According to ATTOM’s just released Q1 2024 U.S. Home Equity & Underwater Report, 45.8% of mortgaged residential properties in the United States were considered equity-rich. This indicates that the total estimated loan balances tied to these properties did not surpass half of their estimated market values.

The latest home equity and underwater analysis compiled by ATTOM found that in the initial quarter of 2024, the proportion of mortgaged homes classified as equity-rich declined to 45.8%, a slight drop from 46.1% in the preceding quarter. This marks the third consecutive quarterly decrease. Additionally, compared to the first quarter of 2023, where the figure stood at 47.2%, it has reached its lowest point in two years.

ATTOM’s first-quarter home equity and underwater report noted that in 26 out of the 50 U.S. states, there was a decline in the proportion of mortgages classified as equity-rich from the fourth quarter of 2023 to the first quarter of 2024, typically by less than two percentage points. Annually, equity-rich levels decreased in 25 states from the first quarter of 2023 to the corresponding period this year.

The report also noted that during the first quarter of 2024, nine out of the top 10 states with the highest levels of equity-rich mortgaged properties in the U.S. were once again located in the Northeast or West regions. Leading the list were Vermont (with 82% of mortgaged homes classified as equity-rich), followed by Maine (59.2%), Montana (58.7%), California (58.6%), and New Hampshire (57%).

ATTOM’s latest report also mentioned that once more, during the first quarter of 2024, nine out of the bottom 10 states with the lowest percentages of equity-rich properties were situated in the Midwest or South regions. Louisiana ranked lowest, with only 20.1% of mortgaged homes classified as equity-rich, followed by Oklahoma (28.1%), Illinois (28.3%), Kentucky (28.7%), and Alaska (29.5%).

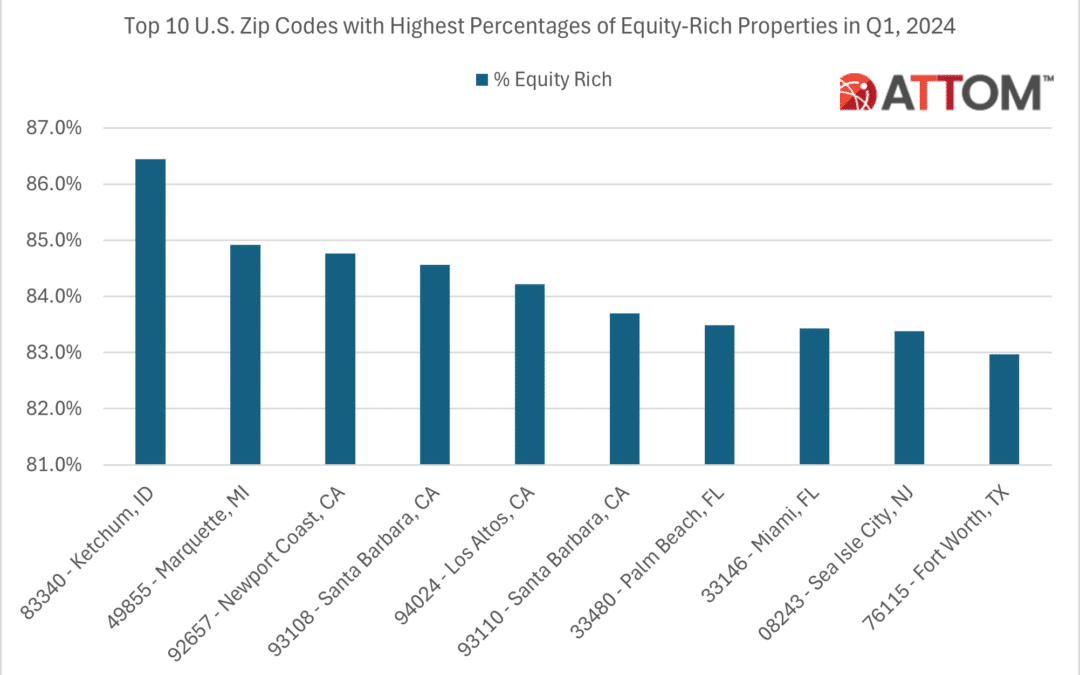

In this post, we dive deep into the data behind our first-quarter home equity and underwater report to uncover those top zip codes, among those with at least 2,000 outstanding mortgages in Q1, 2024, with the highest percentages of equity-rich properties in Q1 2024. Those zips include: 83340 – Ketchum, Idaho (86.4 percent); 49855 – Marquette, Michigan (84.9 percent); 92657 – Newport Coast, California (84.8 percent); 93108 – Santa Barbara, California (84.6 percent); 94024 – Los Altos, California (84.2 percent); 93110 – Santa Barbara, California (83.7 percent); 33480 – Palm Beach, Florida (83.5 percent); 33146 – Miami, Florida (83.4 percent); 08243 – Sea Isle City, New Jersey (83.4 percent); and 76115 – Fort Worth, Texas (83.0 percent).

Want to learn more about home equity and underwater trends in your area? Contact us to find out how!