According to ATTOM Data Solutions Q1 2019 Home Sales Report released on April 25, 2019, nationwide the share of distressed sales continues to decline annually.

Total distressed sales — bank-owned (REO) sales, third-party foreclosure auction sales, and short sales — accounted for 14.2 percent of all single family and condo sales in Q1 2019, up from 12.9 percent in the previous quarter but down from 15.2 percent in Q1 2018. For a detailed home sales data analysis, click here.

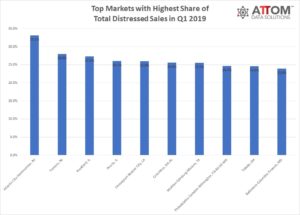

Among 135 metropolitan statistical areas with a population of at least 200,000 and at least 100 total distressed sales in Q1 2019, those with the highest share of total distressed sales were Atlantic City, New Jersey (33.1 percent); Trenton, New Jersey (28.0 percent); Rockford, Illinois (27.3 percent); Peoria, Illinois (26.1 percent); and Shreveport, Louisiana (25.9 percent). See below for the top 10 markets with the highest share of total distressed sales in Q1 2019:

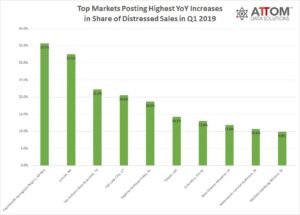

Counter to the national trend, 33 of the 135 metro areas (24 percent) posted year-over-year increases in share of distressed sales, including San Antonio, Texas (up 22.2 percent); Salt Lake City, Utah (up 20.6 percent); New Orleans, Louisiana (up 11.8 percent); Indianapolis, Indiana (up 10.6 percent); and Raleigh, North Carolina (up 8.9 percent). See below for the top 10 markets posting the highest year-over-year increases in share of distressed sales in Q1 2019:

Want to see how your market fares in distressed sales? Contact us to learn more.