Written by Daren Blomquist – VP of Market Economics at Auction.com

Local community developers buying on Auction.com have reliably signaled coming ups and downs in the rollercoaster retail housing market over the last few years. Here’s what they’ve been signaling recently, and what that means for the retail housing market in late 2024 and early 2025.

1. Falling home prices in a minority of local markets

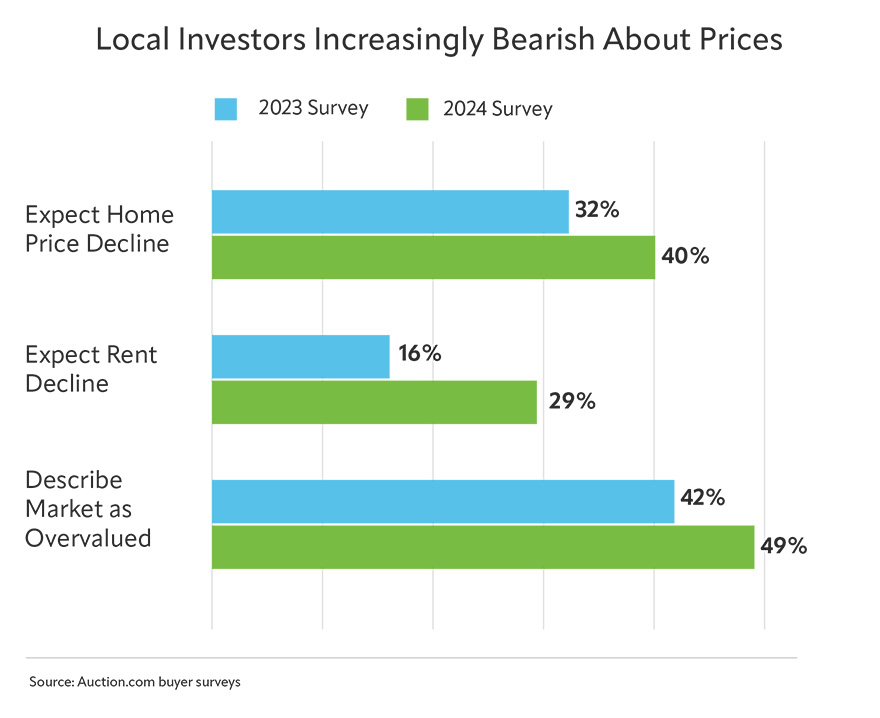

Local investors are becoming more bearish about retail home prices and rents in the latter part of 2024.

In a survey of Auction.com buyers earlier this year, 40 percent said they expect home prices in their local market to decline in 2024. That was up from 32 percent in a 2023 survey and up from 17 percent in a 2022 survey.

In a similar trend, 29 percent of Auction.com buyers surveyed in 2024 said they expect rents to decrease in 2024, up from just 16 percent in the 2023 survey.

Additionally, 49 percent of buyers surveyed in 2024 described their local market as “overvalued with correction possible,” up from 42 percent in the 2023 survey.

This first local investor indicator signals the increasing likelihood of retail home price declines in a minority of local markets by the end of 2024.

2. Persistent housing supply constraints

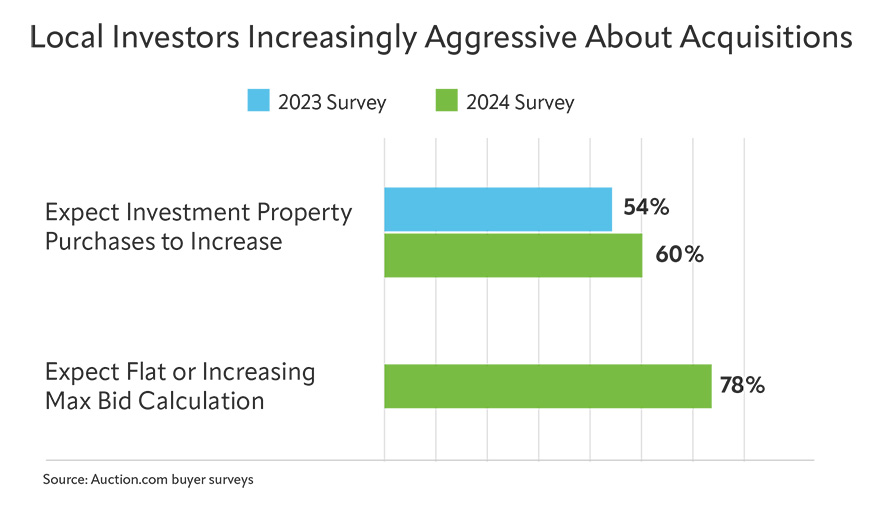

Despite being more bearish about home prices and rents in 2024, local investors buying distressed properties at auction are getting more aggressive about investment property acquisitions and most are willing to pay as much or more for properties they acquire at auction in 2024 as they did in 2023.

Among Auction.com buyers surveyed in 2024, 60 percent said they expect their investment property purchases to increase for the year compared to the previous year. That’s up from 54 percent among those surveyed in 2023.

More than three in four buyers surveyed in 2024 (78 percent) said they expect to keep the same or increase their maximum bid calculation at auction relative to property value. For instance, for a property with an estimated “after-repair” value of $100,000, a buyer who in 2023 set his or her maximum bid at 70 percent of value ($70,000 in this case) would be willing to pay 70 percent or more in 2024 ($70,000+ in this case.

This second local investor indicator signals that the supply-constrained retail market will likely continue for the remainder of 2024 and at least into early 2025, making it a ripe market for value-add investing (renovating distressed properties for resale or rent) that does not depend on rapid home price appreciation to succeed.

3. A shallow floor for home prices in most markets

Local investors aren’t just saying they are willing to pay as much or more for investment properties in 2024 as they did in 2023, they are actually paying more.

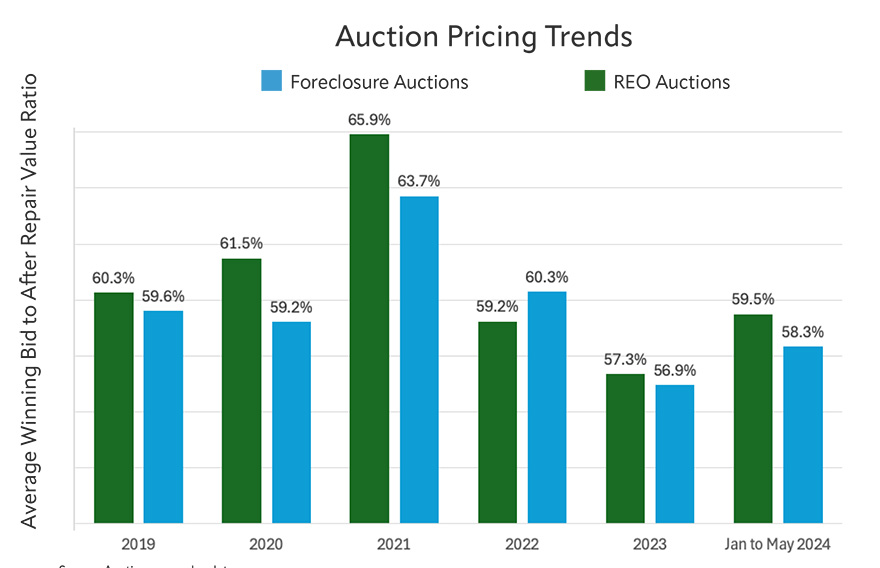

Data from the Auction.com platform shows that through the first five months of 2024, the winning bid at foreclosure auction was 59.5 percent of estimated “after-repair” value on average. That’s up from a 57.3 percent price-to-value ratio in 2023.

A similar trend shows up for properties sold at bank-owned (REO) auctions on the Auction.com platform. So far in 2024, the winning bid at those auctions is 58.3 percent of estimated “after-repair” value on average – up from a 56.9 percent price-to-value ratio in 2023.

This third local investor indicator reinforces the second indicator, signaling that the retail market will continue to be supply-constrained — rich soil for value-add investors. Additionally, it suggests that while retail home price appreciation could soften or even turn negative in a minority of local markets (see the first indicator above), the constrained supply will provide a floor that keeps home prices from dropping dramatically in most markets.

4. No imminent return to the frenzy of 2021

While local investors are upping the price they’re willing to pay in 2024 compared to 2023, they are still bidding conservatively relative to 2021 – the peak of the pandemic housing frenzy – and even slightly below what they were willing to pay back in the relatively normal market of 2019.

The average price-to-after-repair-value ratio in 2021 was an eye-popping 65.9 percent for properties sold at foreclosure auction and robust 63.7 percent for properties sold at REO auction, according to data from the Auction.com platform.

In 2019, the average price-to-after-repair-value ratio at foreclosure auction was 60.3 percent, just slightly above the 59.5 percent so far in 2024. Similarly, the average price-to-value ratio at REO auction 2019 was 59.6 percent, about one point higher than the 58.3 percent so far in 2024.

This fourth local investor indicator suggests that the retail market won’t return to the frenzy of 2021, either in terms of sales volume or price appreciation, anytime in the next three to six months.

5. A steady source of renovated, affordable housing supply

Local investors are buying more of the properties available at foreclosure auction, signaling that a steady stream of renovated, affordable housing supply will be hitting the retail market in late 2024 and early 2025.

The Auction.com data shows 53.2 percent of properties available to purchase at foreclosure auction were actually purchased by local community developers in the first five months of 2024. This is up from 50.5 percent in 2023 and well above the pre-pandemic average of 37.9 percent between 2015 and 2019.

The remainder of properties that don’t sell to third-party buyers at foreclosure auction become bank-owned and are typically sold at REO auction or on the multiple listing service (MLS). But properties sold to local investors at foreclosure auction are renovated and returned to the retail market much faster than those sold as REO on the MLS.

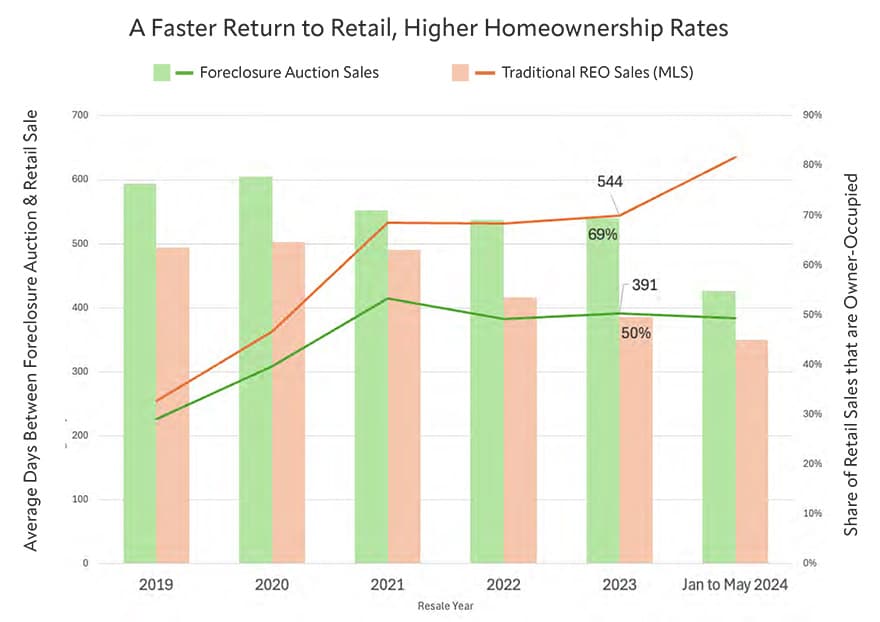

For renovated properties sold on the retail market in 2023, the average renovation and resale timeline was 391 days for those purchased by local investors at foreclosure auction compared to 544 days for those returned to the bank as REO and sold on the MLS. That’s according to an Auction.com analysis of more than 28,000 sales of renovated foreclosures in 2023.The 391-day average incorporates properties bought at foreclosure auction in any previous year so it includes even situations where a local investor held a property as a rental for some time before selling. Many investors who focus solely on a renovate-and-rent strategy will return renovated properties to market in three to six months.

Additionally, a higher percentage of properties purchased by local community developers at foreclosure auction end up in the hands of owner-occupants after renovation – 69 percent compared to 50 percent for REO properties sold on the MLS, according to the same Auction.com analysis of 28,000 resales of renovated foreclosures.