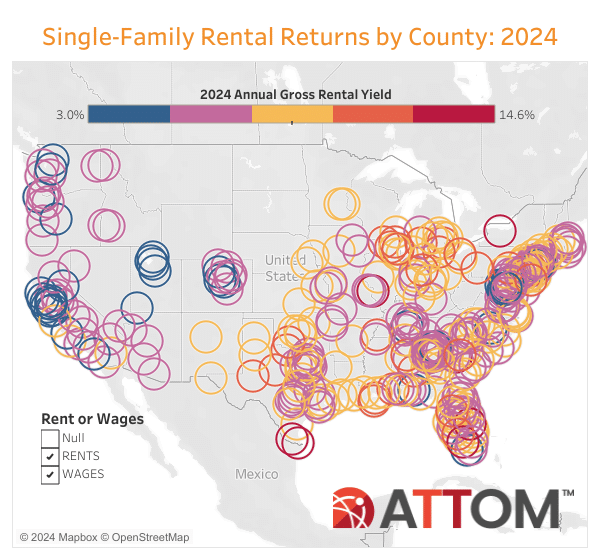

Highest Potential SFR Returns around Vero Beach, St. Louis, Brownsville, Rochester and Augusta;

Rental Margins Increasing in About Two-thirds of Nation

IRVINE, Calif. – Mar. 14, 2024 — ATTOM, a leading curator of land, property, and real estate data, today released its Q1 2024 Single-Family Rental Market report, which ranks the best U.S. markets for buying single-family rental properties in 2024.

The report analyzed single-family rental returns in 341 U.S. counties with a population of at least 100,000 and sufficient rental and home price data. The analysis for this report incorporated median rents and median home prices collected from ATTOM’s nationwide property database, as well as publicly recorded sales deed data licensed by ATTOM (see full methodology below).

View interactive map displaying SFR returns in all 341 counties analyzed

The report shows that the average annual three-bedroom gross rental yield (annualized gross rent income divided by median purchase price) among the 341 counties analyzed is projected to be 7.55 percent in 2024. That is up slightly from an average of 7.39 percent in those same markets a year ago, marking the second year of rising projections after three years of declines.

Investment returns for landlords continue to increase as rents are going up slightly faster than home prices across a majority of the country. From 2023 to 2024, median three-bedroom rents rose more than median single-family home prices in 216, or 63 percent, of the markets analyzed. The gaps were small – usually less than one percentage point – but enough to push rental yields upward.

That has happened amid a combination of market forces spurring demand for rentals. They include a historically tight supply of homes for sale and home-price increases that have slowed but not enough to make buying widely affordable for average wage earners.

“The U.S. home sales market cooled off a good bit last year, with some of the weakest gains over the past decade. But that wasn’t enough to make home prices affordable for most workers, which likely fed enough demand to push up rents and yields for investors who lease out single-family properties,” said Rob Barber, CEO at ATTOM. “The fact that so few homes are available for sale in many markets clearly further helped increase rental demand for landlords and boost their bottom lines.”

Top rental returns in Indian River, St. Lous, Cameron, Monroe and Richmond counties, as well as other parts of Midwest, Northeast and South

Counties with the highest potential annual gross rental yields on three-bedroom properties for 2024 are Indian River County, FL, in the Sebastian-Vero Beach metro area (14.6 percent); St. Lous City, MO, (14.6 percent); Cameron County, TX, in the Brownsville-Harlingen metro area (13.2 percent); Monroe County, NY, in the Rochester metro area (12.8 percent) and Richmond County, GA, in the Augusta-Richmond County metro area (12.7 percent).

The highest potential annual three-bedroom gross rental yields in 2024 among counties with a population of at least 1 million are in Wayne County (Detroit), MI (12 percent); Allegheny County (Pittsburgh), PA (11.2 percent); Cuyahoga County (Cleveland), OH (10.2 percent); Cook County (Chicago), IL (10.1 percent) and Riverside County, CA (9.7 percent).

Rental returns increase across majority of nation

Potential annual three-bedroom gross rental yields for 2024 have increased compared to 2023 in 216 of the 341 counties analyzed in the report (63 percent). They are led by Taylor County (Abilene), TX (yield up from 7.6 percent in 2023 to 11.3 percent in 2024); Jefferson County (Birmingham), AL (up from 8.5 percent to 12.1 percent); Richmond County (Augusta), GA (up from 9.6 percent to 12.7 percent); Midland County, TX (up from 8.7 percent to 11.7 percent) and Aiken County, SC (outside Augusta, GA) (up from 8.4 percent to 11.1 percent).

The biggest increases in potential annual gross rental yields from 2023 to 2024 among counties with a population of at least 1 million are in Riverside County, CA (yield up from 7.4 percent in 2023 to 9.7 percent in 2024); Los Angeles County, CA (up from 5.6 percent to 7.1 percent); Fulton County (Atlanta), GA (up from 6 percent to 6.8 percent); Montgomery County, MD (outside Washington, DC) (up from 4.4 percent to 5.2 percent) and Dallas County, TX (up from 7.4 percent to 8.1 percent).

Metro areas with a population of 1 million of more showing decreases in potential gross three-bedroom rental yields from 2023 to 2024 are led by Kings County, Brooklyn, NY (yield down from 8 percent to 4.4 percent); Cook County (Chicago), IL (down from 11 percent to 10.1 percent); Wayne County (Detroit), MI (down from 12.8 percent to 12 percent); Miami-Dade County, FL (down from 7.9 percent to 7.3 percent) and Nassau County, NY (outside New York City) (down from 7.1 percent to 6.8 percent).

Lowest rental returns in San Francisco, San Jose, Nashville and Washington, D.C., metro areas, along with other western markets

Counties with the lowest potential annual gross returns for 2024 on three-bedroom rentals are Santa Clara County, CA, in the San Jose metro area (3 percent); San Mateo County, CA, in the San Francisco metro area (3.4 percent); Arlington County, VA, in the Washington, DC, metro area (3.8 percent); Williamson County, TN, in the Nashville metro area (3.9 percent) and San Francisco County, CA (3.9 percent).

Aside from Santa Clara County, the lowest potential annual gross three-bedroom rental yields in 2024 among counties with a population of at least 1 million are in Honolulu County, HI (4.1 percent); Fairfax County, VA (outside Washington, D.C.) (4.2 percent); Kings County (Brooklyn), NY (4.4 percent) and Alameda County (Oakland), CA (4.4 percent).

Rents rising faster than wages in majority of counties measured

Median three-bedroom rents are rising faster than average wages in 197 of the 341 counties analyzed (58 percent), including Los Angeles County, CA; Harris County (Houston), TX; Maricopa County (Phoenix), AZ); San Diego County, CA, and Orange County, CA (outside Los Angeles).

Average wages are increasing faster than median three-bedroom rents in 144 of the 341 counties analyzed (42 percent), including Cook County (Chicago), IL; Miami-Dade County, FL; Kings County (Brooklyn), NY; Queens County, NY, and San Bernardino County, CA.

Rents rising faster than home prices in two-thirds of nation

Median three-bedroom rents are rising faster than median single-family home prices in 216 of the 341 counties analyzed (63 percent). They include Los Angeles County, CA; Harris County (Houston), TX; Maricopa County (Phoenix), AZ); San Diego County, CA, and Orange County, CA (outside Los Angeles).

Median home prices are going up faster than median three-bedroom rents in 125 of the counties analyzed (37 percent), including Cook County (Chicago), IL; Miami-Dade County, FL; Kings County (Brooklyn), NY; Queens County, NY, and San Bernardino County, CA.

Wages rising faster than prices in more than half of markets

Average wages are increasing faster than median single-family home prices in 196 of the 341 counties analyzed (57 percent), including Harris County (Houston), TX; Dallas County, TX; Riverside County, CA; Queens County, NY, and Clark County (Las Vegas), NV.

Median home prices are increasing faster than average wages in 145 of the counties analyzed (43 percent). They include Los Angeles County, CA; Cook County (Chicago), IL; Maricopa County (Phoenix), AZ); San Diego County, CA, and Orange County, CA (outside Los Angeles).

Best SFR growth markets include Chicago, Detroit and Cleveland

The report identified 28 “SFR Growth” counties where average wages grew over the past year and potential 2024 annual gross three-bedroom rental yields exceed 10 percent.

The 28 SFR Growth markets include Cook County (Chicago), IL; Wayne County (Detroit), MI; Cuyahoga County (Cleveland), OH; Allegheny County (Pittsburgh), PA and Shelby County (Memphis), TN.

###

Methodology

For this report, ATTOM looked at U.S. counties with a population of 100,000 or more and sufficient home price and rental rate data. ATTOM used single-family, home price data from its publicly recorded sales deed data, as well as three-bedroom rental data, collected and licensed by ATTOM. The analysis also incorporated second-quarter 2023 average weekly wage data from the Bureau of Labor Statistics (most recent available).

About ATTOM

ATTOM provides premium property data to power products that improve transparency, innovation, efficiency, and disruption in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation’s population. A rigorous data management process involving more than 20 steps validates, standardizes, and enhances the real estate data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. The 30TB ATTOM Data Warehouse fuels innovation in many industries including mortgage, real estate, insurance, marketing, government and more through flexible data delivery solutions that include ATTOM Cloud, bulk file licenses, property data APIs, real estate market trends, property navigator and more. Also, introducing our newest innovative solution, making property data more readily accessible and optimized for AI applications– AI-Ready Solutions.

Media Contact:

Megan Hunt

megan.hunt@attomdata.com

Data and Report Licensing:

datareports@attomdata.com