ATTOM Data Solutions’ Q3 2019 Opportunity Zones Analysis reported that about half the opportunity zones included in the study saw median home prices rise more than the national increase of 8.3 percent from Q3 2018 to Q3 2019.

This special report looked at qualified Opportunity Zones established by Congress in the Tax Cuts and Jobs act of 2017. There were nearly 3,700 zones with sufficient sales data to analyze, which included home sales prices with at least five home sales in each quarter from Q1 2005 through Q3 2019.

ATTOM’s report issued this week also showed that 79 percent of the zones had median home prices in Q3 that were less than the national median of $270,000 – almost the same percentage as in the previous quarter. Some 46 percent of the zones had median prices of less than $150,000, also roughly the same as in the Q2 2019.

According to the report, of the 46 percent of the tracts with a median price of less than $150,000, 17 percent ranged from $150,000 to $199,999. Another 16 percent ranged from $200,000 up to the national median of $270,000, 21 percent were more than $270,000. All percentages were similar to those in Q2 2019.

In the metro areas with sufficient sales data to analyze, 87 percent of Opportunity Zones had median Q3 sales prices that were less than the median values for the surrounding MSAs. Among those, 31 percent had median sales prices that were less than half the figure for the MSAs. While 13 percent of the zones had median sales prices that were equal to or above the median sales price of the broader MSAs.

In looking at the top 10 opportunity zones with the greatest appreciating median sales prices, only two had prices above their surrounding metro areas in Q3. Those included 18097354500 in Indianapolis-Carmel, IN (96 percent above) and 01097001002 in Mobile, AL (36 percent above).

The remaining 8 of the top 10 greatest appreciating opportunity zones with sales prices less than their broader MSAs included: 17031251900 in Chicago-Naperville-Joliet, IL-IN-WI (6 percent below); 01003010600 in Daphne-Fairhope, AL (65 percent below); 17197882500 in Chicago-Naperville-Joliet, IL-IN-WI (46 percent below); 42101017100 in Philadelphia-Camden-Wilmington, PA-NJ-DE-MD (84 percent below); 12086000109 in Miami-Fort Lauderdale-Miami Beach, FL (14 percent below); 13255160900 in Atlanta-Sandy Springs-Marietta, GA (67 percent below); 37071032000 in Charlotte-Gastonia-Concord, NC-SC (56 percent below); and 18097352600 in Indianapolis-Carmel, IN (25 percent below).

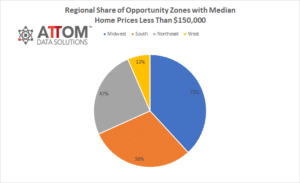

The report also noted that from a regional perspective, the Midwest continued to have the highest rate of Opportunity Zone tracts with a median home price of less than $150,000 (71 percent), followed by the South (56 percent), the Northeast (47 percent) and the West (12 percent).

Want to see how the opportunity zones in your area are impacting your market? Contact us to find out how!