Tag: mortgage data

Top 5 Mortgage Data Providers

***This article was originally written in 2021, but has been updated for 2025 to reflect new solution providers*** Mortgage data powers a range of solutions for real estate professionals and associated industries. Whether you’re a real estate broker looking to provide advice and guidance to your clients or a refinancing lender looking to target... Read More »

Top 10 U.S. Metros with Purchase Mortgage Originations on the Rise

ATTOM’s Q3 2024 U.S. Residential Property Mortgage Origination Report shows that during the third quarter, 1.67 million mortgages secured by residential properties (1 to 4 units) were issued in the United States, marking a modest increase of 1.9% both quarterly and annually.... Read More »

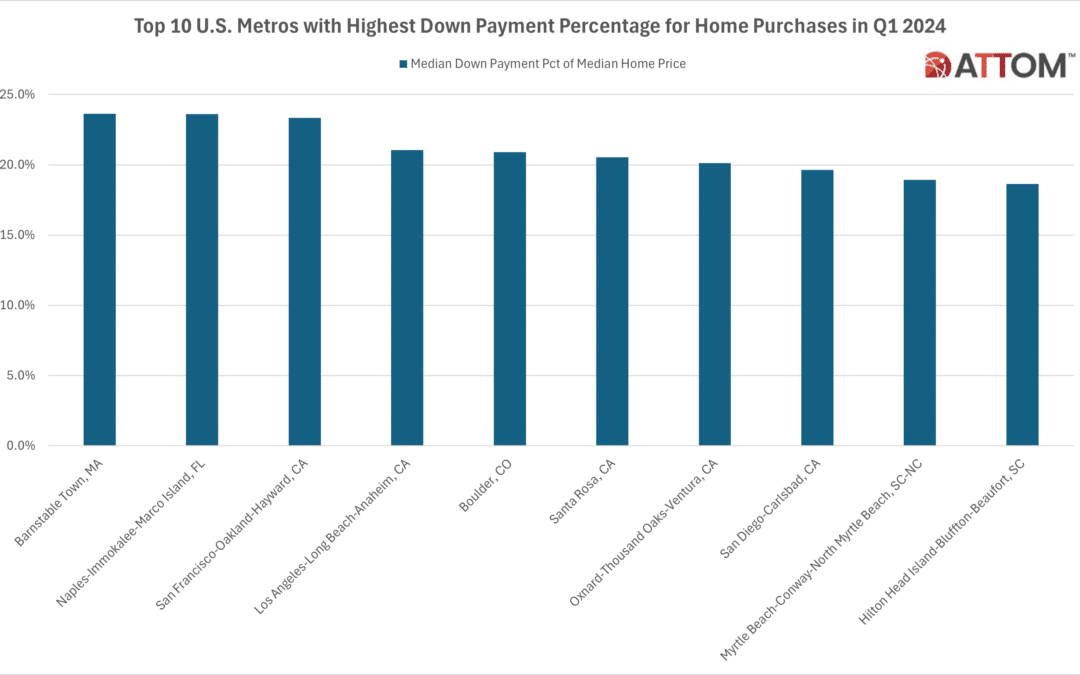

Top 10 U.S. Metros with Highest Down Payment Percentage for Home Purchases

According to ATTOM’s Q1 2024 U.S. Residential Property Mortgage Origination Report, a total of 1.28 million mortgages secured by residential properties (comprising 1 to 4 units) were issued in the United States during the first quarter, reflecting a 6.8 percent decrease from the previous quarter. This decline represents the 11th in the last 12... Read More »