Rankings for Highest SFR Returns by County and Zip Code;

Best Millennial SFR Markets in Detroit, Duluth, Kansas City, Oklahoma City

IRVINE, Calif. – March 23, 2017 — ATTOM Data Solutions, curator of the nation’s largest fused property database, today released its Q1 2017 Single Family Rental Market report, which ranks the best U.S. markets for buying single family rental properties in 2017.

The report analyzed single family rental returns in 375 U.S. counties each with a population of at least 100,000 and sufficient rental and home price data, along with more than 6,000 U.S. zip codes with a population of 2,500 more and sufficient rental and home price data. Rental data was from the U.S. Department of Housing and Urban Development, and home price data was from publicly recorded sales deed data collected and licensed by ATTOM Data Solutions (see full methodology below).

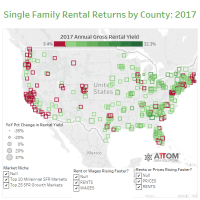

The average annual gross rental yield (annualized gross rent income divided by median purchase price of single family homes) among the 375 counties was 9.0 percent for 2017, down from an average of 9.1 percent in 2016. For a detailed analysis of the single family rental market, click here.

“While good returns on single family rentals are hard to come by in high-priced coastal markets and in some other housing hot spots such as Denver and parts of Dallas, Austin and Nashville, solid returns on single family rentals will continue to be available in many parts of the Southeast, Rust Belt and Midwest for investors purchasing in 2017,” said Daren Blomquist, senior vice president at ATTOM Data Solutions. “And single family rentals should continue to yield strong returns in many parts of the country going forward given the market undercurrents of low rent-ready housing inventory and low homeownership rates. Average fair market rents increased in 2017 in 86 percent of the markets we analyzed even while average wage growth outpaced rent growth in 67 percent of markets — a recipe for sustainable growth in the rental market.”

Counties in Georgia, Maryland, Pennsylvania post highest single family rental returns

Counties with the highest annual gross rental yields were Clayton County, Georgia, in the Atlanta metro area (23.7 percent); Baltimore City, Maryland (23.6 percent); Bibb County, Georgia, in the Macon metro area (23.5 percent); Monroe County, Pennsylvania, in the East Stroudsburg metro area (20.6 percent); and Saginaw County, Michigan (18.8 percent).

Among 40 counties with a population of at least 1 million people, those with the highest gross rental yields were Wayne County, Michigan, in the Detroit metro area (17.3 percent); Cuyahoga County, Ohio in the Cleveland metro area (13.2 percent); Allegheny County, Pennsylvania, in the Pittsburgh metro area (10.6 percent); Philadelphia County, Pennsylvania (10.1 percent); and Franklin County, Ohio in the Columbus metro area (9.9 percent).

Counties with lowest single family rental returns

Counties with the lowest annual gross rental yields were Arlington County, Virginia, in the Washington, D.C., metro area (3.4 percent); Williamson County, Tennessee, in the Nashville metro area (3.9 percent); Santa Cruz County, California (4.1 percent); Norfolk County, Massachusetts, in the Boston metro area (4.2 percent); and Santa Clara County, California, in the San Jose metro area (4.2 percent).

Along with Santa Clara County, the lowest gross annual rental yields for counties with a population of at least 1 million were in Kings County (Brooklyn), New York (4.4 percent); Orange County, California, south of Los Angeles (4.6 percent); Fairfax County, Virginia, in the Washington, D.C., metro area (4.6 percent); and Queens County, New York (4.7 percent).

Rental yields decrease in 57 percent of markets

Median sales prices for single family homes rose faster than average fair market rents in 213 of the 375 counties (57 percent), resulting in declining gross annual rental yields in the same percentage of counties.

Counties with the declining gross annual rental yields included Los Angeles County, California; Cook County, Illinois, in the Chicago metro area; Maricopa County, Arizona in the Phoenix metro area; Miami-Dade County, Florida; and Queens County, New York.

“Unlike their apartment counterparts, single-family home rental rates in the greater Seattle area have leveled off significantly,” said Matthew Gardner, chief economist at Windermere Real Estate, covering the Seattle market, where in King County the annual gross rental yield in 2017 is down from 2016 thanks to median home prices increasing 5 percent compared to a 1 percent increase in average fair market rents. “While home prices in this area continue to see steep increases, rents have not followed suit. I believe this is because the incomes of those who rent single-family homes are not keeping pace with rising home prices, so rents have had to adjust to the realities of the market.

“Single-family home rental rates will likely continue to see very modest increases, as many of these renters are converting to buyers,” Gardner continued. “In fact, ‘Boomerang Buyers’, who were forced to become renters when they lost their homes to foreclosure, are now in a position to qualify for a mortgage again. This process could lead to declining demand for single-family rentals, forcing landlords to adjust their rents accordingly in order to keep their properties occupied.”

Best SFR growth markets in Ohio, New York, Georgia, Pennsylvania

The report identified and ranked 25 counties with the best potential for future growth in returns on single family rentals. In all 25 counties, average weekly wages increased at least 5 percent annually and outpaced growth in fair market rents. All 25 counties also had gross annual yields of 9.5 percent or higher.

The top five counties for single family rental growth were Trumbull County, Ohio, in the Youngstown metro area (17.2 percent); Saint Lawrence County, New York, in the Ogdensburg-Massena metro area (17.1 percent gross annual rental yield); Richmond County, Georgia, in the Augusta metro area (16.6 percent); Broome County, New York, in the Binghamton metro area (16.4 percent); and Lucas County, Ohio, in the Toledo metro area (14.5 percent).

Best millennial SFR markets in Detroit, Duluth, Kansas City, Oklahoma City

The report also identified and ranked the 10 best counties for renting single family homes to millennials. In all 10 counties, the millennial share of the population increased at least 5 percent between 2014 and 2015 — the most recent data available from the Census Bureau — and millennials accounted for at least 20 percent of the total population in 2015. All 10 counties also posted annual wage growth. For purposes of the report, millennials were defined as anyone born between 1979 and 1994, limiting it to millennials at least 20 years old in 2014 and likely to be potential homebuyers.

Sorted by annual gross rental yield, the top five millennial single family rental markets were Saint Clair County, Michigan, in the Detroit metro area (14.5 percent gross annual rental yield); Jackson County, Michigan (13.4 percent); Saint Louis County, Minnesota, in the Duluth metro area (11.8 percent); Jackson County, Missouri, in the Kansas City metro area (11.2 percent); and Cleveland County, Oklahoma, in the Oklahoma City metro area (9.7 percent).

Zip codes with best SFR returns in Toledo, St. Louis, Baltimore, Camden, Birmingham

The report analyzed single family rental returns in 6,019 U.S. zip codes with a population of at least 2,500 and sufficient rental and home price data.

The top five zip codes with the highest potential single family rental returns for 2017 were 43605 in Toledo, Ohio (119.4 percent); 63115 in St. Louis (90.4 percent); 21223 in Baltimore (87.2 percent); 08104 in Camden, New Jersey (86.3 percent); and 35208 in Birmingham, Alabama (78.4 percent).

The five zip codes with the lowest potential single family rental returns for 2017 were 33480 in Palm Beach, Florida (0.7 percent); 90210 in Beverly Hills, California (0.8 percent); 90402 in Santa Monica, California (0.8 percent); 90049 in Los Angeles, California (1.1 percent); and 90272 in Pacific Palisades, California (1.2 percent).

Methodology

For this report, ATTOM Data Solutions looked at all U.S. counties with a population of 100,000 or more and with sufficient home price and rental rate data. Rental returns were calculated using annual gross rental yields: the 2016 50th percentile rent estimates for three-bedroom homes in each county from the U.S. Department of Housing and Urban Development (HUD), annualized, and divided by the median sales price of residential properties in each county.

ATTOM Data Solutions also incorporated weekly wage data from the Bureau of Labor Statistics and demographic data from the U.S. Census into the report.

The millennial generation was defined as someone who was born between the years 1979 to 1993.

About ATTOM Data Solutions

ATTOM Data Solutions is the curator of the ATTOM Data Warehouse, a multi-sourced national property database that blends property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, health hazards, neighborhood characteristics and other property characteristic data for more than 150 million U.S. residential and commercial properties. The ATTOM Data Warehouse delivers actionable data to businesses, consumers, government agencies, universities, policymakers and the media in multiple ways, including bulk file licenses, APIs and customized reports.

ATTOM Data Solutions also powers consumer websites designed to promote real estate transparency: RealtyTrac.com is a property search and research portal for foreclosures and other off-market properties; Homefacts.com is a neighborhood research portal providing hyperlocal risks and amenities information; HomeDisclosure.com produces detailed property pre-diligence reports.

ATTOM Data and its associated brands are cited by thousands of media outlets each month, including frequent mentions on CBS Evening News, The Today Show, CNBC, CNN, FOX News, PBS NewsHour and in The New York Times, Wall Street Journal, Washington Post, and USA TODAY.

Media Contact:

Jennifer von Pohlmann

949.502.8300, ext. 139

jennifer.vonpohlmann@attomdata.com

Data Licensing and Custom Report Orders

Investors, businesses and government institutions can contact ATTOM Data Solutions to purchase the full dataset behind the Environmental Hazards Housing Risk Index, including data at the state, metro, county and zip code level. The data is also available via bulk license or in customized reports. For more information contact our Data Solutions Department at 800.462.5125 or datasales@attomdata.com.