Auction buyers bidding more conservatively, keeping cash ready for possible downturn

Foreclosure and REO auction buyers are on the frontlines of the housing market, repeatedly selling into the retail market properties that they purchased about six months ago and have since renovated.

This repeating cycle keeps them in tune with the latest shifts in retail buyer behavior and motivates them to shift their own buying behavior at foreclosure auction in anticipation of what the retail market landscape will look like in the next six to 12 months.

“I view our houses like a 180-day business cycle. When I acquire a property, I look out six months from now,” said Tony Tritt, an Atlanta-area real estate investor who has been buying properties at foreclosure auction since 2001. “That six-month cycle causes me a little more anxiety in 2022 than it did in 2019.

“I’m not concerned, I just give more pause,” Tritt added, noting market fundamentals are significantly stronger in 2022 than they were during the housing boom leading up to the 2008 housing crash. “We are still undersupplied. … We might see some pain again. A slowdown in price appreciation does not make a crash.”

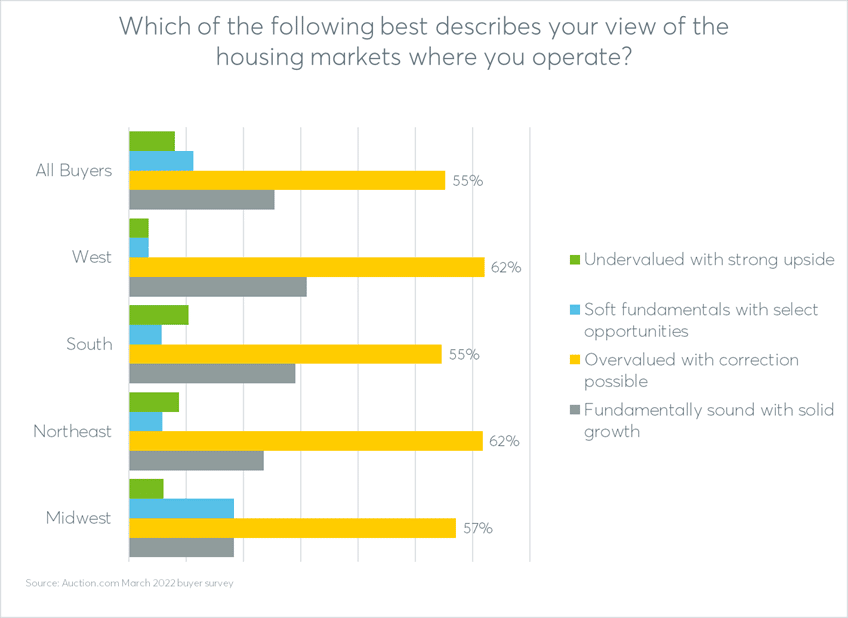

Rising Risk of Correction

The rising risk of a housing correction was a common view among distressed property auction buyers in early 2022, according to a March 2022 survey of more than 250 Auction.com buyers. More than half of those surveyed (55 percent) described their local housing market as “overvalued with a correction possible,” up from 40 percent who described their local market that way in the first quarter of 2021.

More Conservative Bidding

That buyer sentiment has translated into more conservative behavior at foreclosure auction, both in terms of pricing and buy box, according to proprietary data from Auction.com, which handles more than one-third of all foreclosure auctions nationwide.

In terms of pricing, the average discount below estimated as-is property value bottomed out at a 13-month low of 9 percent in February. The average discount has increased since then, hitting as high as 17 percent in June — the most recent month’s data available. This indicates buyers are more cautiously pricing properties. The as-is market value is typically based on a drive-by broker price opinion or external-only appraisal given the properties are usually still occupied.

Florida-based real estate investor and investor coach Paul Lizell said he’s built an extra 10 percent margin into his calculations for determining a “maximum allowable offer” at auction. That provides a cushion should a correction come.

“Just be a little more conservative,” said Lizell, describing his shifting approach to acquisitions of distressed properties at auction. “If (mortgage) rates continue to go up that’s where you’ll see that 10 percent shift.

“Some of your more cyclical markets may take a 20 percent hit,” he added, referring to markets that are prone to larger price swings. I don’t anticipate this being a big hit. This isn’t a 2008, 2009 event.”

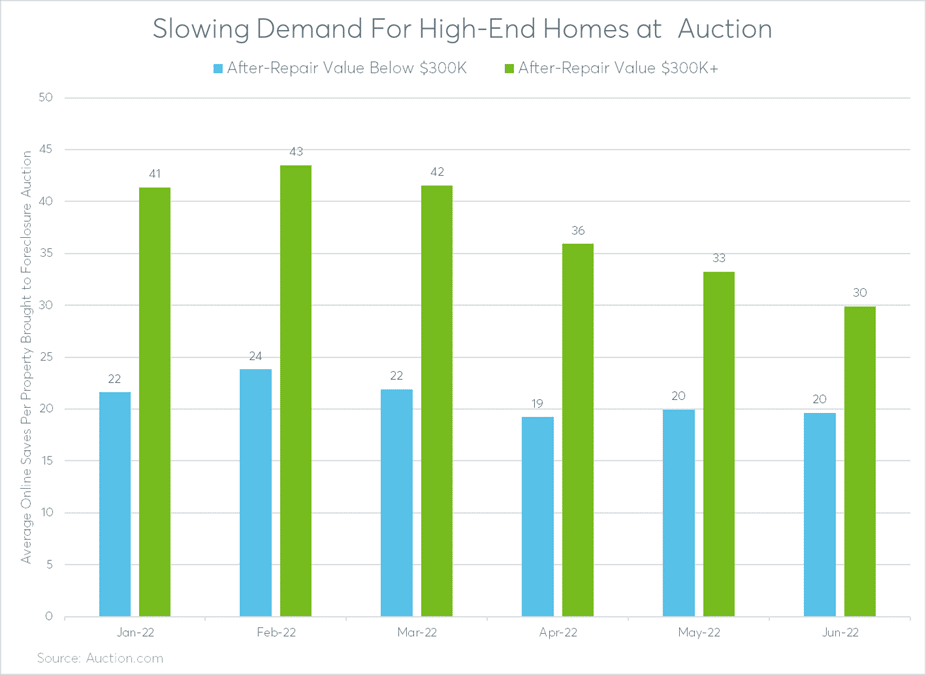

Shrinking Buy Box

Lizell said he’s also shrinking his buy box and advising students to do the same.

“We’re telling them to back off of some of the higher-end properties and stay under the $350,000 (for after-repair value). That’s a safer range,” he said.

Lizell is not the only buyer shying away from higher-end homes, according to buyer behavior data from Auction.com. The average number of online saves per property brought to auction decreased 34 percent between February and June for properties with an estimated after-repair market value of more than $300,000. The saves metric decreased at half that rate (down 17 percent) for properties with an estimated after-repair market value below $300,000.

Lizell is also advising students to shift away from buying in cyclical markets – those that tend to have volatile boom-bust cycles — and shift toward buying in linear markets — those that tend to experience slow but steady growth over time.

Buyers are more aggressively buying in Kentucky, Alabama, Oklahoma, Georgia, South Carolina, Wisconsin, Arizona and Arkansas, according to Auction.com data. The foreclosure auction sales rate — the percentage of properties available at auction that sell to a third-party buyer rather than reverting back to the foreclosing lender as real estate owned (REO) — increased in those states between February and June, counter to the national trend.

On the other hand, the foreclosure auction sales rate decreased at more than three times the national average in California, a state known for its extreme boom-bust cycles. Other states with above-average declines in the foreclosure auction sales rate included Pennsylvania, Minnesota, Tennessee, Texas, and Maryland.

“A lot of our students are California people,” Lizell said. “It’s hard for them to find deals so we teach them how to find deals in these other states … more landlord-friendly states.”

Lizell mentioned Arizona, Tennessee, the Carolinas and Georgia as states that are less likely to see a slowdown in the near future.

“The sunbelt area will stay hotter longer,” he said, adding that he is starting to see some evidence of slowing even in Texas. “A lot of the markets are slowing down. Florida is still red hot, but I anticipate that will slow down in another year.”

Ready to Ramp Up Acquisitions

While investors like Lizell and Tritt are exercising caution in acquiring properties as the market downshifts, they’re also preparing for a possible rapid ramp-up in acquisitions in the event of a more severe correction.

“We make more money in a down market than we do in a market like this,” said Lizell, noting that he’s positioning himself for that possibility of such a down market. “It’s more shifting to get cash quicker … so if it does shift, we are more in the position to take advantage of falling prices.”

Both Lizell and Tritt said lessons they learned during the 2008 crash has left them better prepared for another downturn.

“The mistake we made … when the crash came, we didn’t have a bunch of cash in the bank, so we had to pass on a bunch of $25,000 housing,” said Tritt, referring to the 2008 housing crash. “We bought a lot, but … we would have bought a lot more.”

Foreclosure auction data also provides an early warning system of sorts of where more distressed supply may be coming available soon. Specifically, the trend in scheduled auctions — which are scheduled anywhere from a month to several months in the future — acts as an early indicator of supply. Scheduled auctions can always be canceled, but about 30 percent end up going to auction, according to historical data.

Distressed Supply by State

Nationwide, the number of properties scheduled for foreclosure auction in the third quarter of 2022 was up 155 percent compared to the third quarter of 2021 — although still 54 percent below Q3 2019. In this data, each quarter’s scheduled auction number was limited to those where the scheduling of the auction took place sometime in the previous quarter. This ensures an apples-to-apples comparison given Q3 2022 was not finished at the time of this writing.

States with the biggest year-over-year increase in scheduled foreclosure auctions were Virginia, Texas, Nebraska, New Hampshire and Colorado, all of which saw an increase of more than 500 percent.

Virginia-based investor Rick Starnes said he’s seeing more foreclosure activity in and around the Richmond area where he invests. Starnes said he’s in “aggressive acquisition” mode to take advantage of the still-hot housing market while also protecting himself against inflation.

“I’m just trying to lock in three more houses as inventory,” said Starnes, who has been investing part-time since 2018 even while continuing to hold down a full-time day job. “The best thing I can see to hedge against inflation is to buy real estate.”

While Starnes isn’t expecting double-digit home price appreciation to last much longer, he’s also not expecting home prices to fall in his area. But like Tritt, Lizell and Kerr, he’s also ready to acquire even more properties should a home price correction or even crash occur.

“If that happens again, I’ve got some money set aside, I’ll go out and buy four or five of them,” he said, adding that he may need to hold those properties longer rather than reselling to owner-occupants, his primary investing strategy up until now. “If you’re holding the asset as a cash investor, the market is going to turn around. It might take years to turn around, but in the meantime, you can rent it out.”