Southern California real estate investor, author and trainer Bruce Norris relies on data to drive his real estate investing strategy.

That means his strategy in preparing for the next recession — which he believes is coming in late 2019 or early 2020 — looks much different than his strategy leading up to the last recession.

Negative Interest Rates?

First, the Federal Reserve’s monetary policy in recent years has set the stage for an extremely favorable mortgage rate environment in response to a recession.

“During a recession, interest rates are lowered,” said Norris, CEO of The Norris Group. “The fed fund rate, in past recessions, has been lowered by 4 to 5 percent. What makes this impending recession most interesting is the fed fund rate will stand at 3 percent or less when the easing begins. If the Fed lowers rates as aggressively as they normally do, we could end up in negative interest rate territory and have a 30-year loan that starts with 2 percent!”

Rational Real Estate Borrowing Behavior

Secondly, Norris argued that lender and borrower behavior during the current housing boom has been much more rational and restrained, and that will translate into fewer delinquencies even if when a recession hits.

“During a boom time, owners typically use home equity lines to extract equity and either invest or buy toys. They did not do that this time around,” he said. “What’s happened between 2008 and 2018? The owners left most of that equity untouched! Owners of real estate are sitting on the biggest equity cushion ever!”

Real Estate Lenders Bending Over Backwards

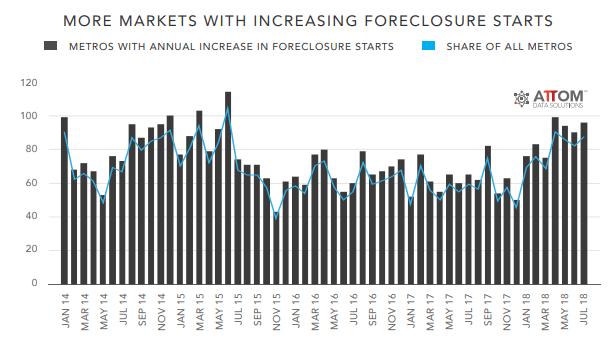

Lastly, Norris said lenders are responding to delinquency with a much kinder and gentler approach in the wake of the Great Recession, which will prevent another foreclosure tsunami like the one that caught the housing market off guard back in 2008.

“Lenders have taught borrowers the new methodology of handling delinquencies. Instead of filing foreclosure: the lenders bent over backwards to avoid taking the asset back via foreclosure,” he explained. “Lenders were allowed to ignore delinquencies, modify loans, and work with buyers in ways they never have before. This experience is still fresh in both the lenders’ and borrowers’ mind. When a recession hits, instead of a massive increase in foreclosure property, we’ll have an increase in delinquencies and a very patient reaction by lenders.”

Shifting Real Estate Investments From California to Florida

Given all this market trend data, Norris is not taking some of the extreme steps he took last time around when he believed a recession was looming, back in 2006.

“(We) saw that recession coming, we knew it would be devastating to real estate prices,” he said. “We sold our properties and told other California investors it would be wise to do the same.

“We go into this next recession feeling that real estate prices won’t take much of a price hit,” he continued. “The biggest change in our business model will be suggesting California investors move some of their equity positions to Florida. That move will increase their cash flow greatly and improve the quality of the inventory they hold.”

This article is sixth in a series spotlighting how different real estate industry leaders leverage property data and technology to hedge against housing market volatility. Below are the first four parts of the series.

Brokerage Taps Technology, Experience to Weather Housing Ups and Downs

Property Data Pre-Fill Streamlines Insurance Claims for Mortgage Servicers

Home Equity Data Optimizes Fundraising Efforts for Nonprofits

Digital Mortgage Application Optimized with Property Ownership Data

Single Family Rental Platform Puts Pedal to the Metal with Marketing Lists