Homeowners are seeing a significant reversal in a home equity trend that previously showed three sequential quarters of decline. After significant spikes in home prices during the 2024 spring buying season, homeowner equity is rising.

This news bodes well for seriously underwater mortgages. Nationally, seriously underwater mortgages are benefiting from economic forces, such as rising home prices and higher demand due to limited inventory. However, some states, particularly in the South and Midwest, continue to struggle.

Here’s a look at the current trends in homeowner equity and underwater mortgages, the factors driving them, and the states that are suffering the most.

More Homeowners Are Equity-Rich

According to ATTOM’s 2024 U.S. Home Equity & Underwater Report for the second quarter, more mortgaged residential properties in the United States were considered equity-rich. Equity-rich means that the combined estimated amount of loan balances secured by a property is no more than half of its estimated market value.

At the national level, the portion of home mortgages that were seriously underwater in the U.S. also declined during the second quarter and was at the lowest level since at least 2019.

Why the Rapid Turnaround?

The second-quarter home equity gains came as home prices spiked during the 2024 Spring buying season, with the median national price shooting up 9 percent quarterly to a new record of $365,000. As home prices rise, the gap widens between the estimated value of homes and the amounts homeowners owe on their loans. This increases the amount of equity they hold.

Equity had seemed stagnant over the past few quarters, but rising prices combined with limited inventory and high demand have boosted equity-rich levels. Relatively stable home-mortgage rates that hovered back and forth around 7 percent for a 30-year fixed loan, a national unemployment rate that fell below 4 percent, and investment markets that hit new highs were additional economic contributors.

Which States are Benefiting?

Equity-rich levels were up in 31 states measured annually. From a quarterly perspective, the biggest increases were seen in lower-priced markets, mainly across the South and Midwest regions.

In Kentucky, the portion of mortgaged homes considered equity-rich increased from 28.7 percent in the first quarter of 2024 to 37.4 percent in the second quarter of 2024. In Illinois, the portion of equity-rich homes rose to 36.1 percent from 28.3 percent. Missouri was up from 38.3 percent to 45.5 percent, Oklahoma from 28.1 percent to 34.5 percent, and Alabama from 35.7 percent to 41.9 percent).

While the South and Midwest regions saw big increases in equity-rich levels, the same regions have high rates of seriously underwater mortgage levels.

Seriously Underwater Mortgage Levels and Aggravating Causes in Southern States

Seriously underwater mortgages have loan balances that are at least 25 percent more than the property’s estimated market value.

Although, nationwide, underwater mortgage levels are improving, some states are still struggling, particularly in the South and Midwest.

According to Fred Goncher of Backyard Mortgage Corp. in Garnerville, New York, quoted by Realtor.com, employment rates are directly related to the problem of underwater mortgage levels.

Goncher states that southern states tend to have a higher rate of seriously underwater mortgage levels. The reasons are often a mix of economic forces like employment rates and demographics.

The states of Louisiana, Kentucky, and Oklahoma are fossil fuel energy-producing states. U.S. policy has dampened fossil fuel production, which has reduced economic activity and employment in these states. House prices drop if people don’t earn enough to buy homes, and more homeowners go underwater on their mortgages.

Population decline is also an aggravating factor that increases underwater mortgages.

“Declining population leads to declining real estate prices,” says Goncher. “Declining real estate prices leads to underwater mortgages.”

Hopefully, homeowners in states with a high proportion of underwater mortgages will start to see some respite now that homeowner equity is being pushed up by economic trends and the recent lowering of interest rates.

Nationwide, the portion of seriously underwater mortgaged homes declined nationwide during the second quarter of 2024 to one in 42. That number was one in 37 in the first quarter of 2024 and one in 36 in the second quarter of 2023. The rate decreased in 47 states quarterly and 37 states annually.

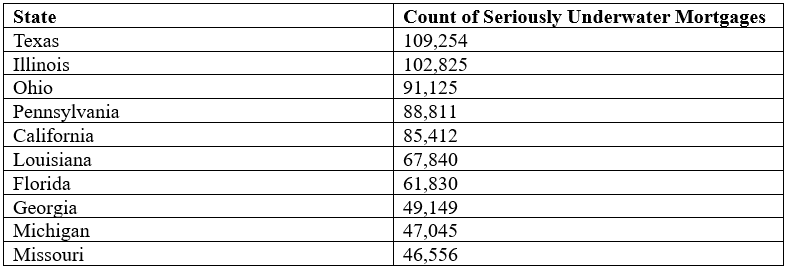

Here’s a list of the top 10 states with underwater mortgages by count as of Q2 2024.

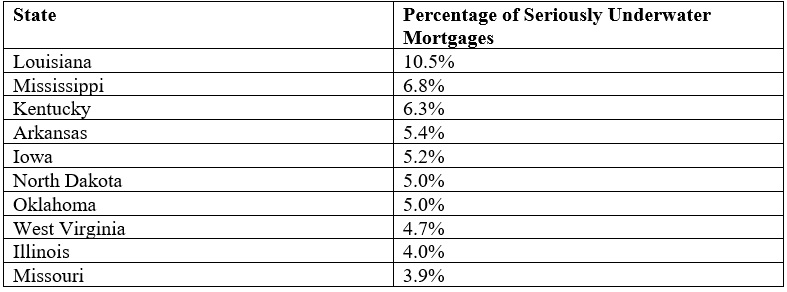

Here’s a list of the top 10 states with underwater mortgages by percentage as of Q2 2024.

Only two states had increases in the percentage of seriously underwater homes from the first quarter to the second quarter of 2024, and the increases were very slight. Utah went up from 2.1 percent to 2.2 percent, and South Dakota went up from 3 percent to 3.1 percent.

On the other end of the spectrum, the states with the smallest shares of underwater mortgages were Vermont, with 0.7 percent of mortgages seriously underwater, Rhode Island at 0.9 percent, New Hampshire at 1 percent, Massachusetts at 1.1 percent, and California at 1.2 percent.

What Does Fourth Quarter 2024 Look Like for Underwater Mortgages?

The gains in homeowner equity have been better in Q2 2024 than they have been in the past five years, and underwater mortgages are benefiting also. But what is to come? Will the trends continue?

According to Rob Barber, CEO for ATTOM, buyer demand is likely to have increased over the summer and to have pushed prices even higher. This is good news for underwater mortgages. That, combined with the recent drop-in interest rates, should mean that demand for homes will rise even more, taking home valuations with them and decreasing the number of underwater mortgages even in Southern and Midwestern states.