This week ATTOM Data Solutions released its Q1 2019 U.S. Foreclosure Market Report, which showed a total of 161,875 U.S. properties with a foreclosure filing during the first quarter of 2019, down 23 percent from the previous quarter and down 15 percent from a year ago to the lowest level since Q1 2008.

One thing to note, not only does this report look at quarterly foreclosure activity, but it also looks at March monthly foreclosure activity. Breaking down the numbers by foreclosure type (NOD, LIS, NTS, NFS, and REO) and going all the way down to the ZIP code level. Not to mention, this data goes back historically, helping to uncover possible trends and/or projecting how the housing market will fair in the future. If you are interested in learning more about our foreclosure reporting, click here.

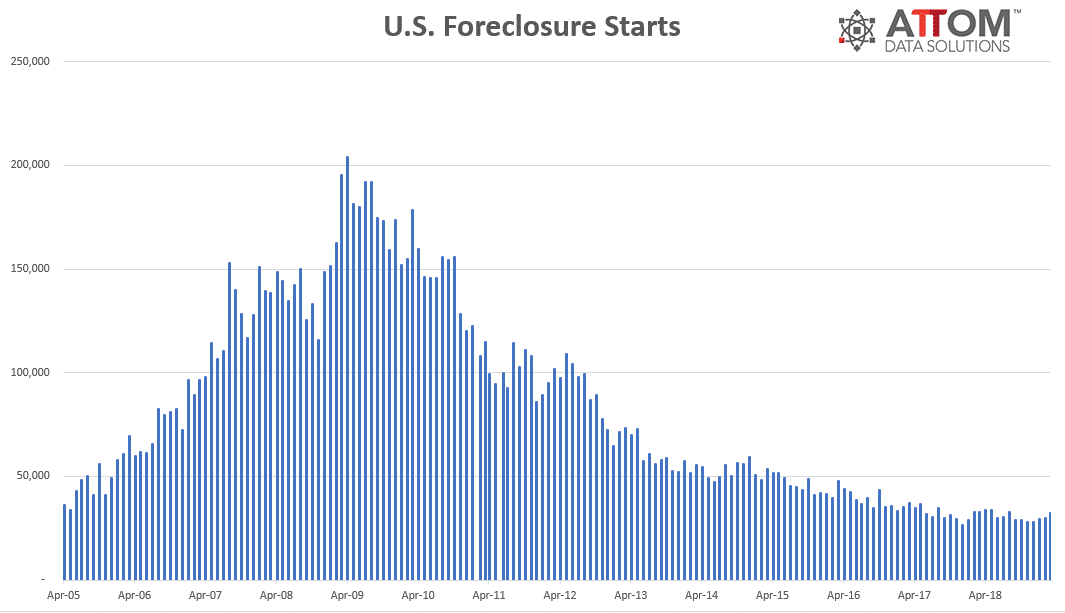

Foreclosure Starts

If you aren’t familiar with the term ‘foreclosure start’ it is the first public foreclosure notice, which can be a notice of default, a Lis pendens, or a notice of trustee sale depending on the state where the property is located.

Therefore, for the nation lenders started the foreclosure process on 32,280 U.S. properties in March 2019, up 9 percent from last month but down 2 percent from a year ago.

Los Angeles County Leads the List

ATTOM Data Solutions took a deeper dive with the data to uncover the Top 10 counties in the nation, that encountered the greatest number foreclosure starts for March 2019.

Leading the nation was Los Angeles county in California, with 837 properties starting the foreclosure process in March 2019. This is up 54 percent from last year. Not to far behind is Cook County, Illinois with 803 properties starting the foreclosure process, however this number is down 17 percent from last year. Counties that follow the top 2 include: Harris County, Texas in the Houston metro area (546 properties); Broward county, Florida in the Miami metro area (381 properties) and Maricopa county, Arizona in the Phoenix metro area (377 properties).

Rounding out the top 10 counties with the most foreclosure starts in March 2019 are as follows: Miami-Dade County, Florida (351 properties); Philadelphia county, Pennsylvania (329 properties); Clark county, Nevada located in the Las Vegas metro area (302 properties); Riverside county, California (300 properties); and Palm Beach county, Florida (298 properties).

Historical Data

Want to get the entire list of counties? Or States? Or MSAs? Want to go back historically to uncover any trends? We can help you with that! Contact us now to find out how!