ATTOM’s recently released Q3 2023 U.S. Home Affordability Report revealed that affordability worsened across the nation amid a third-quarter increase in home prices and home-mortgage rates, which combined to help push the typical portion of average wages nationwide required for major home-ownership expenses up to 35 percent.

The latest home affordability analysis by ATTOM reported that portion is considered unaffordable by common lending standards, which call for a 28 percent debt-to-income ratio. According to the report, the latest figure marks the highest level since 2007 and stands well above the 21 percent figure from early in 2021 – right before home-mortgage rates began shooting up from historic lows.

ATTOM’s Q3 2023 home affordability report noted that counties where major ownership costs require the largest percentage of wages are concentrated in the Northeast and on the west coast, where the top 20 are located.

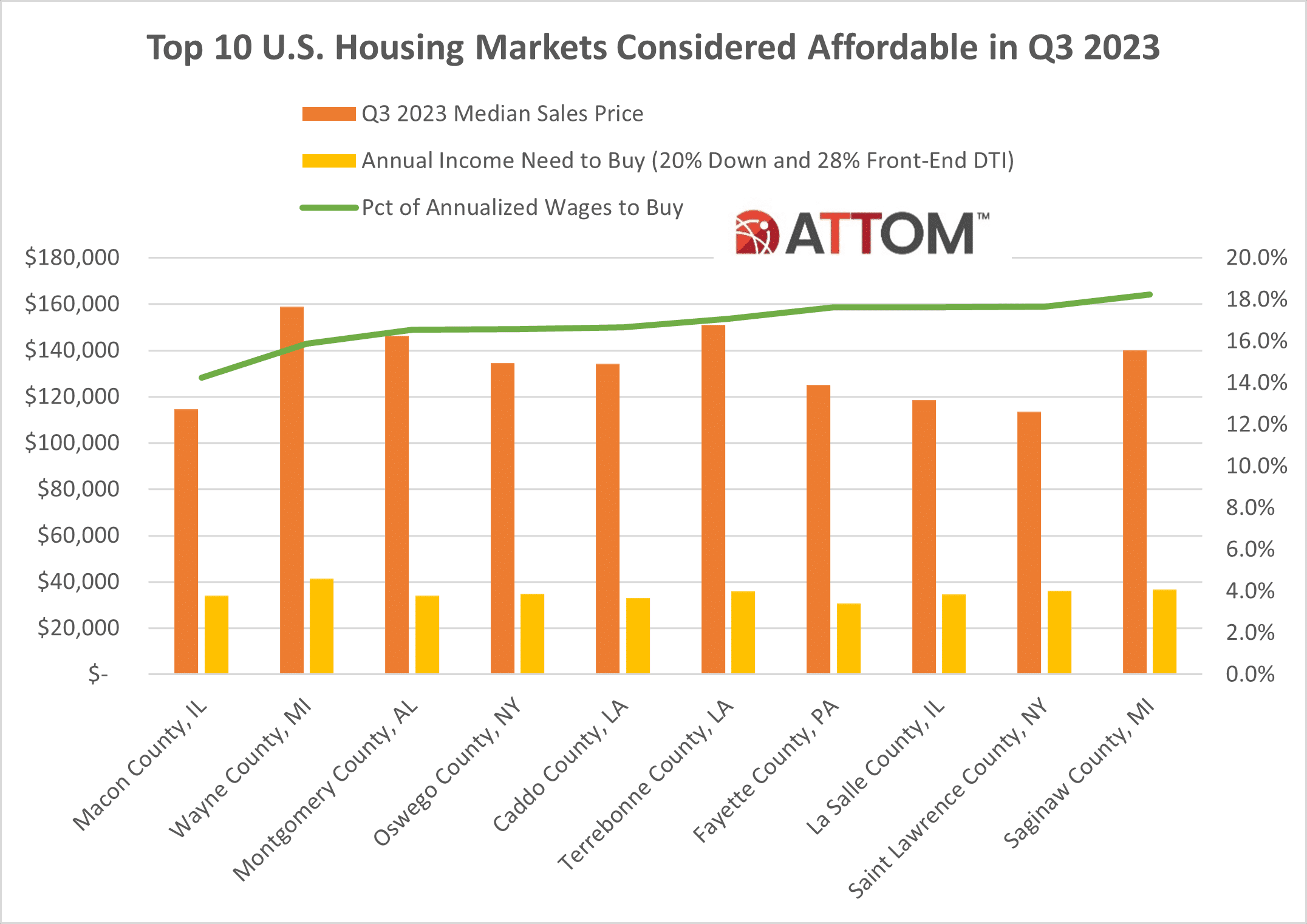

In this post, we dive deep into the data behind ATTOM’s latest home affordability report to uncover the top 10 U.S. counties where major homeownership expenses are considered affordable by common lending standards in Q3 2023. Those counties include:

Macon County, IL

- Median Sales Price $114,551

- Income Need to Buy $33,951

- Pct of Wages 14.2%

Wayne County, MI

- Median Sales Price $159,000

- Income Need to Buy $41,461

- Pct of Wages 15.9%

Montgomery County, AL

- Median Sales Price $146,393

- Income Need to Buy $34,100

- Pct of Wages 16.6%

Oswego County, NY

- Median Sales Price $134,500

- Income Need to Buy $34,790

- Pct of Wages 16.6%

Caddo County, LA

- Median Sales Price $134,250

- Income Need to Buy $33,106

- Pct of Wages 16.7%

Terrebonne County, LA

- Median Sales Price $151,129

- Income Need to Buy $35,811

- Pct of Wages 17.1%

Fayette County, PA

- Median Sales Price $125,000

- Income Need to Buy $30,694

- Pct of Wages 17.6%

La Salle County, IL

- Median Sales Price $118,631

- Income Need to Buy $34,586

- Pct of Wages 17.6%

Saint Lawrence County, NY

- Median Sales Price $113,500

- Income Need to Buy $36,056

- Pct of Wages 17.7%

Saginaw County, MI

- Median Sales Price $140,000

- Income Need to Buy $36,782

- Pct of Wages 18.2%

Also, in this post, we dive deep into the data behind ATTOM’s latest home affordability report to uncover the top 10 U.S. counties where major homeownership expenses are considered unaffordable by common lending standards in Q3 2023. Those counties include:

Kings County, NY

- Median Sales Price $956,200

- Income Need to Buy $230,752

- Pct of Wages 109.9%

Marin County, CA

- Median Sales Price $1,315,000

- Income Need to Buy $325,323

- Pct of Wages 100.4%

Maui County, HI

- Median Sales Price $856,000

- Income Need to Buy $200,478

- Pct of Wages 97.3%

San Luis Obispo County, CA

- Median Sales Price $805,500

- Income Need to Buy $196,163

- Pct of Wages 94.2%

Napa County, CA

- Median Sales Price $889,000

- Income Need to Buy $223,217

- Pct of Wages 91.3%

Queens County, NY

- Median Sales Price $763,000

- Income Need to Buy $188,307

- Pct of Wages 79.8%

Rockland County, NY

- Median Sales Price $625,000

- Income Need to Buy $179,235

- Pct of Wages 78.4%

Sonoma County, CA

- Median Sales Price $782,000

- Income Need to Buy $192,702

- Pct of Wages 77.0%

Nevada County, CA

- Median Sales Price $630,000

- Income Need to Buy $156,787

- Pct of Wages 75.2%

Los Angeles County, CA

- Median Sales Price $845,750

- Income Need to Buy $206,276

- Pct of Wages 72.7%

Want to learn more about home affordability in your area? Contact us to find out how!