Tag: home equity trends

Top 10 Equity-Rich ZIPs in Q1 2025

According to ATTOM’s just released Q1 2025 U.S. Home Equity & Underwater Report, 46.2 percent of mortgaged residential properties nationwide were equity-rich—defined as having combined loan balances amounting to no more than 50 percent of the property’s estimated market value.... Read More »

Top 10 Metros with the Highest Percentages of Equity Rich Properties in Q4 2024

According to ATTOM’s just released Q4 2024 U.S. Home Equity & Underwater Report, in the fourth quarter, 47.7 percent of mortgaged residential properties in the United States were classified as equity-rich. This means the total loan balances secured by these properties did not exceed 50 percent of their estimated market values.... Read More »

Top 10 Equity-Rich ZIPs in Q3 2024

According to ATTOM’s just released Q3 2024 U.S. Home Equity & Underwater Report, nearly half (48.3%) of mortgaged residential properties in the United States were classified as equity-rich in the third quarter. This means that the total loan balances secured by these properties were no greater than 50% of their estimated market value.... Read More »

Home Equity Gains Level Off as U.S. Housing Market Cools Down During Third Quarter of 2024

Almost Half of Mortgaged Homeowners Remain Equity-Rich; Portion of Owners Seriously Underwater Still Close to Five-Year Low IRVINE, Calif. — Oct. 24, 2024 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its third quarter 2024 U.S. Home Equity & Underwater Report, which shows that 48.3 percent of... Read More »

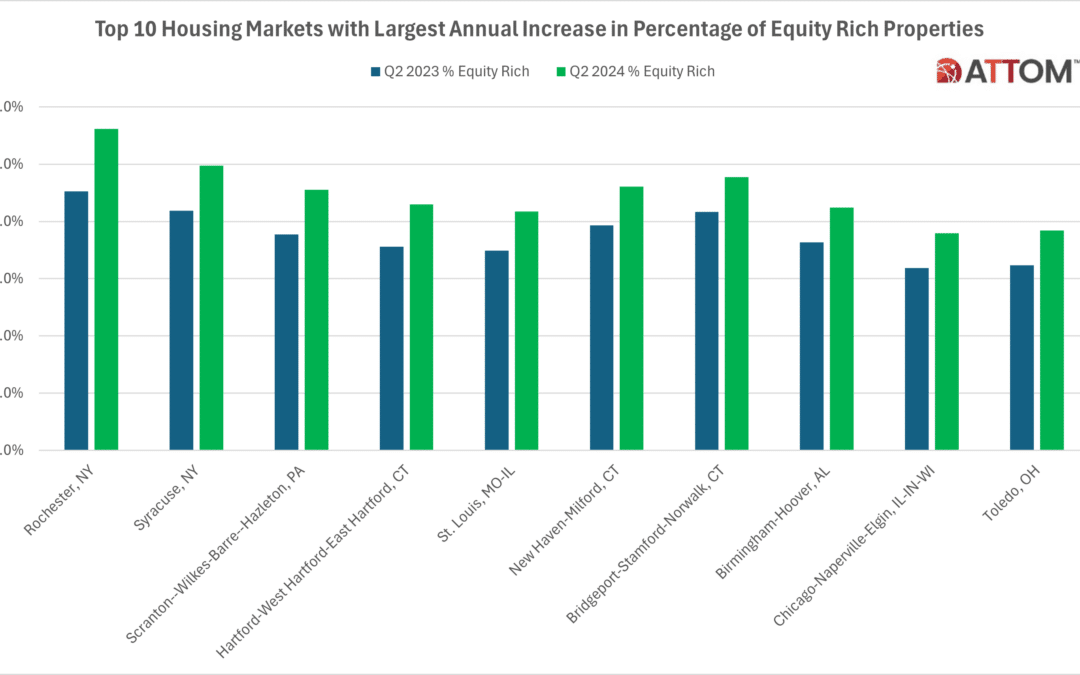

Top 10 U.S. Housing Markets with the Largest Annual Increase in Equity-Rich Properties in Q2 2024

According to ATTOM’s just released Q2 2024 U.S. Home Equity & Underwater Report, in the second quarter 49.2 percent of mortgaged residential properties in the United States were considered equity-rich. This means that the combined estimated loan balances secured by these properties were no more than half of their estimated market values. The... Read More »