Tag: home affordability

Top 10 Counties Where Home Costs Consumed the Lowest Percentage of Average Wages in Q3 2025

According to ATTOM’s Q3 2025 U.S. Home Affordability Report, across the U.S., the typical monthly cost for mortgage payments, homeowners insurance, mortgage insurance, and property taxes was $2,123 in Q3 2025. That figure held steady from the previous quarter but marked a 6 percent increase compared to the same period last year.... Read More »

Third Quarter Sees Homes Grow Less Affordable in Much of Country

In 99 percent of counties, homes less affordable for residents than has historically been the case; Home affordability grew worse in nearly half of counties compared to second quarter IRVINE, Calif. – September 25, 2025 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its latest U.S. Home Affordability... Read More »

Home Affordability Worsens Again Across U.S. in Fourth Quarter as Home Prices Keep Climbing

Major Home-Ownership Expenses Consume 34 Percent of National Average Wage IRVINE, Calif. – Dec. 19, 2024 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its fourth-quarter 2024 U.S. Home Affordability Report showing that median-priced single-family homes and condos remain less affordable in the... Read More »

Top 10 Counties with the Largest Quarterly Increase in Affordability Indexes in Q3 2024

According to ATTOM’s Q3 2024 U.S. Home Affordability Report median-priced single-family homes and condos are still less affordable compared to historical norms in 99 percent of counties with sufficient data. This trend, observed since 2022, reflects a persistent challenge in homeownership, with housing costs consuming historically significant... Read More »

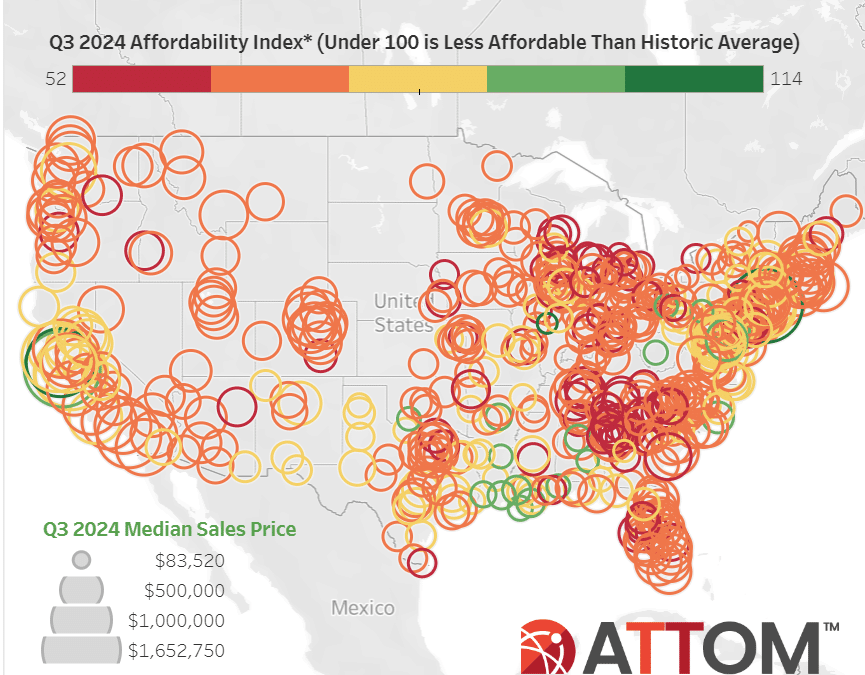

Home Ownership Slightly More Affordable Across U.S. in Third Quarter but Still Difficult for Average Workers

Major Home-Ownership Expenses Consume 34 Percent of National Average Wage; Portion Ticks Downward as Home-Price Spike Eases and Mortgage Rates Drop; Historical Affordability Also Inches Up While Remaining Weak IRVINE, Calif. – Sept. 26, 2024 — ATTOM, a leading curator of land, property data, and real estate analytics, today released its... Read More »