ATTOM’s Q2 2023 U.S. Residential Property Mortgage Origination Report shows that the total number of mortgages secured by residential property in the U.S. increased to 1.56 million in Q2 2023. The report noted that while that figure remained down 38 percent annually, it was up 21 percent quarterly – the first such increase in two years.

According to the report, that turnaround resulted from across-the-board quarterly increases of 13 to 29 percent in purchase, refinance and home-equity lending. The report also noted that total activity rose after eight straight declines that had reduced lending by two-thirds.

ATTOM’s Q2 2023 mortgage origination report stated that overall lending remained down sharply in Q2 2023 compared to highs hit in 2021. However, overall home-mortgage activity included a 29 percent quarterly jump in loans granted to home purchasers, to almost 794,000, and a 14 percent increase in refinance packages, to 477,000. The report also noted that home equity lines of credit, known as HELOCs, went up in Q2 2023, by 13 percent, to 285,000.

Also according to ATTOM’s latest report, while residential purchase-mortgage originations decreased annually in Q2 2023 in 95 percent of those metros analyzed, they were up quarterly in 98 percent.

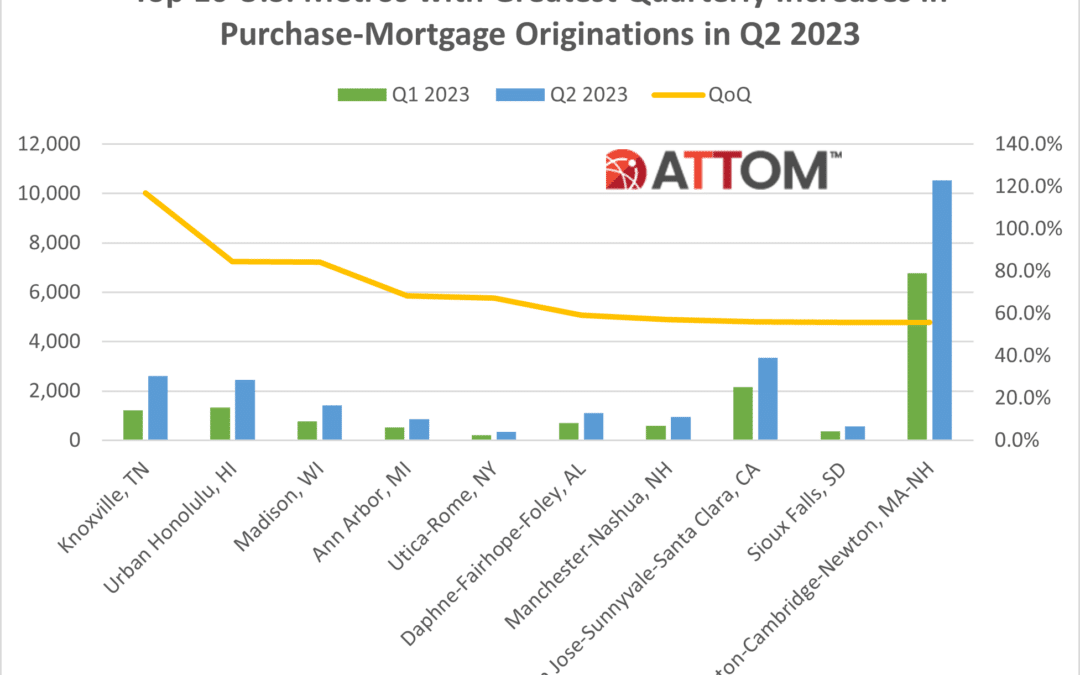

ATTOM’s second-quarter mortgage origination analysis reported that the largest quarterly increases in purchase-mortgage originations were in Knoxville, TN (purchase loans up 116.8 percent); Honolulu, HI (up 84.4 percent); Madison, WI (up 84.4 percent); Ann Arbor, MI (up 68.3 percent) and Utica, NY (up 67.3 percent).

In this post, we take a deep data dive into the data behind the latest ATTOM mortgage origination report to uncover not only the complete list of top 10 U.S. metros with the greatest quarterly increases in purchase-mortgage originations in Q2 2023, but also those purchase loan numbers, contributing to that growth.

Those top markets rounding out the top 10 include: Daphne-Fairhope-Foley, AL (up 59.1 percent); Manchester-Nashua, NH (up 57 percent); San Jose-Sunnyvale-Santa Clara, CA (56.1 percent); Sioux Falls, SD (55.7 percent); and Boston-Cambridge-Newton, MA-NH (55.7 percent).

ATTOM’s Q2 2023 mortgage origination report also found that mortgages backed by the Federal Housing Administration (FHA) rose as a portion of all lending for the seventh straight quarter. According to the report, those loans accounted for 213,944, or 13.8 percent, of all residential property loans originated in Q2 2023, up from 12.9 percent in Q1 2023 and 10.7 percent in Q2 2022.

The report also found that residential loans backed by the U.S. Department of Veterans Affairs (VA) totaled 84,917, or 5.5 percent, of all residential property loans originated in Q2 2023, which was the same portion as in the previous quarter, although still up from 5.1 percent a year earlier.

Want to learn more about mortgage origination trends in your area? Contact us to find out how!