Single Family Rental

ATTOM Data Solutions Ranks Best Counties for Buying Single Family Rentals in 2019

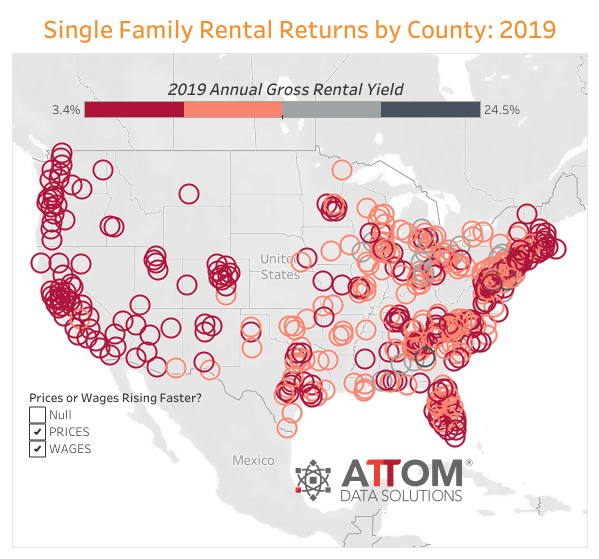

Highest Potential SFR Returns in Baltimore, Macon, Vineland, Rockford, Detroit; Rental Returns Increase from a Year-Ago in 5 7 Percent of Counties Analyzed IRVINE, Calif. – March 14, 2019 — ATTOM Data Solutions, curator of the nation’s premier property database, today released its Q1 2019 Single Family Rental Market report, which ranks the best... Read More »

Leading iBuyers Selling Nearly One in 10 Homes to Institutional Investors According to New ATTOM Data Solutions Analysis

Top Three Buying Entities Related to Companies Purchasing Single Family Homes as Rentals IRVINE, Calif. — Nov. 29, 2018 — ATTOM Data Solutions, curator of the nation’s premier property database, today released an analysis that shows that nearly one in 10 homes sold so far in 2018 by the nation’s two leading iBuyers — Opendoor and Offerpad — were... Read More »

Nearly 1.5 Million Vacant U.S. Homes in Q3 2018 Represent 1.52 Percent of All Single Family Homes and Condos

Vacant Home Rate Down from 1.58 Percent in Q3 2017 10,000 Vacant “Zombie” Foreclosures Down From More Than 44,000 in 2013 IRVINE, Calif. – Oct. 30, 2018 — ATTOM Data Solutions, curator of the nation’s premier property database, today released its 2018 Vacant Property and Zombie Foreclosure Report, which shows that nearly 1.5 million (1,447,906)... Read More »

Changing Seasons of Opportunity for Real Estate Investors

In the Carolinas, fall is always one of my favorite seasons. We’re recharged from vacations and school breaks and feel some relief from the heat and humidity. The fall promises a change of climate, a change of colors from fall foliage and an optimistic outlook for opportunities ahead. At Lima One Capital we’re seeing exciting new opportunities... Read More »

Single Family Rental Platform Puts Pedal to the Metal with Marketing Lists

Online single family rental marketplace OwnAmerica identifies and engages SFR operators with the help of targeted marketing lists generated by ATTOM Data Solutions from its nationwide database of more than 155 million U.S. properties. If you are interested in learning more about our single family rental analysis, visit our single family rental... Read More »