According to ATTOM’s just released Q2 2024 U.S. Home Equity & Underwater Report, in the second quarter 49.2 percent of mortgaged residential properties in the United States were considered equity-rich. This means that the combined estimated loan balances secured by these properties were no more than half of their estimated market values.

The latest home equity and underwater analysis compiled by ATTOM found the percentage of mortgaged homeowners in equity-rich territory rose to 49.2 percent in the second quarter of 2024, up from 45.8 percent in the first quarter of 2024. This increase matched a high point reached in the spring of the previous year and reversed a trend of three consecutive quarterly declines, marking one of the most significant gains in the past five years.

ATTOM’s second-quarter home equity and underwater report noted that equity gains occurred as home prices surged during the 2024 spring buying season, with the median national price increasing by 9 percent quarterly to a new record of $365,000. The rise in prices helped boost equity levels across most of the country by widening the gap between the estimated value of homes and the amounts homeowners owed on their loans.

The report also noted that during the second quarter of 2024, the percentage of equity-rich mortgages increased in 48 out of 50 U.S. states from the first to the second quarter of 2024, often by more than two percentage points. On an annual basis, equity-rich levels rose in 31 states, with the nationwide figure of 49.2 percent in the second quarter of this year matching the percentage from the second quarter of 2023.

ATTOM’s latest analysis also mentioned that the 10 states with the highest levels of equity-rich mortgaged properties in the second quarter of 2024 were once again in the Northeast and West regions. Leading the list were Vermont (83.5 percent of mortgaged homes were equity-rich), Maine (61.5 percent), New Hampshire (61.1 percent), Montana (61.1 percent) and Rhode Island (60.2 percent).

The second quarter report stated that nine of the ten states with the lowest percentages of equity-rich properties in the second quarter of 2024 were in the Midwest or South. The states with the smallest portions included Louisiana (21 percent of mortgaged homes were equity-rich), Alaska (31 percent), North Dakota (32 percent), West Virginia (33.6 percent), and Oklahoma (34.5 percent).

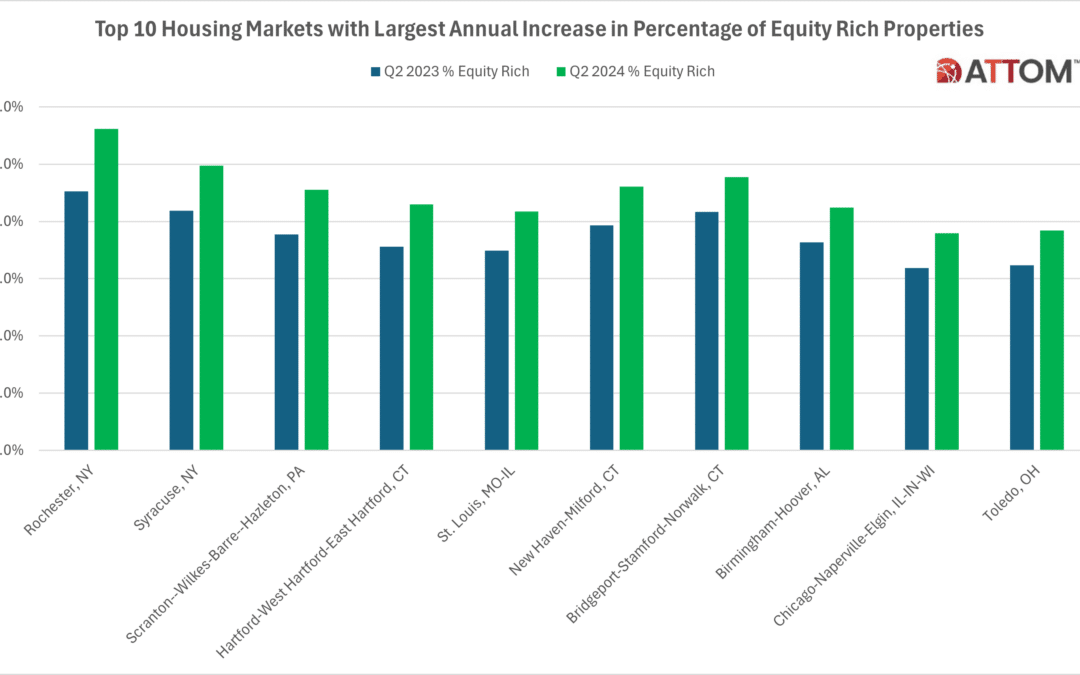

In this post, we dive deep into the data behind our second-quarter home equity and underwater report to uncover those top housing markets, among metro areas with a population greater than 500,000 in Q2, 2024, with the largest annual increase in percentages of equity-rich properties in Q2 2024. Those markets include:

#1 – Rochester, NY

- Q2 2024 Equity-Rich: 56.1 percent

- Q2 2023 Equity-Rich: 45.2 percent

- YoY % Change: 10.9 percent

#2 – Syracuse, NY

- Q2 2024 Equity-Rich: 49.7 percent

- Q2 2023 Equity-Rich: 41.8 percent

- YoY % Change: 7.9 percent

#3 – Scranton-Wilkes-Barre–Hazleton, PA

- Q2 2024 Equity-Rich: 45.5 percent

- Q2 2023 Equity-Rich: 37.7 percent

- YoY % Change: 7.8 percent

#4 – Hartford-West Hartford-East Hartford, CT

- Q2 2024 Equity-Rich: 42.9 percent

- Q2 2023 Equity-Rich: 35.6 percent

- YoY % Change: 7.4 percent

#5 – St. Louis, MO-IL

- Q2 2024 Equity-Rich: 41.8 percent

- Q2 2023 Equity-Rich: 34.9 percent

- YoY % Change: 6.9 percent

#6 – New Haven-Milford, CT

- Q2 2024 Equity-Rich: 46.1 percent

- Q2 2023 Equity-Rich: 39.3 percent

- YoY % Change: 6.8 percent

#7 – Bridgeport-Stamford-Norwalk, CT

- Q2 2024 Equity-Rich: 47.8 percent

- Q2 2023 Equity-Rich: 41.6 percent

- YoY % Change: 6.1 percent

#8 – Birmingham-Hoover, AL

- Q2 2024 Equity-Rich: 42.4 percent

- Q2 2023 Equity-Rich: 36.3 percent

- YoY % Change: 6.1 percent

#9 – Chicago-Naperville-Elgin, IL-IN-WI

- Q2 2024 Equity-Rich: 37.9 percent

- Q2 2023 Equity-Rich: 31.9 percent

- YoY % Change: 6.1 percent

#10 – Toledo, OH

- Q2 2024 Equity-Rich: 38.4 percent

- Q2 2023 Equity-Rich: 32.3 percent

- YoY % Change: 6.1 percent

Want to learn more about home equity and underwater trends in your area? Contact us to find out how!