ATTOM Data Solutions just released its Q1 2019 Home Sales Report and the data shows that U.S. homeowners who sold in the first quarter of 2019 realized an average home price gain since purchase of $57,500, down from an average gain of $60,000 in Q4 2018 but up from an average gain of $56,733 in Q1 2018. The average home seller-gain of $57,500 in Q1 2019 represented an average 31.5 percent return as a percentage of original purchase price. While the percent of gains dropped both quarterly and annually, homeowners are still reaping some nice profits.

The data is derived by looking at what a homeowner originally paid on their property versus what they sold it for. For a historical snapshot of historical seller gains, check out the chart below. Our seller gains data stretches back to Q1 2005 but can go further upon request. The peak quarter when seller dollar gains were at their highest occurred in the fourth quarter of 2005, with $81,006 being made on average, while home sellers selling in the first quarter of 2019 were losing around $53,500…on average.

Markets That Are Hot

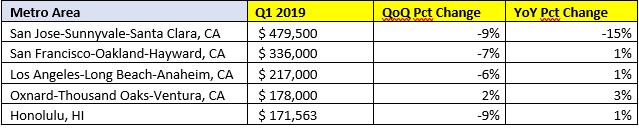

ATTOM Data wanted to showcase those markets, where home sellers are acquiring some serious gains. Among the 124 metropolitan statistical areas with a population greater than 200,000 and with at least 1,000 single family home and condo sales in the first quarter of 2019, those with the greatest dollar gain occurred mainly on the West coast.

The market to top the dollar gains for sellers occurred in San Jose, California with home sellers seeing almost a half-million gain ($479,500). Markets to follow include San Francisco ($336,000); Los Angeles ($217,000); Oxnard ($178,000); and a non-California market, Honolulu, Hawaii ($171,563).

Want More Data?

Don’t see your market or want to drill down to a city or zip code? Want the data going back historically to uncover possible trends that may affect your future portfolio? Contact ATTOM Data Solutions now and just ask!