Flipping Rate Declines for Second Straight Quarter While Profit Margins Increase Again; Investment Returns Continue Rebounding from Two-Year Decline; Raw Flipping Profits Also Up, to High Point Since Middle of 2022

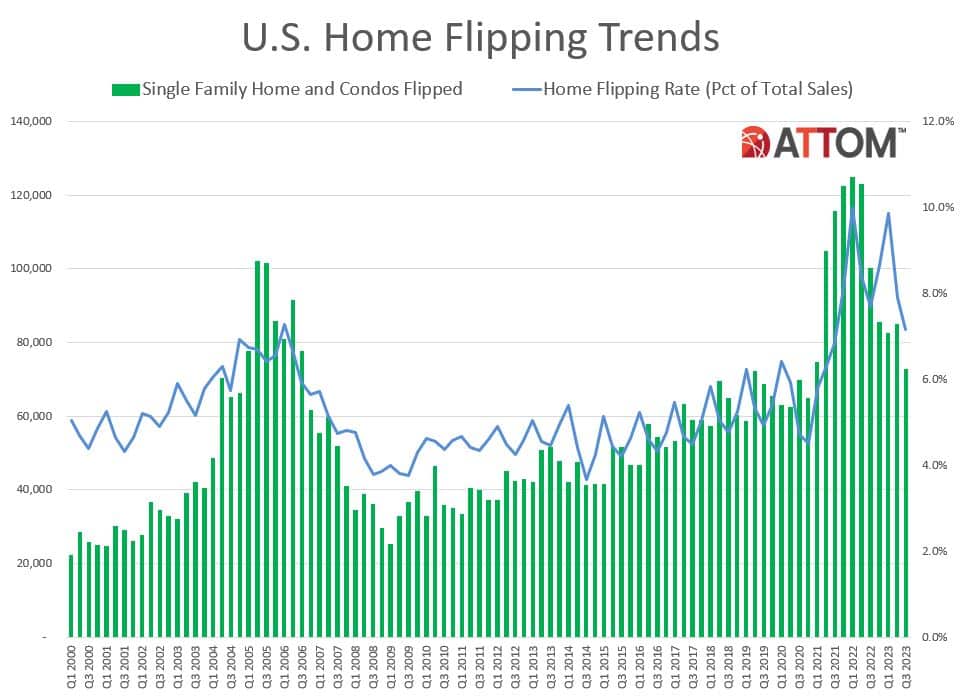

IRVINE, Calif. – Dec. 14, 2023 — ATTOM, a leading curator of land, property, and real estate data, today released its third-quarter 2023 U.S. Home Flipping Report showing that 72,543 single-family homes and condominiums in the United States were flipped in the third quarter. Those transactions represented 7.2 percent, or one of every 14 home sales nationwide, during the months running from July through September of 2023.

WATCH: ATTOM Q3 2023 U.S. Home Flipping Report

The latest portion was down from 7.9 percent of all home sales in the U.S. during the second quarter of 2023 and from 7.7 percent in the third quarter of last year. While the flipping rate remained historically high, it dropped for the second straight quarter, to the lowest point in two years.

But even as flipping rates declined, the latest analysis also revealed that fortunes continued improving for home flippers during the third quarter in the form of rising profits. Investor returns increased for the third quarter in a row, rebounding from a slump that had slashed profit margins by nearly two-thirds from early-2021 to late-2022. Margins, along with raw profits, rose to the highest levels since the middle of last year.

The typical third-quarter profit margin of 29.8 percent nationwide – based on the difference between the median purchase and median resale price for home flips – remained far below peaks hit in 2021. But it was up from 29 percent in the second quarter of 2023 and up seven percentage points from a low of 22.4 percent in the fourth quarter of last year.

Raw profits on typical flips around the country, meanwhile, increased to $70,000. That remained well down from a high of $110,000 reached in 2021. But it was up slightly from the second quarter of 2023 and was $15,000 more than last year’s low point.

“The comeback for the home-flipping industry is looking more like a real trend than a temporary break in what had been a pretty bleak couple of years,” said Rob Barber, CEO for ATTOM. “For sure, investment returns still aren’t anywhere close to where they were a couple of years ago. The latest nationwide profit margin also remains barely within the spread that covers the usual holding costs on flips, with wide variations around the country. Nevertheless, home flippers continue to head back in the right direction.”

Profits and profit margins again turned upward in the third quarter of 2023 as investors were able to benefit from shifts in prices that went in their favor from the time when they were buying their properties to the point at which they sold them.

Specifically, the typical resale price on flipped homes decreased to $305,000 in the third quarter, a 1.5 percent decline from the second quarter of 2023. But that drop-off was not as much as a 2.1 percent dip in median prices that recent home flippers were commonly seeing when they were buying their properties. The smaller quarterly decline in resale prices led to the improvement in profits and profit margins.

Home flipping rates tick downward in three-quarters of nation

Home flips as a portion of all home sales decreased from the second quarter of 2023 to the third quarter of 2023 in 136 of the 183 metropolitan statistical areas around the U.S. with enough data to analyze (74 percent). Most of the declines were by less than two percentage points. (Metro areas were included if they had a population of 200,000 or more and at least 50 home flips in the third quarter of 2023.)

Among those metros, the largest flipping rates during the third quarter of 2023 were in Macon, GA (flips comprised 16.1 percent of all home sales); Salisbury, MD (14.1 percent); Spartanburg, SC (13.3 percent); Atlanta, GA (13.2 percent) and Fayetteville, NC (12.8 percent).

Aside from Atlanta, the largest flipping rates among metro areas with a population of more than 1 million were in Memphis, TN (12.5 percent); Jacksonville, FL (10.8 percent); Phoenix, AZ (10.4 percent) and Cincinnati, OH (10.2 percent).

The smallest home-flipping rates among metro areas analyzed in the third quarter were in Seattle, WA (3.8 percent); Madison, WI (3.9 percent); Honolulu, HI (3.9 percent); Bridgeport, CT (4 percent) and Lansing, MI (4.1 percent).

Regionally, the highest third-quarter flipping rate was in the South (9.1 percent), followed by the West (8.1 percent), Midwest (6.5 percent) and Northeast (5.2 percent).

Typical home flipping returns up in half of U.S.

The median $305,000 resale price of homes flipped nationwide in the third quarter of 2023 generated a gross profit of $70,000 above the median investor purchase price of $235,000. That resulted in a typical 29.8 percent profit margin in the third quarter of 2023, up from 29 percent the second quarter of this year and 27 percent in the third quarter of last year (as well the recent low point of 22.4 percent in the fourth quarter of 2022). But the latest nationwide figure still remained far beneath the 60.8 percent level in the second quarter of 2021.

Profit margins went up from the second to the third quarter in 93 of the 183 metro areas analyzed (51 percent) and were up annually in 111 of those markets, or 61 percent.

The biggest year-over-year increases in typical profit margins during the third quarter came in Akron, OH (ROI up from 50 percent in the third quarter of 2022 to 114.1 percent in the third quarter of 2023); Flint, MI (up from 61.6 percent to 113.8 percent); Canton, OH (up from 17.8 percent to 69.6 percent); Augusta, GA (up from 44.8 percent to 93.5 percent) and York, PA (up from 61.5 percent to 107.5 percent).

The biggest annual increases in typical profit margins among metro areas with a population of at least 1 million were in Birmingham, AL (ROI up from 35.4 percent in the third quarter of 2022 to 71.9 percent in the third quarter of 2023); Buffalo, NY (up from 75.6 percent to 109.7 percent); Cleveland, OH (up from 35.8 percent to 67 percent); Cincinnati, OH (up from 33.5 percent to 55.3 percent) and Tulsa, OK (up from 32.3 percent to 53.8 percent).

The recent gains resulted in typical profit margins of below 30 percent in just 68, or about a third, of the 183 metros with enough data to analyze in the third quarter of 2023. That was far better than a year earlier, when half of those metro areas commonly had investment returns that low.

Metro areas with a population of at least 1 million and the weakest returns on typical home flips in the third quarter of 2023 were Austin, TX (1.2 percent); Dallas, TX (4.9 percent); San Antonio, TX (5.7 percent); Houston, TX (8.1 percent) and Salt Lake City, UT (11.2 percent).

Investors earn highest raw profits in West and Northeast

The highest raw profits on median-priced home flips in the third quarter of 2023, measured in dollars, were concentrated in the West and Northeast regions of the country. Twenty of the top 25 were in those regions, led by San Jose, CA (typical gross profit of $355,000); San Francisco, CA ($249,000); Salisbury, MD ($231,015); San Diego, CA ($189,000) and both Bridgeport, CT, and New York, NY ($165,000).

The South dominated the opposite end of the range, along with the West. Those two regions had 24 of the 25 worst raw profits on median-priced transactions during the third quarter. The weakest numbers were in Albuquerque, NM ($1,875 loss); Tyler, TX ($1,749 profit); Provo, UT ($2,120 profit); Austin, TX ($4,939 profit) and Beaumont, TX ($6,062 profit).

All-cash investing by home flippers increases slightly

Nationwide, 62.9 percent of homes flipped in the third quarter of 2023 had been purchased by investors with cash. That was up from 62.3 percent in the second quarter of 2023, although still down from 63.7 percent portion in the third quarter of 2022. Meanwhile, 37.1 percent of homes flipped in the third quarter of 2023 had been bought with financing. That was down from 37.7 percent in the prior quarter, but still up from 36.3 percent a year earlier.

“All-cash flipping inched up a bit as average home mortgage rates rose by a full percentage point across the country during the third quarter following some small drop-offs earlier in 2023,” Barber noted. “With rates now dipping back down, the pressure to finance flips with cash is receding a bit. That could lead more investors back to financing their purchases, much as they did when rates were super low a couple of years ago.”

Among metropolitan areas with a population of 1 million or more and sufficient data to analyze, those with the highest percentage of homes flipped in the third quarter of 2023 that had been purchased with cash were in Detroit, MI (79.7 percent); Cleveland, OH (76.5 percent); Rochester, NY (73.4 percent); Cincinnati, OH (72.6 percent) and Buffalo, NY (70.4 percent).

Average time to flip nationwide decreases by 17 days

The average time it took from purchase to resale on home flips dropped to 161 days in the third quarter of 2023. That was down from 178 in the second quarter of 2023 and 165 days in the third quarter of 2022, to the smallest level since the fourth quarter of 2021.

Investor resales to FHA buyers drop for first time in more than a year

Of the 72,543 U.S. homes flipped in the third quarter of 2023, 10.1 percent were sold to buyers using loans backed by the Federal Housing Administration (FHA), marking the first quarterly decline since the second quarter of last year. The latest portion was down from 11.8 percent in the second quarter of 2023, although still up from 8.9 percent in the third quarter of 2022.

Among metro areas with a population of at least 200,000 and at least 50 home flips in the third quarter of 2023, those with the highest percentage of flipped properties sold to FHA buyers — typically first-time home purchasers — were Bakersfield, CA (27.7 percent); Visalia, CA (27.4 percent); Greeley, CO (27.3 percent); Vallejo, CA (26.7 percent) and Lakeland, FL (24.9 percent).

One of every six counties have home-flipping rates of at least 10 percent

Home flips accounted for at least 10 percent of all home sales in 175, or 17.9 percent, of the 979 counties around the U.S. with at least 10 flips in the third quarter of 2023. That was below the 23.9 percent of all counties with enough data to measure in the second quarter of 2023. The leaders in the third quarter of this year were Somerset County (Princess Anne), MD (22 percent); Lumpkin County, GA (north of Atlanta) (20.4 percent); Lamar County, GA (south of Atlanta) (20 percent); Cobb County (Marietta), GA (20 percent) and Hopewell City/County, VA (19.4 percent).

Report methodology

ATTOM analyzed sales deed data for this report. A single-family home or condo flip was any arms-length transaction that occurred in the quarter where a previous arms-length transaction on the same property had occurred within the last 12 months. The average gross flipping profit is the difference between the purchase price and the flipped price (not including rehab costs and other expenses incurred, which flipping veterans estimate typically run between 20 percent and 33 percent of the property’s after-repair value). Gross flipping return on investment was calculated by dividing the gross flipping profit by the original purchase price.

About ATTOM

ATTOM provides premium property data to power products that improve transparency, innovation, efficiency and disruption in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation’s population. A rigorous data management process involving more than 20 steps validates, standardizes, and enhances the real estate data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. The 30TB ATTOM Data Warehouse fuels innovation in many industries including mortgage, real estate, insurance, marketing, government and more through flexible data delivery solutions that include bulk file licenses, property data APIs, real estate market trends, property navigator and more. Also, introducing our newest innovative solution, that offers immediate access and streamlines data management – ATTOM Cloud.

Media Contact:

Christine Stricker

949.748.8428

christine.stricker@attomdata.com

Data and Report Licensing:

949.502.8313