This ATTOM webinar, presented by industry thought-leaders, Rick Sharga, EVP of Market Intelligence for ATTOM, Len Kiefer, Deputy Chief Economist for Freddie Mac, and Sean Mooney, VP of Product Management for ATTOM, addresses the impact rates have been having on the mortgage industry and the U.S. housing market.

This webinar also provides a U.S. economic update, overview of mortgage rates, affordability review, ATTOM property data use cases for industry professionals, and more.

Rick Sharga begins this discussion by diving deep into a historical look at the GDP, employment data, consumer spending, consumer credit, inflation, and other U.S. economic trends, noting that the Federal Reserve has taken aggressive action based on these key economic indicators.

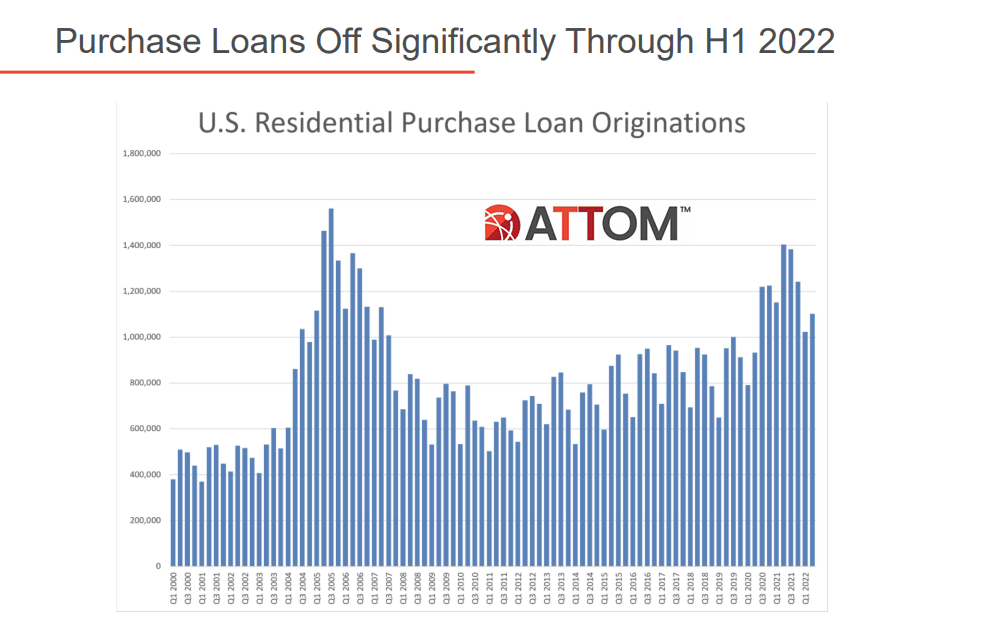

Rick also discusses key findings from ATTOM’s recent data reports, including historical trends in U.S. Residential Purchase Loan Originations, REFI Loans, and HELOC Activity.

Also, during this webinar, Len Kiefer examines the U.S. economy and housing market, looking at historical mortgage rate trends, as well as mortgage payments, interest rates, loan size trends, and mortgage payments relative to rents. Len also looks at the distribution of origination interest rates, noting that nearly two or three mortgages have interest rates of four percent of less.

Other areas Len discusses include the home purchase mortgage applications index, regional price trends, the reality of home prices, U.S. homeowner equity, and the growth of U.S. mortgage debt.

Sean Mooney weighs in on ATTOM Data for the mortgage industry, exploring the breadth of data solutions available, including:

- Tax Assessor

- Recorder/Deeds

- Pre-Foreclosure

- ATTOM AVM

- Loan and Estimated Equity

- NMLS IDs/Loan Origination

- Boundaries

- Climate Change Risk

Sean also presents various use cases for ATTOM’s mortgage data, ranging from marketing, processing and underwriting, to analytics and risk. He also outlines ATTOM Data solution details, including Data Licensing, APIs, ATTOM List, Match and Append, and Property Reports.

This webinar also provides an overview of ATTOM’s core value proposition and breadth of data solutions. ATTOM is the one-stop shop for premium property data fueling innovation, ATTOM provides analytics-ready data for real-world applications. ATTOM blends property tax, deed, mortgage, foreclosure, environmental risk, natural hazard and neighborhood data for more than 155 million U.S. residential and commercial properties, multi-sourced from more than 3,000 U.S. counties. ATTOM’s property data fuels growth across many industries to help drive decisions while delivering data in a variety of flexible customer solutions, including bulk data licensing, property data APIs and introducing ATTOM Cloud.

ATTOM’s robust property data is leveraged by customers to innovate in a variety of industries, including Real Estate, Insurance, Mortgage, Marketing, Government and Academia. By utilizing ATTOM’s robust property data, ATTOM clients not only create innovation but gain that competitive advantage within their industries. End-users of the data include developers, data scientists, risk managers, investors, policymakers and analysts. Discover ATTOM’s Table of Data Elements.

Want to hear more firsthand on whether rising mortgage rates will sink all ships?

Click here to listen to the entire webinar.