Big Data and Insurance: How Home Insurers Can Bring Greater Speed and Accuracy to Their Loan Underwriting Processes by Utilizing Property Characteristics

Just like the real estate industry before it, big data is slowly revolutionizing the home insurance industry. When it comes to underwriting, big data and insurance data analysis allows tech-savvy home insurers to pool every variable to accurately assess their risk. In the case of big data and insurance, early adopters have a sizable advantage over their tech-adverse competitors.

Statistics unearthed by the Chartered Insurance Institute and the Chartered Institute of Loss Adjusters and Ordnance Survey, found that 82% of those questioned felt that insurers who failed to utilize Big Data would become ‘uncompetitive’.

While many home insurers are rushing to adopt new data and data analytics, the legacy of the industry’s pen-to-paper approach leaves many struggling to identify high-quality data sources.

As such, several home insurers are consequently weighed down by missing and inaccurate data on property characteristics – such as inaccurate details on construction and roofing materials. Low-quality data adversely impacts an insurer’s ability to accurately assess risks and make insightful judgements on their clients needs.

Therefore, ensuring you have access to extensive, accurate, high-quality data on property characteristics will ensure you maintain your competitive edge in the home insurance market place.

Back Up Your Insights with Evidence: The Benefits of Big Data and Insurance

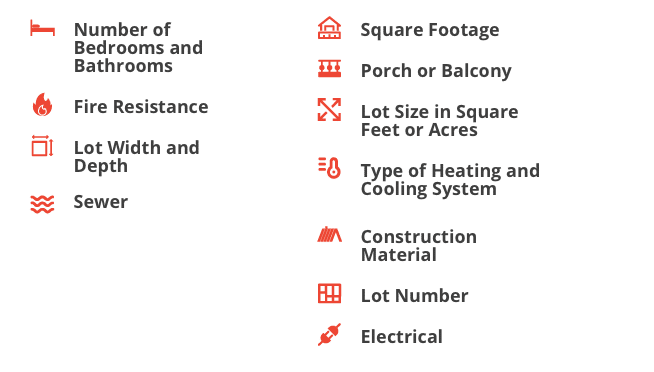

Property characteristics included in ATTOM’s database.

Comprehensive third-party data on property characteristics transform home insurance underwriting from an intuitive analysis on the behalf of the insurer to an evidence-based process.

ATTOM offers insurance industry professionals one of the most sweeping data warehouses on the market. ATTOM’s exhaustive property characteristics data ensures you have a full picture of every property you insure – bringing a pointed accuracy to your risk assessment processes.

With data on more than 155 million properties nationwide, ATTOM’s property characteristics include:

- Number of bedrooms and bathrooms

- Fire resistance

- Lot width and depth

- Sewer details

- Lot size: square feet or acres

- Type of heating and cooling system

- Roofing-material

- Construction material information

- Lot number

- Electrical details

In addition, ATTOM’s property characteristics data also enhances customer satisfaction as the loan underwriting process becomes quicker and more accurate. ATTOM’s data allows you to gain greater insights into your client base, and enables you to process claims faster – strengthening your client relationships and reputation.

Transforming Homeowner Insurance Underwriting with ATTOM

Many industry leaders are turning to big data on property characteristics to improve the accuracy of their risk analysis processes, improve customer retention and satisfaction, and speed-up outdated underwriting practices. As a leading property data provider ATTOM is an invaluable resource for many of the top home insurers.

Looking to get started with ATTOM’s property data? You can receive sample data on property characteristics straight away. Contact one of our data specialists to find out more.