Tag: down payment

Top 10 U.S. Housing Markets with Greatest Median Down Payments in Q1 2023

According to ATTOM’s Q1 2023 U.S. Residential Property Mortgage Origination Report, just 1.25 million mortgages secured by residential property were originated in Q1 2023 – the lowest point since late-2000. The report noted that figure was down 19 percent from Q4 2022 – marking the eighth quarterly decrease in a row – and down 56 percent from Q1... Read More »

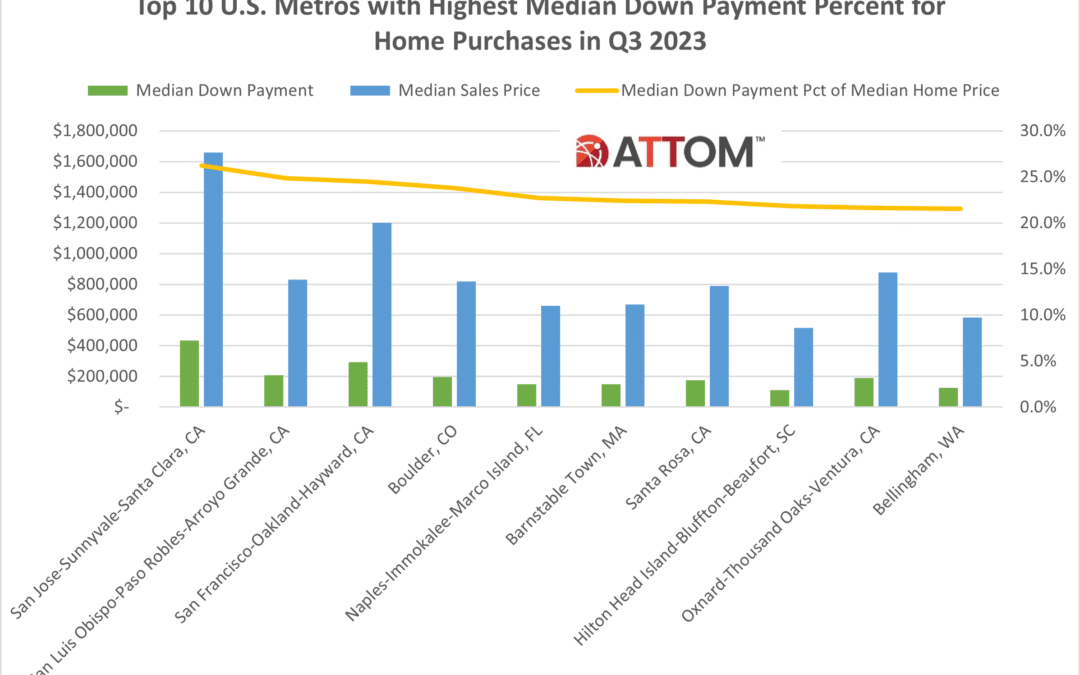

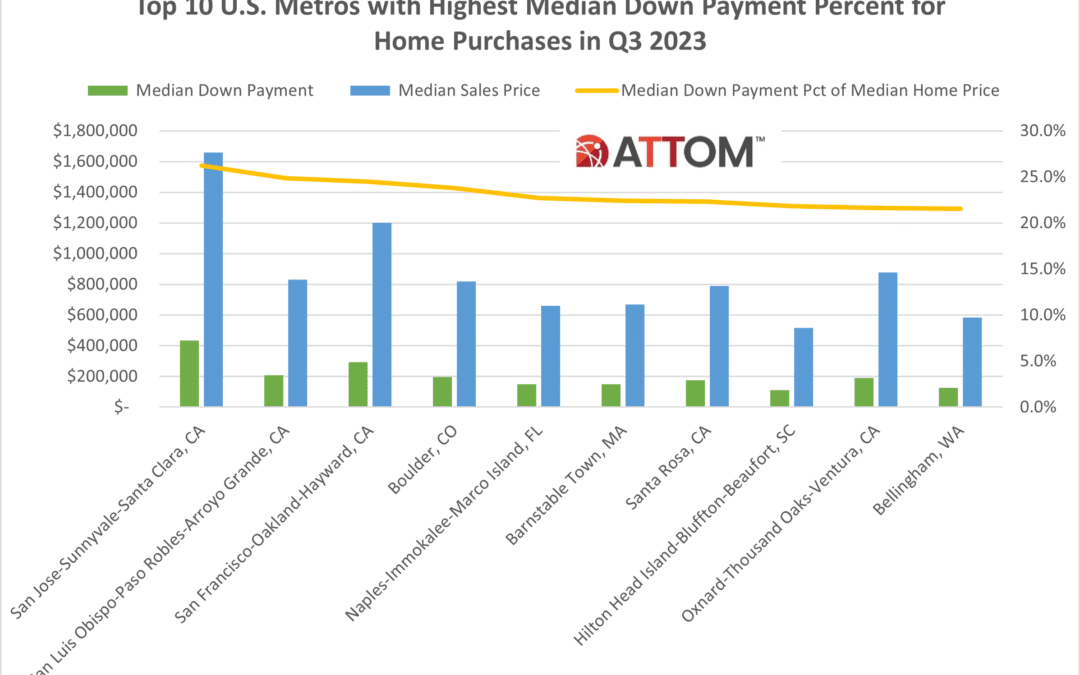

Top 10 U.S. Metros with Highest Home-Purchase Down Payments

ATTOM’s just released Q3 2021 U.S. Residential Property Mortgage Origination Report shows that overall mortgage lending was down 8 percent in Q3 2021, marking the second straight quarterly decline and the first time in more than two years that total lending decreased in two consecutive quarters. The Q3 2021 loan origination analysis conducted by... Read More »

Top 10 U.S. Housing Markets with Highest Median Down Payments in Q3 2020

According to ATTOM Data Solutions’ recently released Q3 2020 U.S. Residential Property Mortgage Origination Report, the median down payment on single-family homes and condos purchased with financing in Q3 2020 was up 48.9 percent from Q2 2020 and 68.6 percent from Q3 2019, to the highest level recorded since at least 2000. ATTOM’s third quarter... Read More »

U.S. Refinance Originations Drop to Four-Year Low in Q2 2018

Editor’s Note: this report was updated on Sept. 13, 2018, after the original publication with revised loan origination data. For more details on the revisions contact christine.stricker@attomdata.com. IRVINE, Calif. – Sept. 13, 2018 — ATTOM Data Solutions, curator of the nation’s premier property database, today released its Q2 2018 U.S.... Read More »

How Much Money Do You Need for a Home Down Payment?

Did you know that the median home down payment with financing in Q4 2017 was $18,000? This is down from a record high $19,100 in the previous quarter but up 20 percent from $14,950 in Q4 2016. If you are looking to buy a home, do you know how much home down payment you will need? Many factors come into play but one major factor depends where you... Read More »