Delinquencies, Defaults, Forbearance & Foreclosures.

This webinar, presented by RealtyTrac Executive Vice President, Rick Sharga, and ATTOM Director of Content & PR, Jennifer von Pohlmann, offers high-level insight on the foreclosure market and what to expect now that the foreclosure moratorium has lifted, and the forbearance program is winding down.

A few of the key themes discussed during this webinar include:

- Zombie foreclosures

- The latest and historical foreclosure activity trends

- Mortgage delinquency rates

- The impact of the CARES Act forbearance program

- Risk analysis – are FHA loans and commercial loans most vulnerable?

- Housing market dynamics – and why they might prevent another flood of foreclosures

ATTOM’s Jennifer von Pohlmann dives into the data to begin the webinar, noting that amid a moratorium that temporarily barred lenders from pursuing most delinquent homeowners, the number of so-called zombie foreclosure properties dipped to near a two-year low in Q3 2021. According to Jennifer, the count of zombie foreclosures was down 7 percent from Q2 2021 and 5 percent from Q3 2020.

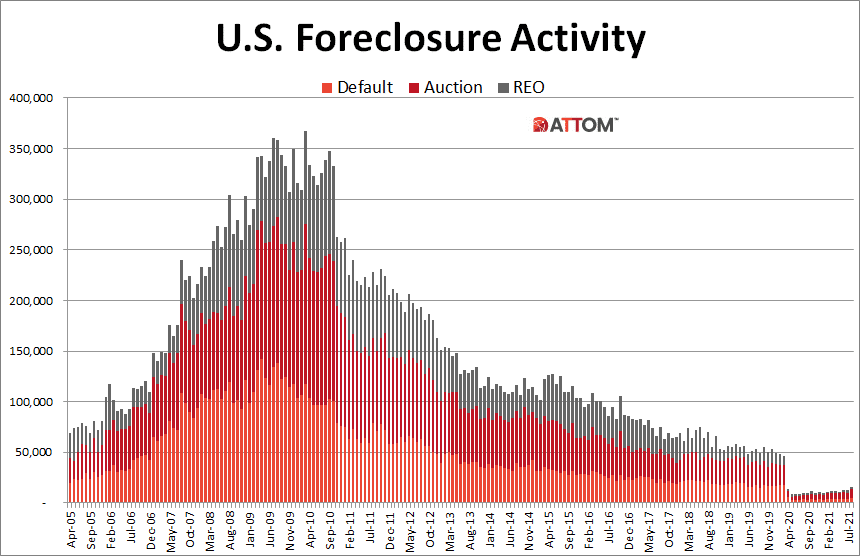

Other key data points that Jennifer covers during this webinar were derived from the latest August 2021 foreclosure activity, which shows there were a total of 15,838 U.S. Properties with foreclosure filings (default, scheduled auctions, REOs), while nationwide one in every 8,677 housing units had a foreclosure filing in August 2021. Jennifer also provides a historical look at foreclosure filing trends going back to 2005.

Also, during this webinar, RealtyTrac’s Rick Sharga presents a historical look at foreclosure inventory going back to 2007, which indicates that the levels of REO inventory are historically low. Rick also notes that mortgage delinquencies have fallen for nine consecutive months, as delinquency rates have closely tracked unemployment rates.

Other key takeaways from this webinar include a look at how the forbearance program has inflated delinquency rates, areas of potential vulnerability – including the top metros threatened, as well as commercial loan vulnerability and the single family rental market. Rick also explores how the housing market dynamic weighs against foreclosures and his take on whether foreclosures will or will not rise exponentially.

ATTOM is the one-stop shop for premium property data fueling innovation, ATTOM provides analytics-ready data for real-world applications. ATTOM blends property tax, deed, mortgage, foreclosure, environmental risk, natural hazard and neighborhood data for more than 155 million U.S. residential and commercial properties, multi-sourced from more than 3,000 U.S. counties. ATTOM’s property data fuels growth across many industries to help drive decisions while delivering data in a variety of flexible customer solutions, including bulk data licensing, property data APIs and introducing ATTOM Cloud.

ATTOM’s robust property data is leveraged by customers to innovate in a variety of industries, including Real Estate, Insurance, Mortgage, Marketing, Government and Academia. By utilizing ATTOM’s robust property data, ATTOM clients not only create innovation but gain that competitive advantage within their industries. End-users of the data include developers, data scientists, risk managers, investors, policymakers and analysts. Discover ATTOM’s Table of Data Elements.

RealtyTrac is the nation’s foremost source of foreclosure data and the leading marketplace for foreclosed and defaulted properties. Three million people visit RealtyTrac each month to access its comprehensive foreclosure data and listings that cover more than 3,000 U.S. counties, including both active and historical default, foreclosure, auction and bank-owned records.

RealtyTrac.com offers a one-stop shop for home buyers, investors and other real estate professionals to access the largest selection of foreclosures as well as homes for sale, sold homes and off-market properties. RealtyTrac has built a team of more than 100 data abstractors across the U.S. who aggregate and key foreclosure records directly from the source documents at the county assessor and recorder offices.

Want to learn more about the effects of the foreclosure moratorium and what’s next?

Click here to listen to the entire webinar.