Top Three Buying Entities Related to Companies Purchasing Single Family Homes as Rentals

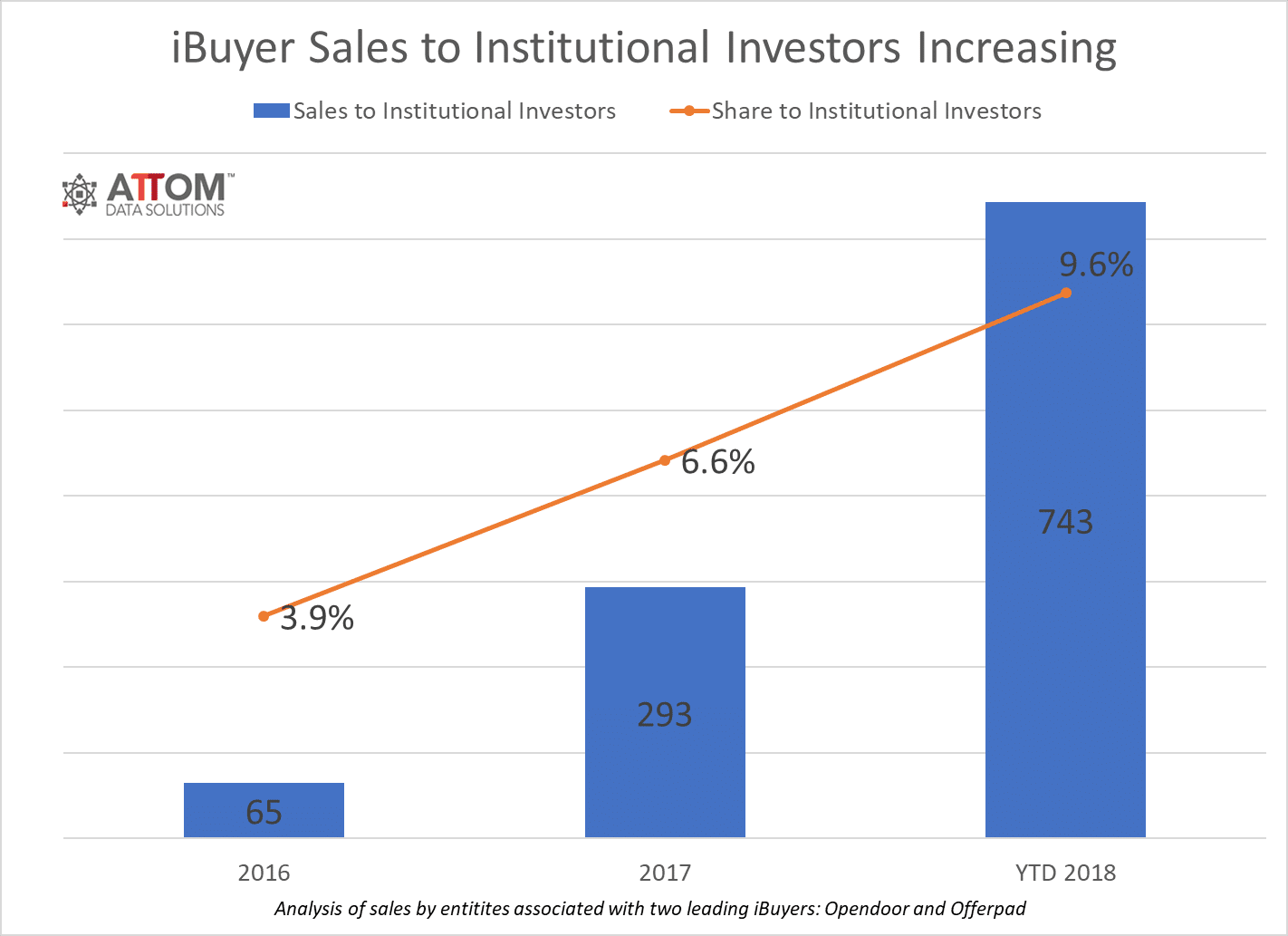

IRVINE, Calif. — Nov. 29, 2018 — ATTOM Data Solutions, curator of the nation’s premier property database, today released an analysis that shows that nearly one in 10 homes sold so far in 2018 by the nation’s two leading iBuyers — Opendoor and Offerpad — were purchased by institutional investor entities buying at least 10 homes.

According to the analysis, a total of 743 homes sold by the two iBuyers — companies that buy directly from homeowners via all-cash offers — were purchased by institutional investors so far in 2018, representing 9.6 percent of all sales by those two iBuyers combined. That is up from 293 institutional investor purchases representing 6.6 percent of the iBuyer sales in 2017, and 65 institutional investor purchases representing 3.9 percent of the iBuyer sales in 2016.

“Tight inventory is a common challenge facing both individual and institutional single family rental investors across the country,” said Daren Blomquist, senior vice president with ATTOM Data Solutions. “Meanwhile the appetite for more SFR inventory continues to grow as a new wave of institutional capital builds. Industry innovators are rising to meet this challenge through a variety of inventory-inducing channels, including off-market, build-to-rent, and iBuyer initiatives.”

Top Three Buying Entities

The top three institutional buying entities — CERBERUS SFR HOLDINGS LP, CSH PROPERTY ONE LLC, and TAH HOLDING LP — all appear to be related to companies purchasing single family homes as rentals. For a detailed analysis of the single family rental market, click here.

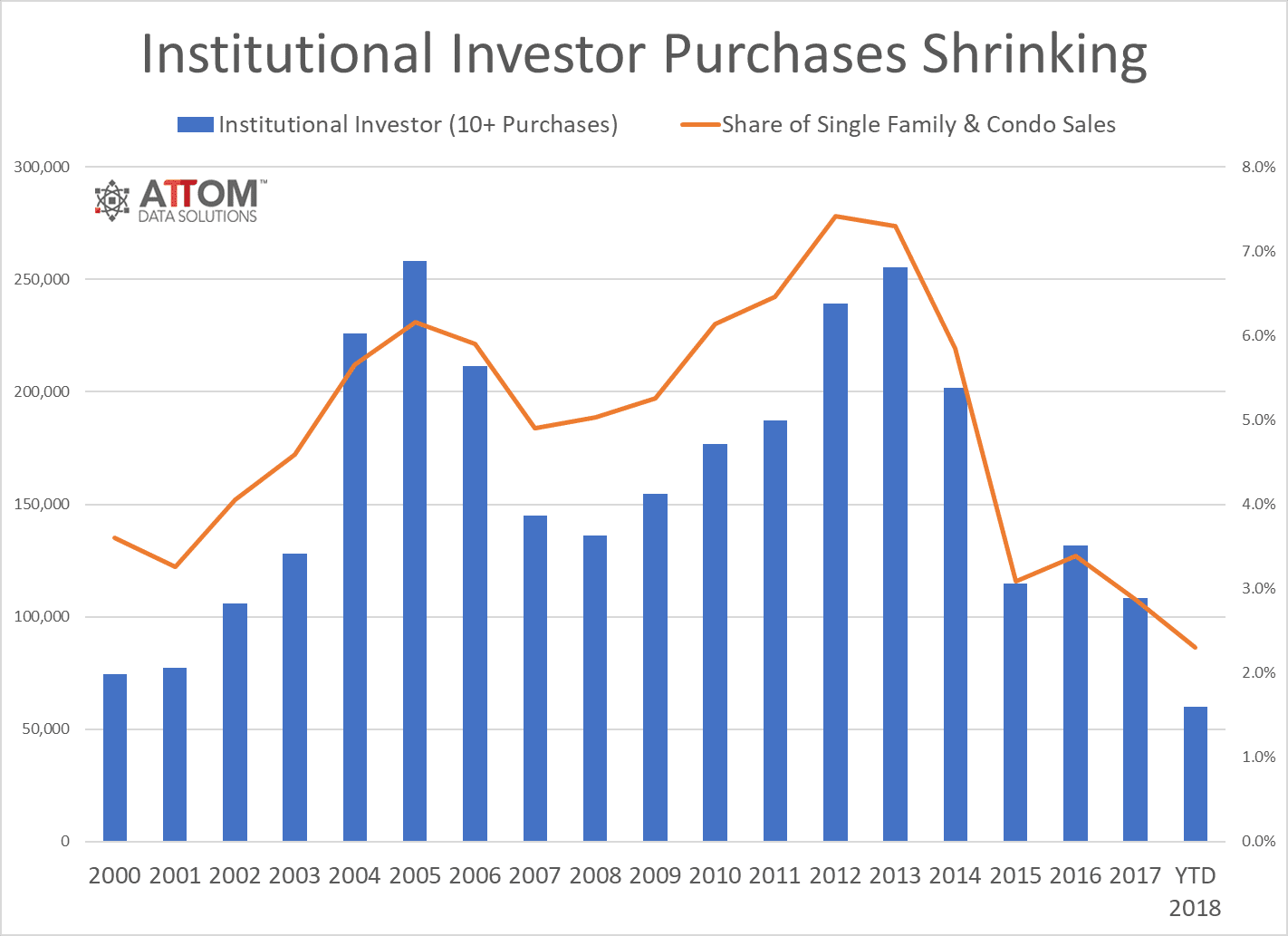

These institutional investors may be turning to iBuyers as a source of inventory even as other sources of inventory such as foreclosures have largely dried up in recent years. Institutional investor purchases represented just 2.3 percent of all U.S. home sales so far in 2018, down from 2.9 percent in 2017 and down from a peak of 7.4 percent in 2012, according to the ATTOM analysis.

“There are a lot of buyers, both big and small, looking to grow their SFR portfolios and inventory is very tight. This is leading to creative ways to find new product — from build-to-rent programs, off-market inventory programs and iBuyer initiatives,” said Kevin Ortner, CEO with Renters Warehouse, a company that manages more than 22,000 SFR properties in 42 states. “There are several firms positioning themselves to be able to help bring supply to meet the demands of investors, and I expect that will continue to grow. I’m also seeing investment in technology and data across the space allowing greater scale, efficiencies and insights.”

“A properly priced rental home today, there is almost limitless demand for it,” said Gary Beasley, CEO and co-founder with Roofstock, an online marketplace for SFR properties that itself is working on ways to create SFR inventory for both retail buyers and institutional buyers. “We have to get creative about how to attract this inventory, and if it isn’t available to create it.”

Methodology

ATTOM Data Solutions analyzed public record sales deed data from its nationwide property data warehouse for sales by entities associated with Opendoor and Offerpad, broken down by purchase entity. Purchase entities that bought at least 10 homes from the two iBuyers combined were considered institutional investors. For overall home sales, ATTOM considered any entity buying 10 or more properties in a calendar year as an institutional buyer.

About ATTOM Data Solutions

ATTOM Data Solutions provides premium property data to power products that improve transparency, innovation, efficiency and disruption in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation’s population. A rigorous data management process involving more than 20 steps validates, standardizes and enhances the data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. The 9TB ATTOM Data Warehouse fuels innovation in many industries including mortgage, real estate, insurance, marketing, government and more through flexible data delivery solutions that include bulk file licenses, APIs, market trends, marketing lists, match & append and more.

Media Contact:

Christine Stricker

949.748.8428

christine.stricker@attomdata.com

Data and Report Licensing:

949.502.8313

datareports@attomdata.com