According to ATTOM’s Q3 2023 U.S. Residential Property Mortgage Origination Report, 1.54 million mortgages secured by residential property were issued in the U.S. in Q3 2023, representing a 3 percent decline from the prior three-month period. The report noted that drop-off marked the ninth decline in the last 10 quarters – a string broken only by a spike during the second quarter of this year.

ATTOM’s latest analysis found that the third-quarter downturn, which came amid increases in mortgage rates and home prices, left total residential lending activity down 26 percent from a year earlier and 63 percent from a high point hit in 2021.

The newly released Q3 2023 mortgage origination report also found that lending activity resumed its extended downturn with a mix of gains and losses in major categories of residential lending, as growth in refinance activity was more than offset by drops in purchase and home-equity lending.

Also according to the report, the number of refinanced loans increased 5 percent quarterly, to roughly 516,500, while lending to home buyers went down 7 percent, to about 752,000, and home-equity credit lines also dipped 7 percent, to 272,000.

ATTOM’s third-quarter mortgage origination analysis reported that while the median single-family home loan saw a slight decrease nationwide, the typical down payment percentage for home purchases increased.

The report stated that among homes purchased with financing in Q3 2023, the median loan amount was $319,500. That figure was down 0.9 percent from $322,500 in the prior quarter, although still up annually by 1.1 percent, from $316,000.

According to the report, the median down payment of $35,050 on single-family homes and condos purchased with financing in Q3 2023 was up 12.2 percent from $31,250 in Q2 2023. The report noted that with home prices rising at a smaller pace around the country, the typical down payment increased as a percentage of the median purchase price. That represented 9.2 percent of the median price in the third quarter of 2023, which was up from 8.2 percent in the prior quarter and about the same as the 9.3 percent level from a year earlier.

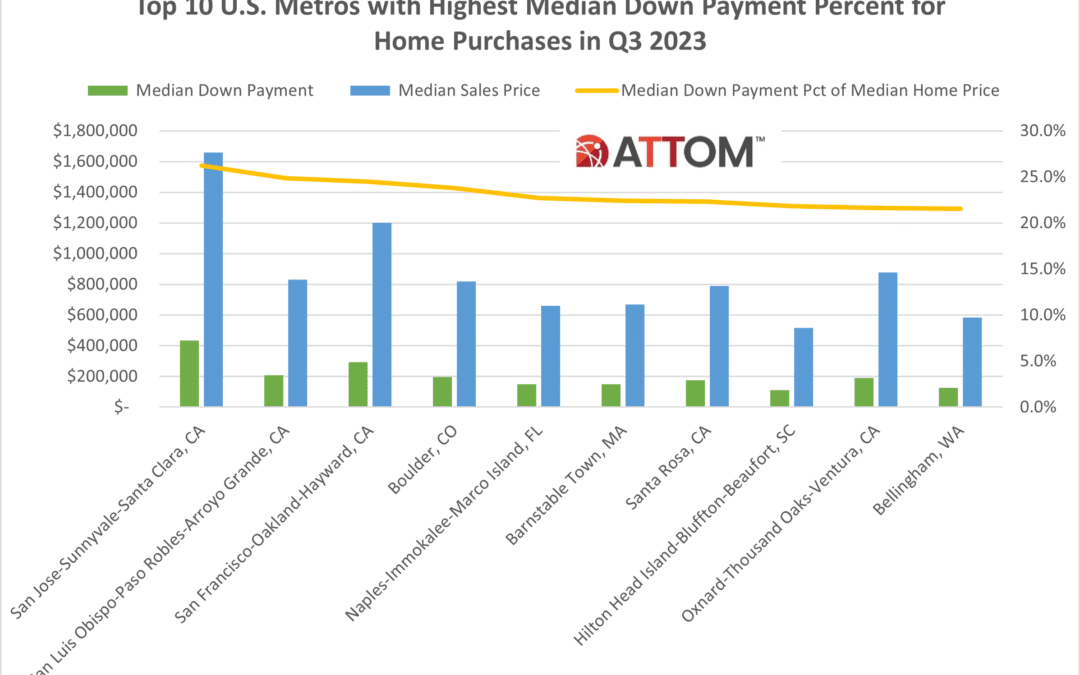

In this post, we take a deep data dive into the data behind the latest ATTOM mortgage origination report to uncover the top 10 U.S. metros with the highest median down payment percentage for home purchases.

Those metros include: San Jose-Sunnyvale-Santa Clara, CA (26.2 median down payment percent of median home price); San Luis Obispo-Paso Robles-Arroyo Grande, CA (24.9 percent); San Francisco-Oakland-Hayward, CA (24.5 percent); Boulder, CO (23.8 percent); Naples-Immokalee-Marco Island, FL (22.7 percent); Barnstable Town, MA (22.4 percent); Santa Rosa, CA (22.3 percent); Hilton Head Island-Bluffton-Beaufort, SC (21.8 percent); Oxnard-Thousand Oaks-Ventura, CA (21.6 percent); and Bellingham, WA (21.5 percent).

Want to learn more about mortgage origination trends in your area? Contact us to find out how!