ATTOM’s newly released Q1 2022 U.S. Home Sales Report revealed that nationwide, all-cash purchases accounted for 34.2 percent of all single-family home sales in Q1 2022 – the highest level since Q1 2015 – up from 32 percent in Q4 2021 and from 30.3 percent in Q1 2021.

According to ATTOM’s latest home sales analysis, among metro areas with a population of at least 200,000 and sufficient cash-sales data, those where cash sales represented the largest share all transactions in Q1 2022 included Flint, MI (61.8 percent of all sales); Detroit, MI (61.5 percent); Utica, NY (54.8 percent); Naples, FL (54.4 percent) and Ann Arbor, MI (53 percent).

The report noted that those areas where cash sales represented the smallest share of all transactions in Q1 2022 included Kennewick, WA (17.2 percent of all sales); Augusta, GA (17.9 percent); Lincoln, NE (18.1 percent); Washington, DC (19.4 percent) and San Jose, CA (19.4 percent).

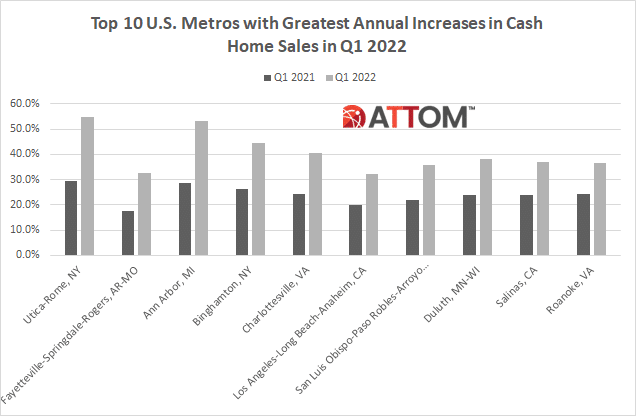

In this post, we dive deeper into the data behind the latest ATTOM home sales report to uncover those top housing markets that also saw the greatest annual increases in cash sales share in Q1 2022. Among those top 10 metros with a population of 200,000 or more, those with the greatest annual increases in cash sales share in Q1 2022 included: Utica-Rome, NY (up from 29.4 percent in Q1 2021 to 54.8 percent in Q1 2022); Fayetteville-Springdale-Rogers, AR-MO (up from 17.6 percent in Q1 2021 to 32.6 percent in Q1 2022); Ann Arbor, MI (up from 28.7 percent in Q1 2021 to 53.0 percent in Q1 2022); Binghamton, NY (up from 26.1 percent in Q1 2021 to 44.6 percent in Q1 2022); Charlottesville, VA (up from 24.2 percent in Q1 2021 to 40.6 percent in Q1 2022); Los Angeles-Long Beach-Anaheim, CA (up from 19.7 percent in Q1 2021 to 32.0 percent in Q1 2022); San Luis Obispo-Paso Robles-Arroyo Grande, CA (up from 22.0 percent in Q1 2021 to 35.6 percent in Q1 2022); Duluth, MN-WI (up from 23.8 percent in Q1 2021 to 38.3 percent in Q1 2022); Salinas, CA (up from 23.8 percent in Q1 2021 to 37.0 percent in Q1 2022); and Roanoke, VA (up from 24.1 percent in Q1 2021 to 36.5 percent in Q1 2022).

Also, according to ATTOM’s new home sales analysis, median home prices in Q1 2022 exceeded values from Q4 2021 in 52 percent of metro areas analyzed and remained up annually in 97 percent. The report noted that nationally, the median price of $320,500 in Q1 2022 was up from $315,000 in Q4 2021 and $275,000 in Q1 2021.

The report also noted the biggest quarterly increases in median home prices in Q1 2022 were in Honolulu, HI (up 7.9 percent); Port St. Lucie, FL (up 7.7 percent); Lakeland, FL (up 7.6 percent); Austin, TX (up 7.6 percent) and Cape Coral-Fort Myers, FL (up 7.5 percent).

ATTOM’s Q1 022 home sales report mentioned that home prices in Q1 2022 hit or tied all-time highs in 47 percent of the metros analyzed, including New York, NY; Los Angeles, CA; Dallas, TX; Houston, TX, and Miami, FL. The largest quarterly decreases in median prices in Q1 2022 were in Macon, GA (down 15.4 percent); Kalamazoo, MI (down 10.9 percent); Detroit, MI (down 10 percent); York, PA (down 9.5 percent) and Des Moines, IA (down 9.3 percent).

Want to learn more about cash home sales, prices and other home sale trends in your market? Contact us to find out how!