This ATTOM webinar, presented by Sean Mooney, VP of Product Management at ATTOM, and Daren Blomquist, VP of Market Economics for Auction.com, offers an in-depth look into the volatile housing market, as foreclosure activity begins to increase and the housing market flattens.

This webinar also explores ATTOM’s various distressed datasets, and how they can be implemented for your industry, to help gain that competitive edge.

Daren dives into this presentation by examining various economic trends, including key recession indicators, such as yield curve impacts or recession probability, the manufacturing index, consumer sentiment, unemployment rate, and foreclosure starts.

He also explores various distressed housing market indicators, including metrics based on unemployment rate, home price appreciation, SDQ rate, real estate net worth, 30-year fixed rate mortgage, and average days delinquent.

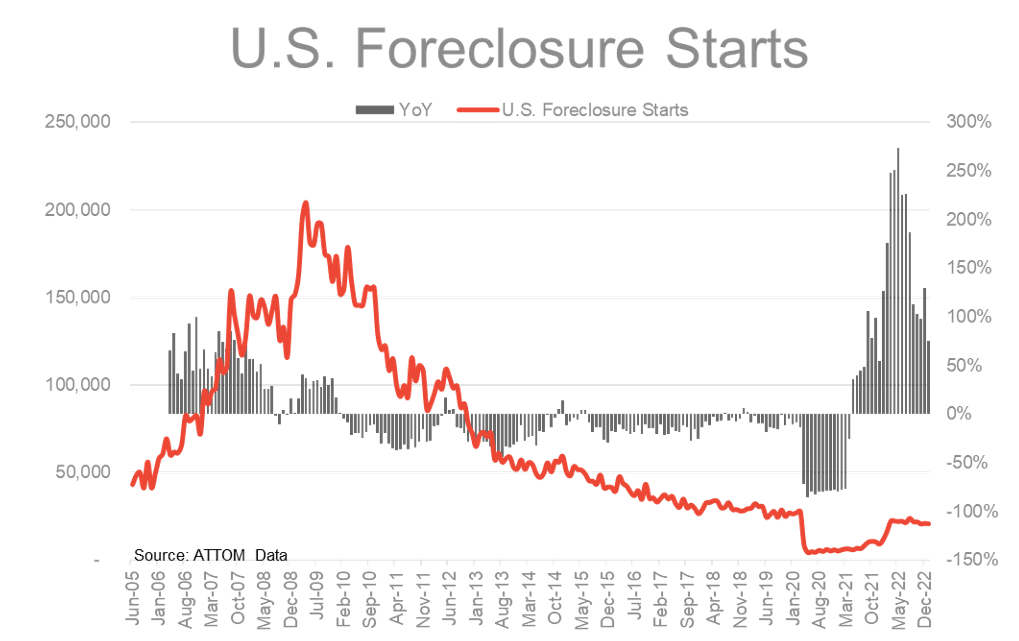

Daren notes that recession risk for January 2024 is at the highest in four decades; however, as the housing downturn continues, there are signs pointing toward a correction, and while foreclosure starts continue to surge, that measure is still below pre-pandemic levels.

Other areas Daren covers include more distressed market trends, distressed supply and demand, as well as distressed market opportunities.

Also during this webinar, Sean presents an overview of ATTOM’s comprehensive foreclosure data, covering all three stages of the foreclosure process, including default, auction and REO. Sean also examines the various types of foreclosure data available, including mortgage and HOA/COA, as well as historical foreclosure data, going back to 2005.

Sean also reviews ATTOM’s foreclosure data collection process, the various data delivery solutions available, use cases for distressed data, and various resources for accessing ATTOM’s data.

This webinar also provides an overview of ATTOM’s core value proposition and breadth of data solutions. ATTOM is the one-stop shop for premium property data fueling innovation, ATTOM provides analytics-ready data for real-world applications. ATTOM blends property tax, deed, mortgage, foreclosure, environmental risk, natural hazard and neighborhood data for more than 155 million U.S. residential and commercial properties, multi-sourced from more than 3,000 U.S. counties. ATTOM’s property data fuels growth across many industries to help drive decisions while delivering data in a variety of flexible customer solutions, including bulk data licensing, property data APIs and introducing ATTOM Cloud.

ATTOM’s robust property data is leveraged by customers to innovate in a variety of industries, including Real Estate, Insurance, Mortgage, Marketing, Government and Academia. By utilizing ATTOM’s robust property data, ATTOM clients not only create innovation but gain that competitive advantage within their industries. End-users of the data include developers, data scientists, risk managers, investors, policymakers and analysts. Discover ATTOM’s Table of Data Elements.

Auction.com goes beyond the courthouse, combining the company’s passion for real estate with technology and data science to create an unrivaled transaction platform, resulting in: $52 billion in sales, 6.3 million registered buyers on Auction.com, 451,000 properties sold to date, 16,000+ properties available for sale, 700+ employees serving the needs of buyers and sellers, and more than 10,000 auctions per year in all 50 states. Auction.com’s future proves to be as innovative as its past, as it continues to bring buyers and sellers closer together, because interaction across both sides of the transaction unleashes the power of the marketplace.

Want to learn more about how the Future of the Distressed Housing Market?

Click here to listen to the entire webinar.