Real Estate News – Recent Articles

Profits for U.S. Home Sellers Decline Again in First Quarter of 2024 as Prices Fall

Profit Margins on Typical Home Sales Nationwide Decrease to 55 Percent; Returns Slip Downward as Median U.S. Home Price Slumps 4 percent; IRVINE, Calif. – Apr. 25, 2024 — ATTOM, a leading curator of land, property, and real estate data, today released its first-quarter 2024 U.S. Home Sales Report, which shows that profit margins on median-priced... Read More »

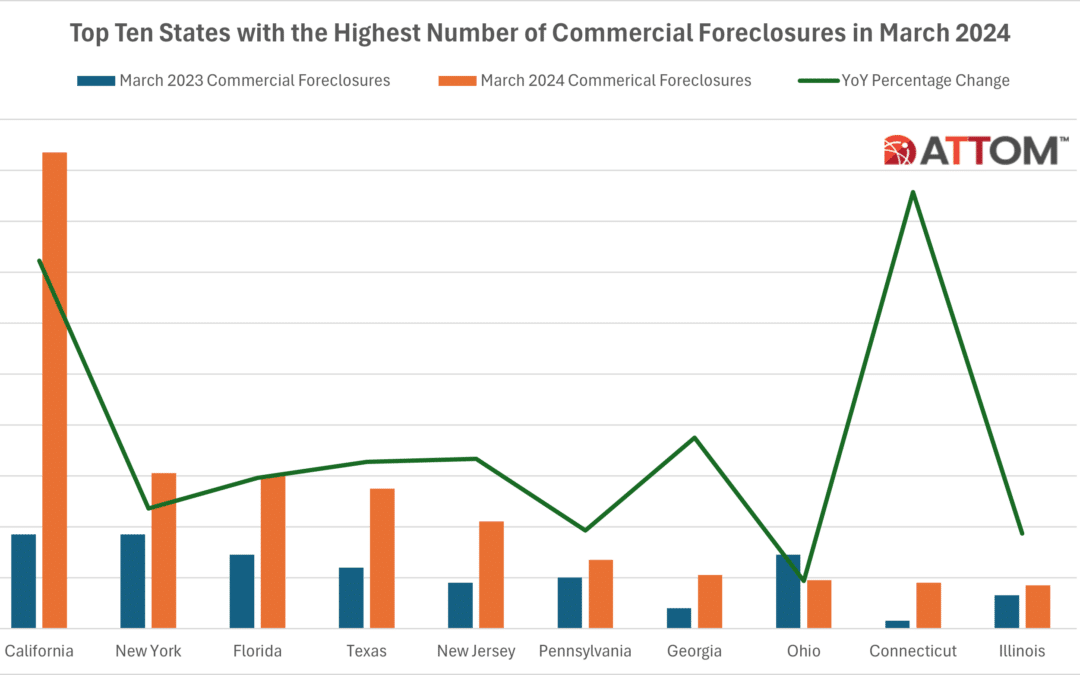

Top 10 States with the Highest Number of Commercial Foreclosure in March 2024

According to ATTOM’s newly released U.S. Commercial Foreclosure Report, there is a persistent uptrend in commercial foreclosures over the years, starting from a minimum of 141 in May 2020 and reaching 625 in March 2024. This signifies a consistent rise over the entire period. ATTOM’s latest commercial foreclosure activity analysis also noted that... Read More »

U.S. Commercial Foreclosures Increase in March 2024

Commercial Foreclosures Increased 6 Percent from Last Month and 117 Percent from Last Year; States with the Most Commercial Foreclosures in March 2024 Included California, New York and Florida IRVINE, Calif. — April 17, 2024 — ATTOM, a leading curator of land, property, and real estate data, today released an updated monthly report on U.S.... Read More »

The Benefits of Pre-Populated Customer Forms for Insurers

With so much competition across the insurance markets, insurers need to find new ways to help draw in new customers and improve the experience of existing ones — from providing the most competitive rates to offering additional benefits. Another way insurers can help convert more prospects and improve customer satisfaction rates is by offering the... Read More »

Top 10 ZIPS with Highest Foreclosure Rates in Q1 and March 2024

According to ATTOM’s newly released Q4 and March 2024 U.S. Foreclosure Market Report, there were a total of 95,349 U.S. properties with foreclosure filings in the first quarter. That figure was up 3 percent from the previous quarter but down less than 1 percent from a year ago. ATTOM’s latest foreclosure activity analysis reported that nationwide... Read More »