According to ATTOM’s Q1 2023 Special Housing Impact Report, which spotlights how the recent U.S. housing market downturn is starting to affect counties around the nation, the Western region and other more-upscale areas are bearing the greater brunt so far.

ATTOM’s latest analysis, based on key measures from Q1 2023, found that the West and those upscale areas posted larger-than-average declines in home values or increases in underwater mortgage rates and foreclosure activity. The Q1 2023 report also found that in contrast, lower-priced markets have experienced relatively less impact from the downturn.

The report noted that patterns in Q1 2023 – based on changes in home price, home affordability, underwater mortgages and foreclosures since Q2 2022 – revealed that almost half of the 50 counties seeing the biggest impact were in the West. The report also noted that among the top 50, 12 were in Oregon and Washington.

Also according to ATTOM’s latest analysis, at the other end of the spectrum, the South, Midwest and Northeast were seeing less fallout along with lower-priced markets. The report found that states in those regions, led by Texas, Connecticut and Illinois, had 18 of the 50 counties showing the smallest effects from the pullback after a decade of nearly unceasing gains in prices, profits and other key measures.

The report stated that the top 50 counties included seven in Oregon, mostly in or near the city of Eugene: Deschutes County (east of Eugene), Douglas County (south of Eugene), Jackson County (south of Eugene), Lane County (Eugene), Linn County (north of Eugene), Marion County (Salem) and Yamhill County (outside Portland).

While another five of the top 50 were in Washington: Clark County (Vancouver), Cowlitz County (north of Vancouver), Skagit County (north of Seattle), Spokane County and Yakima County. Others in the top 50 were scattered around the country, with concentrations in areas where single-family homes typically sold for at least $350,000.

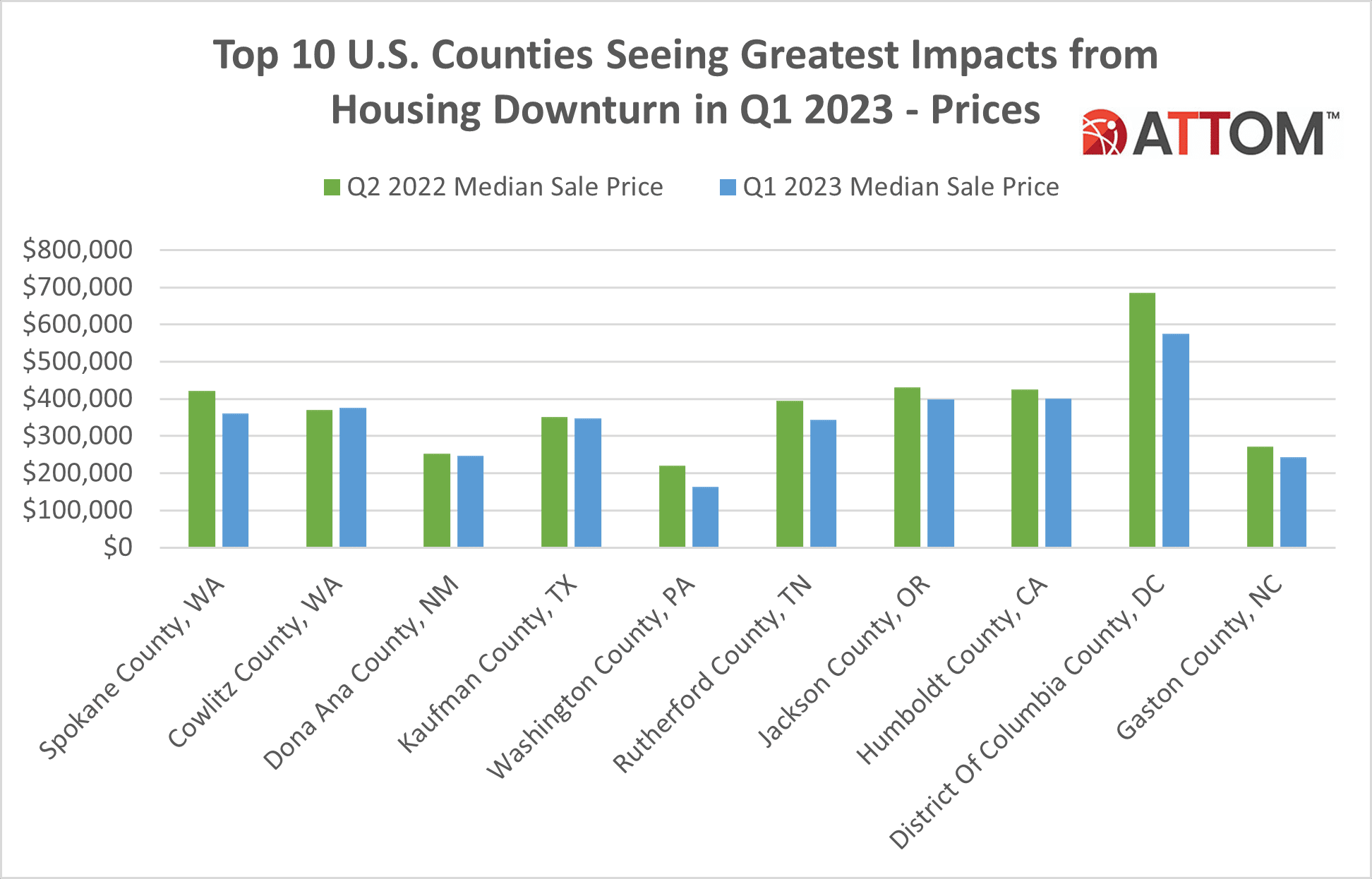

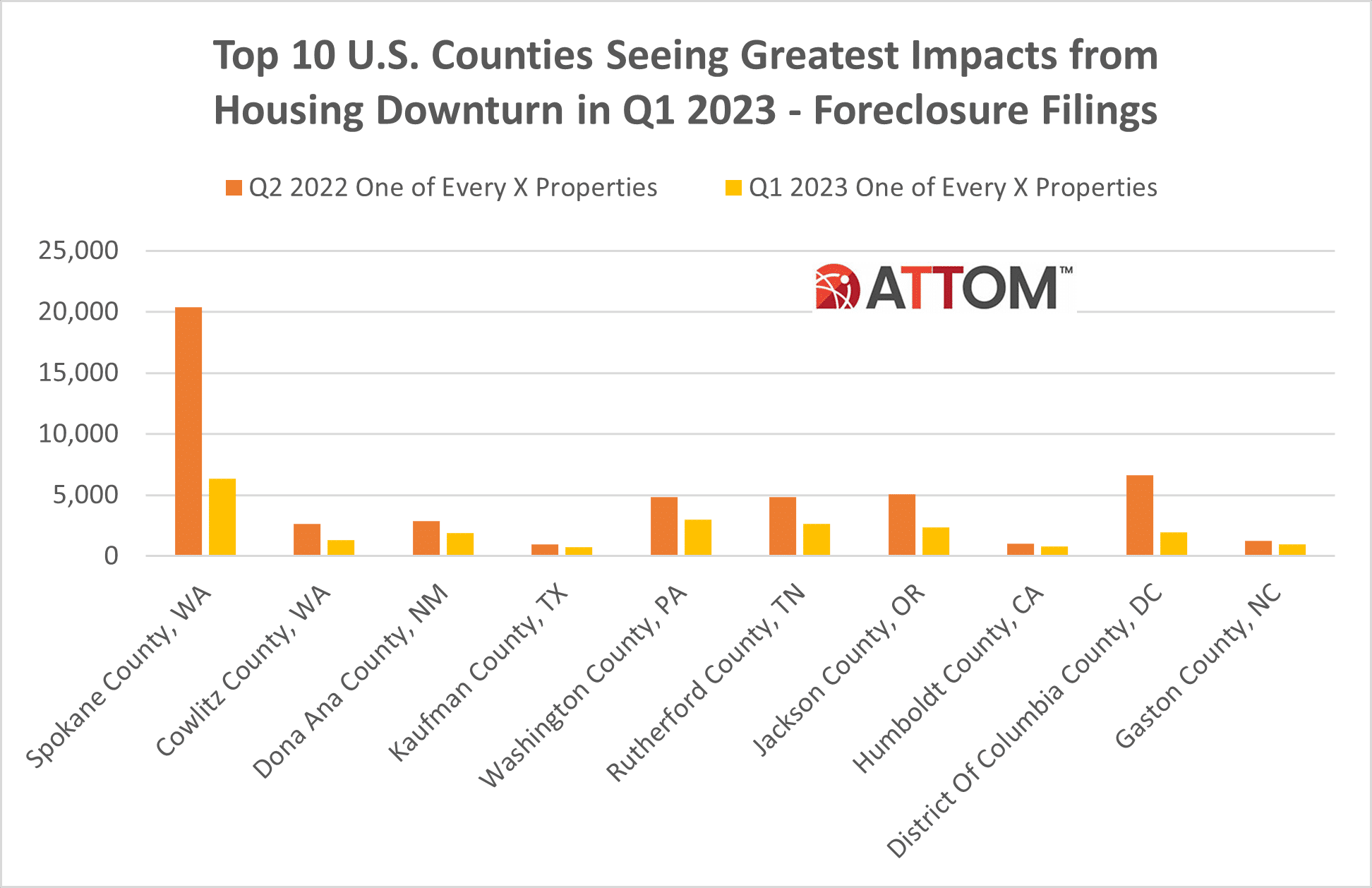

In this post, we dig into the data behind this latest analysis to uncover the top 10 U.S. counties, in addition to those in Oregon and Washington, starting to see an impact from the recent housing market downturn, based the above criteria. Those counties include: Spokane County, WA; Cowlitz County, WA; Dona Ana County, NM; Kaufman County, TX; Washington County, PA; Rutherford County, TN; Jackson County, OR; Humboldt County, CA; District Of Columbia County, DC; and Gaston County, NC.

For this ATTOM analysis, counties were considered more or less affected by the market slowdown based on changes from Q2 2022 to Q1 2023 in these four measures: median home prices, the percentage of homes facing possible foreclosure, the percentage of average local wages required to pay for major home ownership expenses on median-priced homes, and the portion of homes with mortgage balances that exceeded estimated property values. The conclusions were then drawn from ATTOM’s most recent reports on each topic.

Want to learn more about foreclosure trends in your area? Contact us to find out how!