Online single family rental marketplace OwnAmerica identifies and engages SFR operators with the help of targeted marketing lists generated by ATTOM Data Solutions from its nationwide database of more than 155 million U.S. properties. If you are interested in learning more about our single family rental analysis, visit our single family rental report page.

The Power of Property Marketing Lists

The property-level marketing lists include not just ownership information for non-owner occupied properties, but also property characteristics and home value data, allowing OwnAmerica to also provide portfolio valuation services to the rapidly growing SFR market.

“OwnAmerica is operating on the assumption that the market is very strong and will continue to be,” said Greg Rand, CEO. Rand even posted a challenge on LinkedIn offering to place a $10,000 bet that there will not be a recession in 2020. “Predictions of a coming recession might be wishful thinking from some people. I will leave you to speculate on why anyone would root for a recession.”

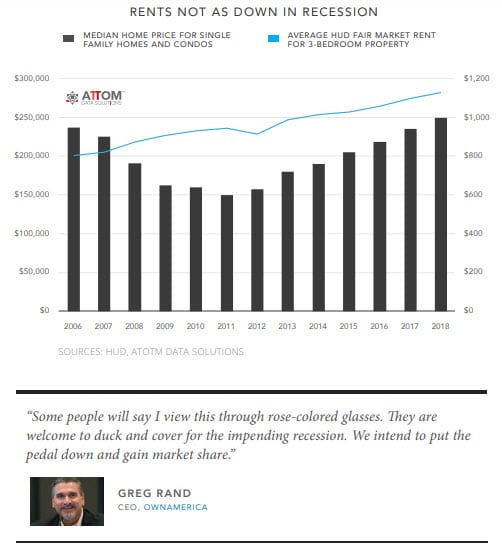

Rand argued that the investor niche his company operates in — single family rentals (SFR) — will benefit even if home prices do take a hit.

“Remember that SFR is different than housing overall. When the market is strong, investors and consumers are confident and prices rise. Investors win on appreciation,” he explained. “When the market is weak, homeownership declines and renter demand increases. Investors win on yield. SFR is a two-sided coin because every house has two uses: owner-occupied or tenant-occupied/investor owned. No other commercial asset class gives owners two demand drivers and two exit strategies.

“This is why ‘affordability’ being the negative buzz word of the year is all wrong,” Rand continued. “When prices rise, affordability necessarily declines. When buyers can’t afford, home sales decline, sellers get more reasonable and prices flatten or decline to meet the demand. This is the sign of a healthy market.

“Have you ever heard someone say the stock market is up, and that’s bad news because stock market affordability is down? You haven’t because it would be absurd,” he said, acknowledging that some may view his outlook as too optimistic. “Some people will say I view this through rose-colored glasses. They are welcome to duck and cover for the impending recession. We intend to put the pedal down and gain market share.”