Commercial Foreclosures Increased 11 Percent from Last Month and 27 Percent from Last Year; States with the Most Commercial Foreclosures in December 2024 Included California, New York, and Florida

IRVINE, Calif. — February 4, 2025 — ATTOM, a leading curator of land, property data, and real estate analytics, today released an updated monthly report on U.S. Commercial Foreclosures. The report indicates that commercial foreclosures have continued their upward trajectory. Since June 2023, foreclosure numbers have risen sharply, with activity fluctuating throughout 2024. The latest data shows a peak of 725 foreclosures in December 2024, marking one of the highest levels in recent years. This sustained increase points to growing financial strain in the commercial sector, influenced by interest rates, shifting property demand, and broader economic pressures.

Historical Commercial Foreclosure Overview

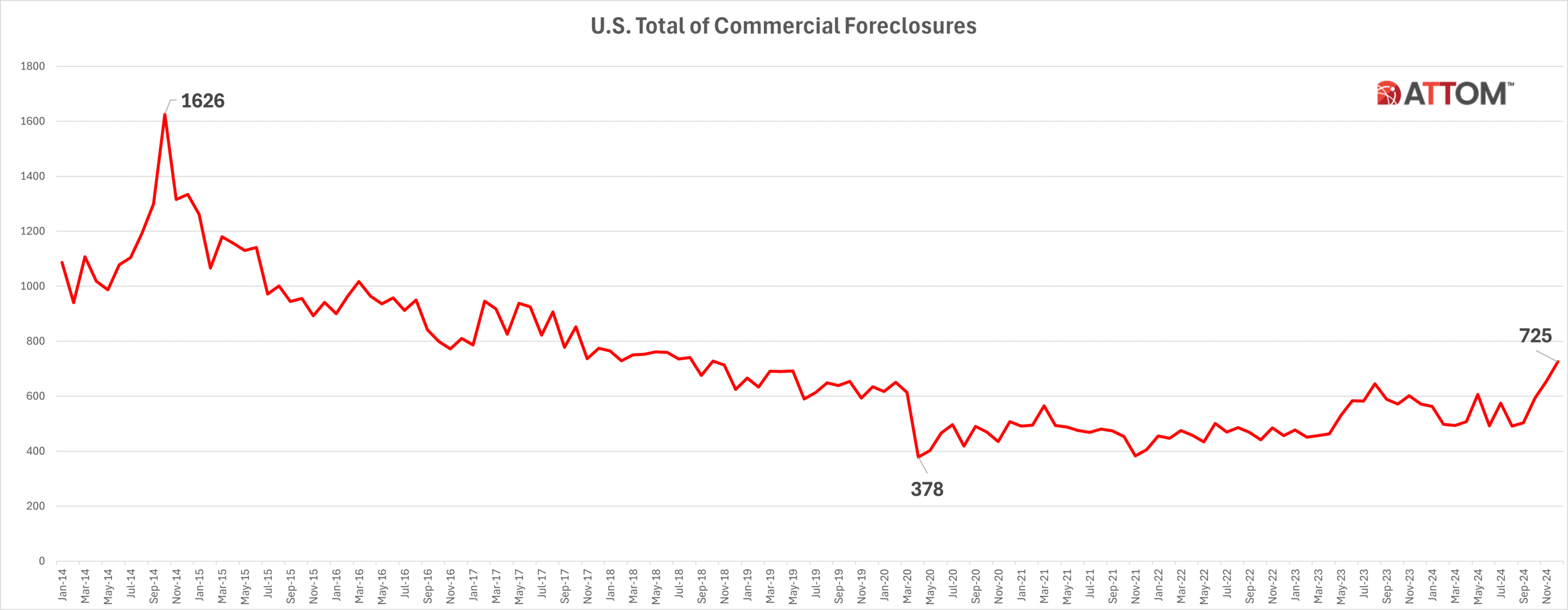

The historical data on commercial foreclosure activity from January 2014 through December 2024 reveals distinct cycles of financial distress and recovery, shaped by broader economic shifts. In the early years, foreclosure activity was at its highest, peaking at 1,626 commercial foreclosures in October 2014. This period reflected lingering financial instability in the commercial real estate market. However, a steady decline followed, with foreclosure numbers dropping below 800 per month by late 2016, signaling a stabilization in the market.

A significant low point occurred in April 2020, when foreclosures hit just 378, the lowest in the dataset. However, commercial foreclosures began a resurgence in mid-2021.

Recent data from 2024 shows a renewed upward trend. While foreclosure activity fluctuated throughout the year, numbers surged in the last quarter. By December 2024, total commercial foreclosures climbed to 725, marking one of the highest monthly figures since 2018.

State-by-State Commercial Foreclosure Review

In December 2024, California led the nation with 257 commercial foreclosures, reflecting a 90% increase from the previous month and a 104% jump compared to the same time last year. New York followed with 73 foreclosures, marking a 4% rise month over month and a 26% increase year-over-year. Florida recorded 67 commercial foreclosures, down 42% from the previous month but up 60% from a year ago. Texas saw 58 foreclosures, a 2% increase from the previous month, but a 5% decrease compared to last year. New Jersey had 51 foreclosures, experiencing a 46% increase month over month and a 24% increase year-over-year.

Methodology Update:

To ensure a more comprehensive and accurate representation of foreclosure activity, ATTOM’s U.S. Commercial Foreclosure report now includes all foreclosure filings associated with a property across different months. If a property has received multiple foreclosure filings over time, all filings will be reflected in the report. However, if multiple filings occur within the same month, only the most recent filing for that month is included. This adjustment provides a clearer picture of foreclosure trends, ensuring that all relevant foreclosure activity is accounted for. The report incorporates documents filed in all three phases of foreclosure:

- Default — Notice of Default (NOD) and Lis Pendens (LIS)

- Auction — Notice of Trustee Sale and Notice of Foreclosure Sale (NTS and NFS)

- Real Estate Owned (REO) — Properties that have been foreclosed on and repurchased by a bank

About ATTOM

ATTOM delivers AI-driven property intelligence built on one of the nation's most trusted property data assets, covering 158 million U.S. properties—99% of the population. Our engineered, multi-sourced real estate data spans property tax, deeds, mortgages, foreclosure, environmental risk, property conditions, natural hazards, neighborhood insights, and geospatial boundaries, rigorously validated for advanced analytics. ATTOM supports analytics and AI-driven applications through flexible delivery options including APIs, bulk licensing, cloud delivery, market trend products, and the MCP Server for AI-powered, agentic access to engineered property data—enabling organizations to automate analysis and scale property intelligence across industries.

Media Contact:

Megan Hunt

Megan.hunt@attomdata.com

Data and Report Licensing:

949.502.8313

datareports@attomdata.com