Real Estate Bubble, or Boom? This webinar, presented by ATTOM Data Solutions Chief Product and Technology Officer, Todd Teta, and Altos Research Founder and CEO, Michael Simonsen, looks at key housing market indicators to explore what may be on the horizon for the housing market.

Click here to listen to this webinar, featuring a year-to-date analysis of home prices, overview of the distressed market, new insights into market velocity and immediate sales, as well as the latest on interest rates, inventory and more.

ATTOM’s Todd Teta kicks off this webinar by examining today’s mortgage rates and offering a comparison in rates over the past year, as well as excusive insights on expectations around housing supply improvement.

Teta also provides a detailed analysis of residential loan volumes over the past several years, weighing in on refinancing demand and mortgage origination expectations. Also during this webinar, Teta discusses home prices in 2021, along with home ownership tenure, as well as a comparison of how those key indicators have performed over the past few years, suggesting a possible outlook for the second half of the year.

This webinar also looks at foreclosure trends over time. Teta notes that while foreclosures are still a non-factor due to the moratoriums, ATTOM expects foreclosures to follow a similar pattern as in 2015, driven by unemployment and other traditional factors, rather than forbearance programs ending.

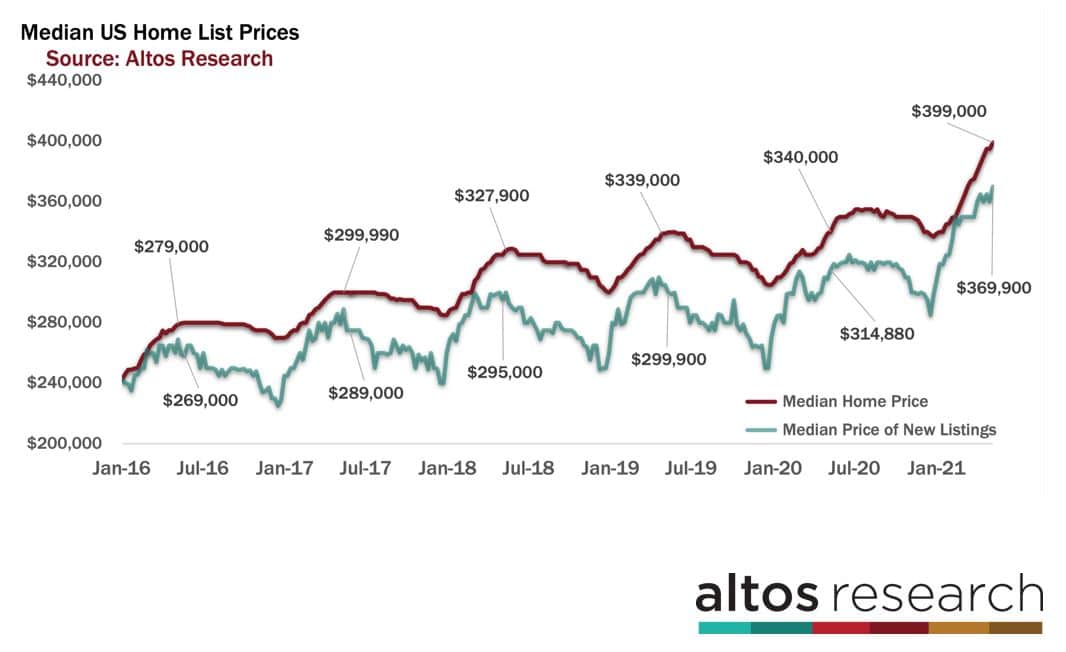

Michael Simonsen for Altos Research jumps in on this webinar to explore median home prices compared to median prices of new listings over the past few years, noting that prices are up 17 percent this year, while supply is inching back up, as illustrated by total inventory of single-family homes for sale.

Simonsen also offers a closer look at new single-family residential inventory by week, stating that immediate sales dominate over new listings, while demand is unrelenting as evidenced by the percent of homes taking price reductions over the past few years. Also during this webinar, Simonsen examines how various market segments impact price ranges.

Altos was founded in 2006 by Simonsen, a real estate analytics pioneer whose insights are regularly cited in national media such as Forbes, New York Times, Bloomberg BusinessWeek and the Wall Street Journal. Over the past 15 years, Altos has helped thousands of real estate professionals and many of the largest financial institutions in the world build their businesses through better understanding of the real estate market.

Altos Research is the premier resource for real-time real estate data, providing weekly market statistics, analysis and reporting for 99% of the zip codes in the U.S., helping real estate professionals, investors, financial institutions, and their clients make better-informed decisions.

ATTOM is the one-stop shop for premium property data fueling innovation, ATTOM provides analytics-ready data for real-world applications. ATTOM blends property tax, deed, mortgage, foreclosure, environmental risk, natural hazard and neighborhood data for more than 155 million U.S. residential and commercial properties, multi-sourced from more than 3,000 U.S. counties. ATTOM’s property data fuels growth across many industries to help drive decisions while delivering data in a variety of flexible customer solutions, including bulk data licensing, property data APIs and more.

ATTOM’s robust property data is leveraged by customers to innovate in a variety of industries, including Real Estate, Insurance, Mortgage, Marketing, Government and Academia. By utilizing ATTOM’s robust property data, ATTOM clients not only create innovation but gain that competitive advantage within their industries. End-users of the data include developers, data scientists, risk managers, investors, policymakers and analysts.

Want to learn more about key housing market indicators as we head into the second half of 2021?

Click here to listen to the entire webinar.