December 4th and November Offer 2024’s Lowest Homebuying Premiums

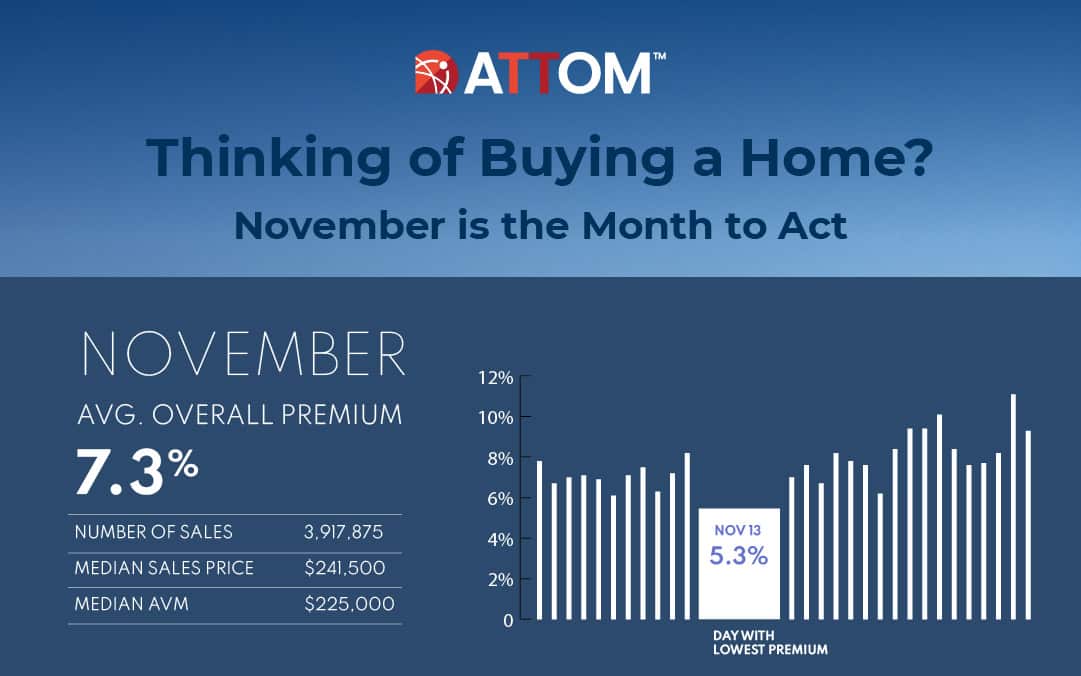

IRVINE, Calif. — Nov. 14, 2024 —ATTOM, a leading curator of land, property data, and real estate analytics, today released its annual analysis highlighting the best days of the year to purchase a home. The report found that while November offers a 7.3 percent premium, it remains the lowest premium for buyers. Additionally, December 4 stands out as the single best day to buy a home.

According to ATTOM’s latest analysis of more than 52 million single family home and condo sales over the past 11 years, buyers who close on December 4 are seeing the lowest premium above the automated valuation model (AVM). While still above market value, homebuyers are only paying a 4.8 percent premium, compared to the 14.6 percent premium buyers are seeing on May 27. (Full methodology is enclosed below.)

Other days of the year offering lower premiums for homebuyers include: October 2 (5.0 percent premium above market value); December 24 (5.1 percent premium); January 16 (5.1 percent premium); November 13 (5.3 percent premium); and October 9 (5.5 percent premium).

ATTOM’s new analysis also looked at the best months to buy at the national level and best months to buy at the state level.

Best Months to Buy

Nationally, the best months to buy are November (7.3 percent premium above market value); October (7.4 percent premium); December (7.6 percent premium); August (8.0 percent premium); and September (8.0 percent premium).

Best Months to Buy by State

According to the study, the states realizing the biggest discounts below full market value are Michigan (-3.2 percent in December); Connecticut (-1.2 percent in January); Hawaii (-1.1 percent in June); Illinois (-0.9 percent in December); and Minnesota (-0.9 percent in December).

Methodology

For this analysis ATTOM looked at any calendar day in the last 11 years (2013 to 2023) with at least 15,000 single family home and condo sales. There were 362 days (including leap year data) that matched these criteria, with the four exceptions being Jan. 1, July 4, Nov. 11, and Dec. 25. To calculate the premium or discount paid on a given day, ATTOM compared the median sales price for homes with a purchase closing on that day with the median automated valuation model (AVM) for those same homes at the time of sale.

About ATTOM

ATTOM powers innovation across industries with premium property data and analytics covering 158 million U.S. properties—99% of the population. Our multi-sourced real estate data includes property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, neighborhood and geospatial boundary information, all validated through a rigorous 20-step process and linked by a unique ATTOM ID.

From flexible delivery solutions—such as Property Data APIs, Bulk File Licenses, Cloud Delivery, Real Estate Market Trends—to AI-Ready datasets, ATTOM fuels smarter decision-making across industries including real estate, mortgage, insurance, government, and more.

Media Contact:

Megan Hunt

megan.hunt@attomdata.com

Data and Report Licensing:

datareports@attomdata.com