ATTOM’s Q1 2024 Single-Family Rental Market report highlights the top U.S. counties for investing in single-family rental properties. The analysis covers 341 counties with populations of at least 100,000, examining median rents, home prices, and sales deed data. The average annual three-bedroom gross rental yield is projected to be 7.55% in 2024, up from 7.39% in 2023, driven by rents rising slightly faster than home prices in many areas.

Several market forces contribute to this trend, including a tight supply of homes for sale and slow home price increases, which haven’t made home buying widely affordable. Consequently, rental demand has surged, benefiting landlords and investors.

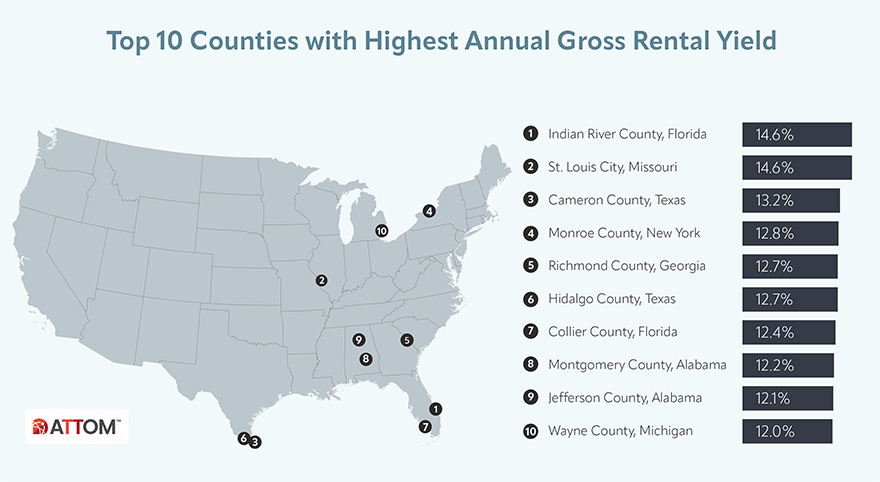

Counties with the highest potential annual gross rental yields for three-bedroom properties in 2024 are Indian River County, FL (14.6%), St. Louis City, MO (14.6%), Cameron County, TX (13.2%), Monroe County, NY (12.8%), and Richmond County, GA (12.7%). Among counties with populations of at least one million, the highest yields are in Wayne County, MI (12%), Allegheny County, PA (11.2%), Cuyahoga County, OH (10.2%), Cook County, IL (10.1%), and Riverside County, CA (9.7%).

Rental yields have increased in 216 of the 341 counties analyzed (63%) from 2023 to 2024. Notable increases include Taylor County, TX (7.6% to 11.3%), Jefferson County, AL (8.5% to 12.1%), Richmond County, GA (9.6% to 12.7%), Midland County, TX (8.7% to 11.7%), and Aiken County, SC (8.4% to 11.1%). Among large metro areas, the biggest increases are in Riverside County, CA (7.4% to 9.7%), Los Angeles County, CA (5.6% to 7.1%), Fulton County, GA (6% to 6.8%), Montgomery County, MD (4.4% to 5.2%), and Dallas County, TX (7.4% to 8.1%).

Some large metro areas have seen declines in rental yields, including Kings County, NY (8% to 4.4%), Cook County, IL (11% to 10.1%), Wayne County, MI (12.8% to 12%), Miami-Dade County, FL (7.9% to 7.3%), and Nassau County, NY (7.1% to 6.8%). Counties with the lowest potential annual gross rental yields for 2024 include Santa Clara County, CA (3%), San Mateo County, CA (3.4%), Arlington County, VA (3.8%), Williamson County, TN (3.9%), and San Francisco County, CA (3.9%).

Overall, rents are rising faster than wages in 58% of the counties analyzed, while wages are rising faster than rents in 42%. Similarly, rents are increasing faster than home prices in 63% of the counties, while home prices are rising faster in 37%.

The report also highlights 28 “SFR Growth” counties where average wages have increased over the past year and potential 2024 annual gross three-bedroom rental yields exceed 10%. These include major markets like Cook County, IL (Chicago), Wayne County, MI (Detroit), Cuyahoga County, OH (Cleveland), Allegheny County, PA (Pittsburgh), and Shelby County, TN (Memphis).

This report underscores the growing opportunities for investors in single-family rental properties across the U.S., with the Midwest, Northeast, and Southern regions showing particularly strong potential for high rental yields in 2024.

To learn more and access detailed data, or to get the data behind these findings, contact one of ATTOM’s data experts.