Tag: loan origination

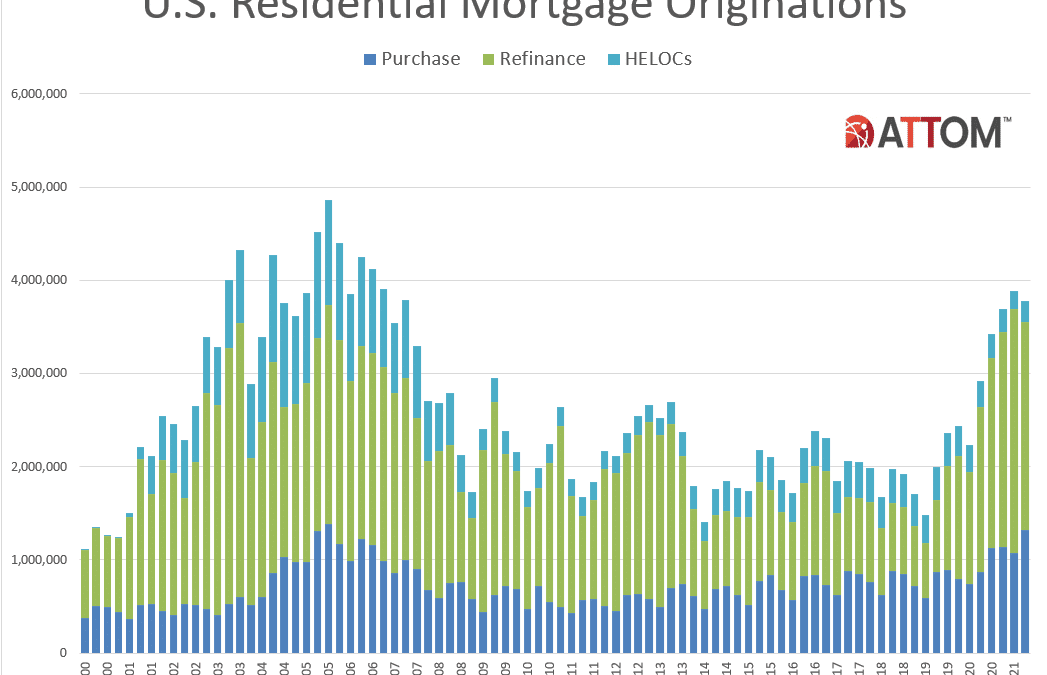

U.S. Home-Mortgage Lending Declines Again in First Quarter, Nearing Low Point

Residential Loans Down Another 7 Percent, to Smallest Level Since 2000; Total Lending Activity Off Almost 70 Percent in Three Years; Purchase, Refinance and Home-Equity Lending All Decrease IRVINE, Calif. – June 6, 2024 — ATTOM, a leading curator of land, property, and real estate data, today released its first-quarter 2024 U.S. Residential... Read More »

Home-Mortgage Lending Near Two-Decade Low as Slump Continues Across U.S. During Fourth Quarter

Residential Loans Drop Another 14 Percent; Purchase, Refinance and Home-Equity Lending All Decline IRVINE, Calif. – Feb. 29, 2024 — ATTOM, a leading curator of land, property, and real estate data, today released its fourth-quarter 2023 U.S. Residential Property Mortgage Origination Report, which shows that 1.35 million mortgages secured by... Read More »

Mortgage Lending Slows Amid Retreat In Refinancing Activity Across U.S. In Second Quarter

Overall Loan Activity Shows Rare Second-Quarter Decline; Refinance Lending Drops 15 percent Quarterly – Largest Decline in Three Years; Home-Purchase and Home-Equity Mortgages Increase IRVINE, Calif. – Aug. 19, 2021 — ATTOM, curator of the nation’s premier property database, today released its second-quarter 2021 U.S. Residential Property... Read More »

Residential Refinance Mortgages Comprise Over Half Of Home Loans In First Quarter Of 2020

Dollar Volume of Refinance Originations Doubles Annually in First Quarter of 2020; Total Loan Origination Dollar Volume Up 54 Percent from Last Year IRVINE, Calif. – May. 21, 2020 — ATTOM Data Solutions, curator of the nation’s premier property database and first property data provider of Data-as-a-Service (DaaS), today released its... Read More »

Residential Refinance Mortgages More Than Double in Fourth Quarter of 2019

Dollar Volume of Refinance Originations At Nearly Seven-Year High; Purchase Mortgages Up Annually 3 Percent; HELOC Originations Down Annually 6 Percent IRVINE, Calif. – Mar. 19, 2020 — ATTOM Data Solutions, curator of the nation’s premier property database and first property data provider of Data-as-a-Service (DaaS), today released its... Read More »