According to ATTOM’s newly released Q1 2024 Single-Family Rental Market Report, landlords are experiencing rising investment returns due to rents increasing slightly faster than home prices in most parts of the country. The report noted that rising rents have occurred in conjunction with various market forces driving rental demand. These include a historically limited supply of homes for sale and a slowing down of home price increases, although not sufficiently to make home ownership widely affordable for average wage earners.

According to the report, between 2023 and 2024, median three-bedroom rents increased more than median single-family home prices in 216, or 63 percent, of the markets analyzed. Although the differences were slight—typically less than one percentage point—they were sufficient to drive rental yields upward.

ATTOM’s latest single-family rental market analysis reported that the anticipated average annual gross rental yield for three-bedroom properties, calculated by dividing the annualized gross rent income by the median purchase price across 341 counties under analysis, is expected to reach 7.55 percent in 2024. This reflects a slight increase from the previous year’s average of 7.39 percent in the same markets. It signifies the second consecutive year of rising projections following a three-year period of declines.

The Q1 single-family rental report noted that rental returns are on the rise across most of the nation. Potential annual gross rental yields for three-bedroom properties in 2024 have increased compared to 2023 in 216 out of the 341 counties analyzed in the report (63 percent). Leading the increase are counties such as Taylor County (Abilene), TX (yield up from 7.6 percent in 2023 to 11.3 percent in 2024); Jefferson County (Birmingham), AL (up from 8.5 percent to 12.1 percent); Richmond County (Augusta), GA (up from 9.6 percent to 12.7 percent); Midland County, TX (up from 8.7 percent to 11.7 percent); and Aiken County, SC (outside Augusta, GA) (up from 8.4 percent to 11.1 percent).

The report noted the top 28 single-family rental growth markets, counties where average wages have increased over the past year and potential annual gross rental yields for three-bedroom properties in 2024 surpass 10 percent. The list of top “SFR Growth” markets includes Chicago, Detroit, and Cleveland.

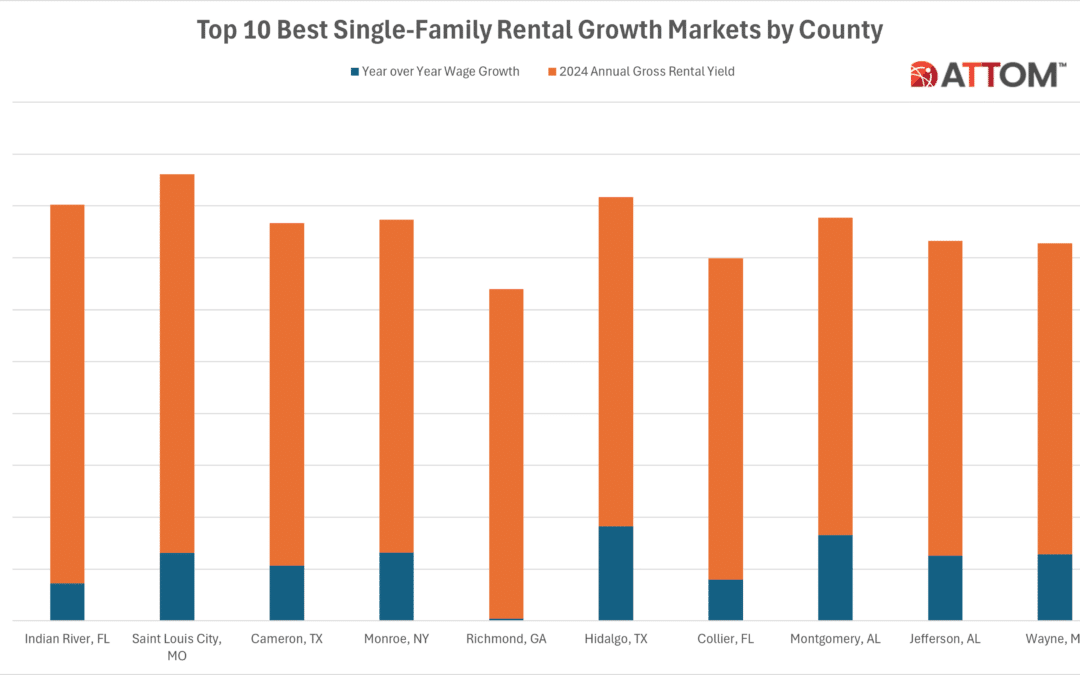

In this post, we take a more granular look at the data behind ATTOM’s Q1 2024 Single-Family Rentals report to uncover the top 10 best single-family rental growth counties.

#1 – Indian River, FL

• 1.4% year over year wage growth

• 14.6% 2024 Annual Gross Rental Yield

#2 – St. Louis, MO

• 2.6% year over year wage growth

• 14.6% 2024 Annual Gross Rental Yield

#3 – Cameron, TX

• 2.1% year over year wage growth

• 13.2% 2024 Annual Gross Rental Yield

#4 – Monroe, NY

• 2.6% year over year wage growth

• 12.8% 2024 Annual Gross Rental Yield

#5 – Richmond, GA

• 0.1% year over year wage growth

• 12.7% 2024 Annual Gross Rental Yield

#6 – Hidalgo, TX

• 3.7% year over year wage growth

• 12.7% 2024 Annual Gross Rental Yield

#7 – Collier, FL

• 1.6% year over year wage growth

• 12.4% 2024 Annual Gross Rental Yield

#8 – Montgomery, AL

• 3.3% year over year wage growth

• 12.2% 2024 Annual Gross Rental Yield

#9 – Jefferson, AL

• 2.5% year over year wage growth

• 12.1% 2024 Annual Gross Rental Yield

#10 – Wayne, MI

• 2.6% year over year wage growth

• 12% 2024 Annual Gross Rental Yield

Want to learn more about how single-family rental activity is faring in your market? Contact us to find out how!