According to ATTOM Data Solutions’ 2020 Property Tax Analysis conducted for almost 87 million U.S. single family homes, $323 billion in property taxes were levied on single-family homes in 2020. That figure was up 5.4 percent from $306.4 billion in 2019.

ATTOM’s latest property tax analysis reported that the average tax on single-family homes in the U.S. in 2020 was $3,719 — resulting in an effective tax rate of 1.1 percent. The report noted the average property tax amount was up 4.4 percent from $3,561 in 2019, while the effective property tax rate was down slightly from 1.14 percent in 2019.

The 2020 property tax report also noted that the states with the highest effective property tax rates in 2020 remained New Jersey (2.2 percent), Illinois (2.18 percent), Texas (2.15 percent), Vermont (1.97 percent) and Connecticut (1.92 percent). According to the analysis, the lowest effective tax rates were in Hawaii (0.37 percent), Alabama (0.44 percent), West Virginia (0.51 percent), Colorado (0.54 percent) and Utah (0.54 percent).

ATTOM’s latest property tax analysis also reported that among the 220 U.S. metro areas included in the study, with a population of at least 200,000 in 2020, 12 of the top 20 effective tax rates were in the Northeast. Those with the highest effective property tax rates were Syracuse, NY (2.83 percent); Trenton, NJ (2.69 percent); Binghamton, NY (2.67 percent); El Paso, TX (2.66 percent) and Rockford, IL (2.62 percent).

County-Level Property Tax Trends

The report noted that among 1,453 U.S. counties with at least 10,000 single family homes in 2020 and sufficient data, 16 had an average single-family-home tax of more than $10,000, including 12 in the New York City metro area. The report mentioned the top five were Rockland County, NY ($13,931); Marin County, CA (outside San Francisco) ($13,257); Essex County, NJ ($12,698); Nassau County, NY ($12,386) and Bergen County, NJ ($12,348).

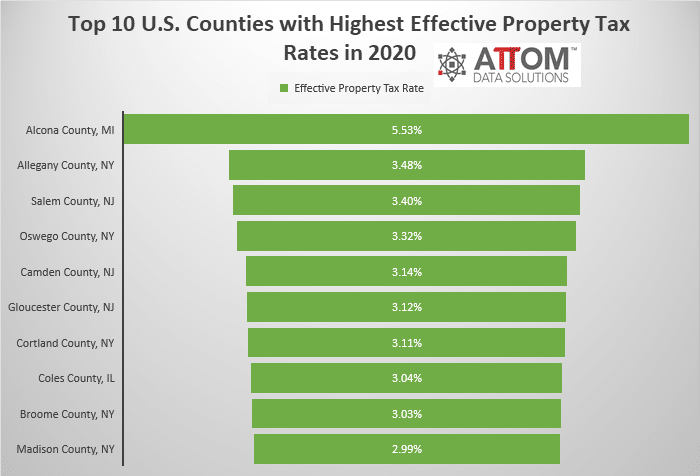

In this post, we take a deeper dive into the data behind ATTOM’s 2020 property tax analysis to uncover the top 10 counties with the highest effective property tax rates, among those counties with 10,000 or more single family homes in 2020 and sufficient data. Those top 10 counties include: Alcona County, MI (5.53 percent); Allegany County, NY (3.48 percent); Salem County, NJ (3.40 percent); Oswego County, NY (3.32 percent); Camden County, NJ (3.14 percent); Gloucester County, NJ (3.12 percent); Cortland County, NY (3.11 percent); Coles County, IL (3.04 percent); Broome County, NY (3.03 percent); and Madison County, NY (2.99 percent).

The 2020 property tax analysis also reported that the average tax was more than 10 times higher in the most expensive state versus the least expensive. New Jersey’s average property tax on single-family homes of $9,196 was more than 10 times over than the average tax of $841 in Alabama, the state with the lowest average levy.

ATTOM’s property tax report analyzes property tax data collected from county tax assessor offices nationwide at the state, metro and county levels, along with estimated market values of single-family homes calculated using an automated valuation model (AVM). The average annual property tax expressed as a percentage of the average estimated market value of homes in each geographic area is the effective tax rate.

Want to learn more about property tax trends in your state, metro area or county? Contact us to find out how!