#figuresfriday

Top 10 U.S. Counties Most Affected by Housing Market Downturn in Q1 2023

According to ATTOM’s Q1 2023 Special Housing Impact Report, which spotlights how the recent U.S. housing market downturn is starting to affect counties around the nation, the Western region and other more-upscale areas are bearing the greater brunt so far. ATTOM’s latest analysis, based on key measures from Q1 2023, found that the West and those... Read More »

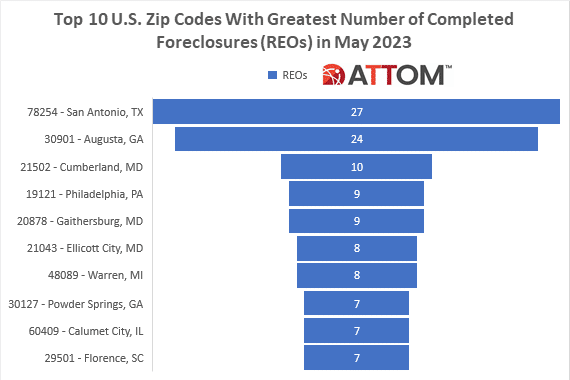

Top 10 ZIPS With Greatest Number of REOs in May 2023

ATTOM’s newly released May 2023 U.S. Foreclosure Market Report shows that foreclosure filings were up 7 percent from April 2023 and 14 percent from May 2022. According to the latest foreclosure market analysis by ATTOM, nationwide one in every 3,967 housing units had a foreclosure filing in May 2023. The report noted that states with the highest... Read More »

Top 10 U.S. Housing Markets with Greatest Median Down Payments in Q1 2023

According to ATTOM’s Q1 2023 U.S. Residential Property Mortgage Origination Report, just 1.25 million mortgages secured by residential property were originated in Q1 2023 – the lowest point since late-2000. The report noted that figure was down 19 percent from Q4 2022 – marking the eighth quarterly decrease in a row – and down 56 percent from Q1... Read More »

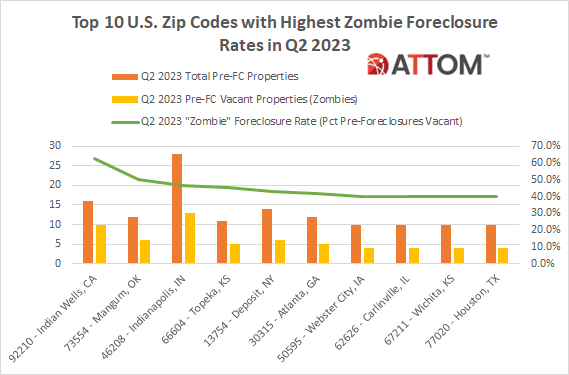

Top 10 Zombified ZIPS in Q2 2023

According to ATTOM’s newly released Q2 2023 Vacant Property and Zombie Foreclosure Report, 1.3 million residential properties in the U.S. are vacant, representing 1.3 percent, or one in 79 homes, across the nation. ATTOM’s latest vacant properties analysis also revealed that 311,508 residential properties are in the process of foreclosure in Q2... Read More »

Top 10 Opportunity Zones Where Home Prices Nearly Doubled Annually in Q1 2023

ATTOM’s newly released Q1 2023 Opportunity Zones Report found that median single-family home and condo prices stayed the same or decreased from Q4 2022 to Q1 2023 in 52 percent of qualified zones, and fell at least 3 percent in almost half. The report noted that at the same time, prices increased by at least that much in about 40 percent of those... Read More »