ATTOM’s Q4 2022 U.S. Residential Property Mortgage Origination Report found that 1.52 million mortgages secured by residential property (1 to 4 units) were originated in Q4 2022 in the U.S. According to the report, that figure was down 24 percent from Q3 2022, marking the seventh quarterly decrease in a row, and down 55 percent from Q4 2021.

The report noted that lenders issued just $476 billion worth of mortgages in Q4 2022, down quarterly by 27 percent and annually by 57 percent. The report also noted there were 708,739 loans granted to home purchasers in Q4 2022. That figure was down 26 percent from Q3 2022 and 45 percent from Q4 2021. ATTOM’s latest report also found the dollar volume of purchase mortgages dropped 28 percent quarterly and 44 percent annually, to $257 billion.

Also according to the report, on the refinance side, only 496,221 mortgages were rolled over into new ones, down 27 percent quarterly and 73 percent annually. While the dollar volume of refinance loans was down 27 percent from the prior quarter and 73 percent annually, to $158 billion.

ATTOM’s Q4 2022 mortgage origination report stated that even home-equity lending dropped, by 16 percent in the last few months of 2022 – to a total of 313,973, following growth in five of the previous six quarters. The report mentioned the latest HELOC lending number was still up 31.8 percent from 238,164 in Q4 2021.

According to the report, despite the fourth-quarter decline, HELOCs still comprised 20.7 percent of all Q4 2022 loans – nearly five times the 4.6 percent level from the Q1 2021.

The report also stated that HELOC mortgage originations decreased from Q3 to Q4 2022 in 83 percent of the metro areas analyzed, with the largest decreases among metro areas with a population of at least 1 million, in Buffalo, NY (home-equity credit lines down 45.1 percent); Fresno, CA (down 39.8 percent); San Jose, CA (down 38.9 percent); Sacramento, CA (down 35.5 percent) and San Francisco, CA (down 35.2 percent).

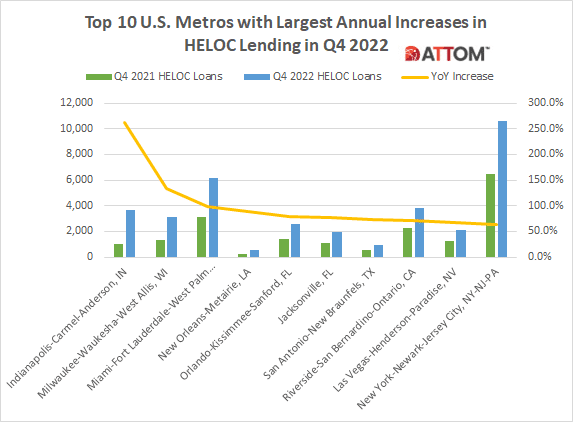

In this post, we take a deep data dive among U.S. metro areas with a population greater than 1 million, to reveal the top 10 metros with the largest annual increases in HELOC lending in Q4 2022. Those top metros include: Indianapolis-Carmel-Anderson, IN (up 261.4 percent); Milwaukee-Waukesha-West Allis, WI (up 134.3 percent); Miami-Fort Lauderdale-West Palm Beach, FL (up 97.9 percent); New Orleans-Metairie, LA (up 89.5 percent); Orlando-Kissimmee-Sanford, FL (up 79.5 percent); Jacksonville, FL (up 76.2 percent); San Antonio-New Braunfels, TX (up 74.0 percent); Riverside-San Bernardino-Ontario, CA (up 71.2 percent); Las Vegas-Henderson-Paradise, NV (up 68.3 percent); and New York-Newark-Jersey City, NY-NJ-PA (up 62.6 percent).

ATTOM’s Q4 2022 mortgage origination analysis also found that mortgages backed by the Federal Housing Administration (FHA) rose as a portion of all lending for the fifth straight quarter. According to the report, they accounted for 181,324, or 11.9 percent, of all residential property loans originated in Q4 2022. That figure was up from 11.3 percent in Q3 2022 and 9.8 percent in Q4 2021.

Also according to the report, residential loans backed by the U.S. Department of Veterans Affairs (VA) totaled 80,061, or 5.3 percent, of all residential property loans originated in Q4 2022 – up from 5.2 percent in the previous quarter, although still down from 6 percent a year earlier.

Want to learn more about HELOC lending and other mortgage origination trends in your area? Contact us to find out how!