Tag: mortgage origination

Top 10 U.S. Metros with Highest Home-Purchase Down Payments

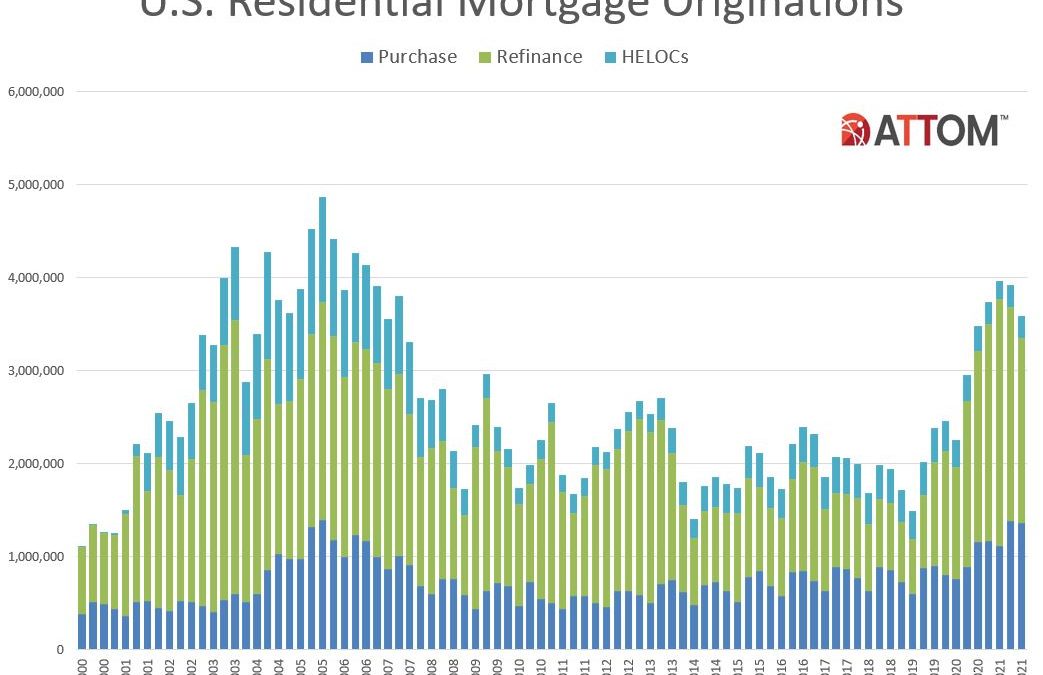

ATTOM’s just released Q3 2021 U.S. Residential Property Mortgage Origination Report shows that overall mortgage lending was down 8 percent in Q3 2021, marking the second straight quarterly decline and the first time in more than two years that total lending decreased in two consecutive quarters. The Q3 2021 loan origination analysis conducted by... Read More »

Mortgage Lending Declines At Unusually Fast Pace Across U.S. During Third Quarter Of 2021

Overall Loan Activity Down 8 Percent, Marking Second Straight Quarterly Decrease; Mortgage Lending Down in Both Second and Third Quarters for First Time This Century; Refinance Mortgages Drop 13 Percent Quarterly, Purchase Loans Off 2 Percent IRVINE, Calif. – Dec. 2, 2021 — ATTOM, curator of the nation’s premier property database, today released... Read More »

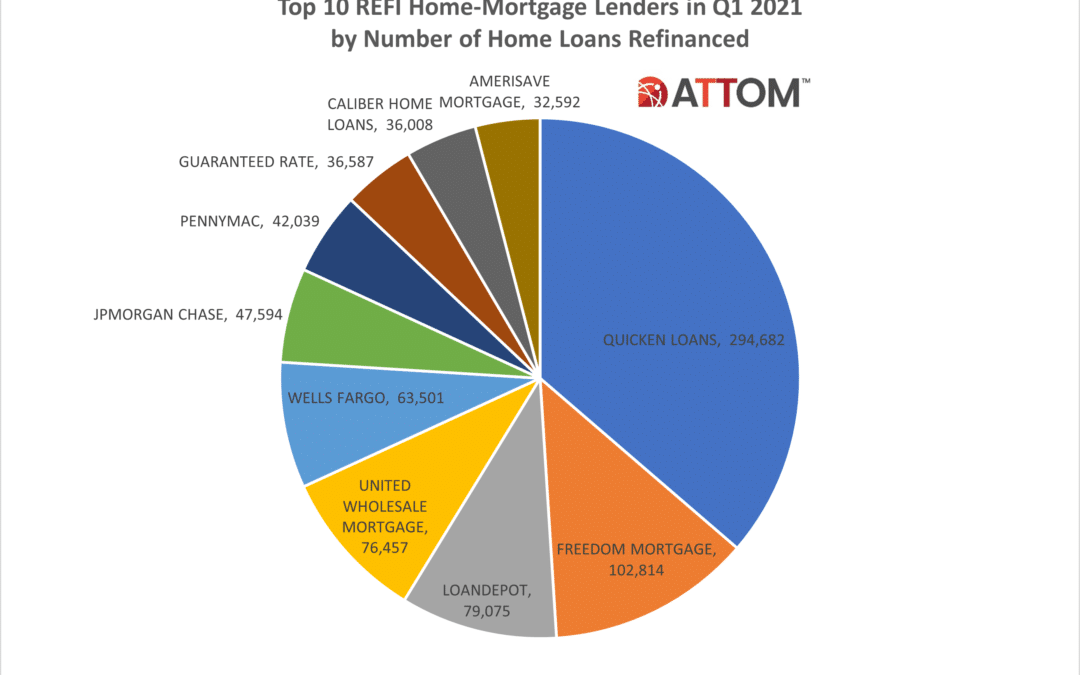

Top 10 REFI Home-Mortgage Lenders in Q1 2021

The key takeaway from ATTOM’s just released Q1 2021 U.S. Residential Property Mortgage Origination Report, was that the continued increase in mortgage activity during Q1 2021 resulted from the latest jump in refinance mortgages. The report noted that jump in refinance mortgages, which more than doubled over the past year, outpaced declines in... Read More »

Refinance Lending Continues Powering Unusually Strong Home-Mortgage Activity Across U.S.

Total Lending Increases Quarterly 3 Percent in First Quarter of 2021; Refinance Activity Rises 12 Percent While Purchase and Home-Equity Credit Lending Drop; Increase in Total Activity During First Quarter Not Seen Since 2009 IRVINE, Calif. – June 3, 2021 — ATTOM Data Solutions, curator of the nation’s premier property database, today released... Read More »

Refinance Loans Propel Yet Another Increase in Home Mortgage Lending Activity During Fourth Quarter of 2020

Total Lending Increases Another 5 Percent as Housing Market Remains Unscathed by Coronavirus Pandemic Fallout; Refinance Activity Rises 12 Percent Over Previous Quarter, Accounting For Almost Two-Thirds of All Loans; Home-Purchase Lending Dips While Home-Equity-Credit-Line Volume Grows IRVINE, Calif. – Mar. 4, 2021 — ATTOM Data Solutions, curator... Read More »