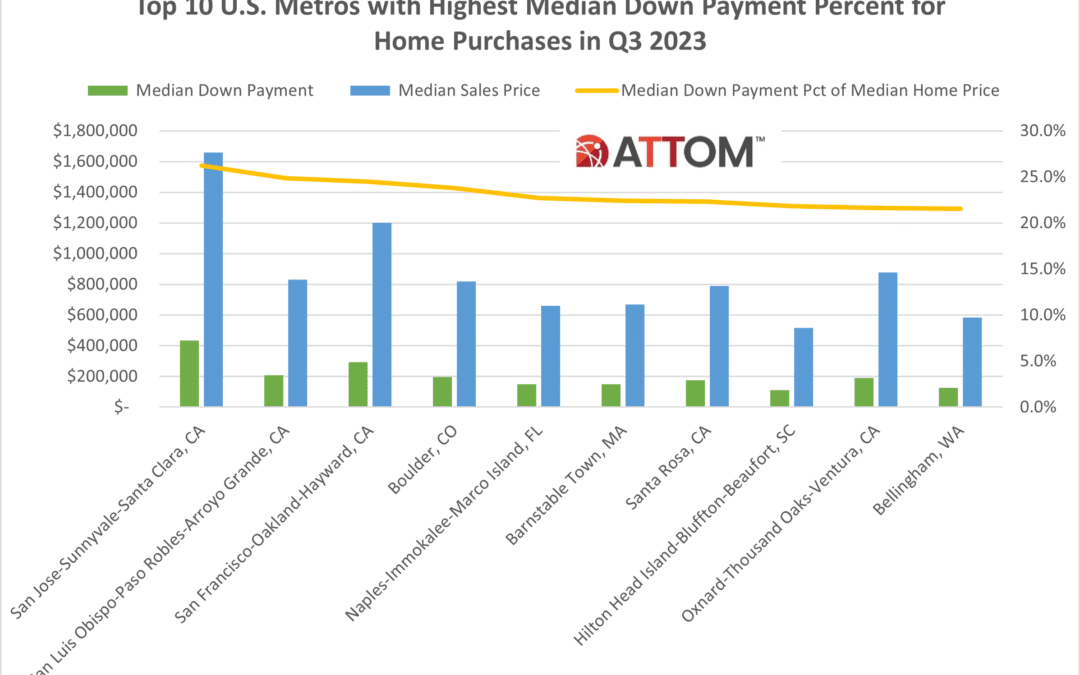

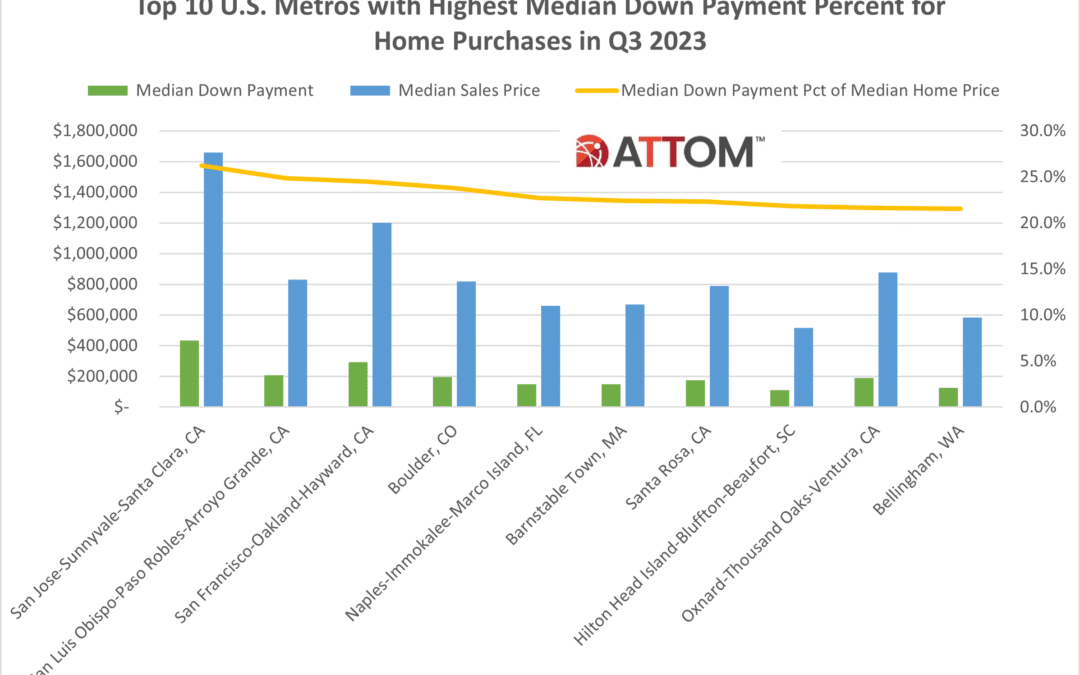

Top 10 U.S. Housing Markets with Greatest Median Down Payments in Q1 2023

According to ATTOM’s Q1 2023 U.S. Residential Property Mortgage Origination Report, just 1.25 million mortgages secured by residential property were originated in Q1 2023 – the lowest point since late-2000. The report noted that figure was down 19 percent from Q4 2022 – marking the eighth quarterly decrease in a row – and down 56 percent from Q1... Read More »

Home-Mortgage Lending Across U.S. Falls To More Than 20-Year Low In First Quarter

Total Residential Loans Drop Another 19 Percent Quarterly to Lowest Point Since 2000; Refinance and Purchase Lending Decline Nearly 20 Percent Quarterly, With Refinancing Down 85 Percent Annually; Home-Equity Lending Decreases for Second Straight Quarter IRVINE, Calif. – June 1, 2023 — ATTOM, a leading curator of land, property, and real estate... Read More »