If You Have Access to the Data, There’s No Need to Wait.

When COVID-19 shut down the country just 32 months ago, it changed things permanently. Although Americans optimistically hoped for a “return to normal” even as they locked their doors, began buying excessive volumes of home goods online, and struggled with “remote school” conducted in tandem with “remote work,” the fact was that many of our daily rules – including those governing how we earn, spend, and invest money – were altered forever. As scientists and researchers slowly have begun to acknowledge that COVID-19 will likely be endemic, the U.S. economy has begun the slow, painful process of correction from an artificially induced and supported boom resulting from desperate measures related to pandemic policies. However, it remains unclear just exactly what type of “new normal” the country will face when that correction concludes. In the meantime, real estate investors continue to think and invest creatively and strategically in a fast-paced, highly regionalized, largely unpredictable market. This, for investors, is the “new normal.” The question has become how to manage it.

“[COVID] is going to be with us for the long-term, like flu,” Baylor College of Medicine dean James McDeavitt, M.D., observed in August. Calling reported COVID case numbers “incredibly unreliable,” he predicted, “For the foreseeable future, we are going to be chasing it to a degree.” He was talking about viral case management, but he could have been describing the long-awaited housing correction. The key to chasing housing fluctuations, like the key to viral research and tracking, lies in geographically unique, real-time data.

Linking the Right Data to the Best Returns

Successful real estate investors in the post-pandemic market are relying heavily on current strategies that generate cash flow from existing assets. This permits investors to build up portfolio value without risking an entire project on the somewhat unreliable promise of appreciation, forced or otherwise. As more investors veer toward cash-flowing projects rather than focusing on one-time-yield strategies like flipping, investor interest in traditional distressed and potentially distressed assets is growing.

Jonathan Veit, a training and development manager at ATTOM’s GeoData Plus, the nation’s largest residential and commercial property database, observed, “We are definitely starting to see market shifts in interest in foreclosures and distressed property searches across the nation.” In his role as a training and development manager, Veit interacts directly on a daily basis with investors using the massive data reservoir. Just as public-sentiment analysts often use consumer data to track prevailing feelings about current events, economists may use investor interests to make predictions and observations about volatile and otherwise ambiguous market conditions. In the case of Veit’s clients, investor interests indicate that change is in the air. Fortunately for real estate investors, change does not have to be a bad thing.

“It is particularly noteworthy among our client base, most of which are active, full-time investors, that we are seeing nature of the contents on the lists of ‘target properties,’ those that are of interest, changing,” Veit said. Investors are targeting tried-and-true asset classes, such as properties heading toward auction, that are delinquent or distressed, or that are already REO (real estate owned) properties. Some investors are searching the GeoData Plus database for defaults as far back as 2019, Veit noted. This trend is likely a result of expectations that most eviction moratoriums and foreclosure forbearance programs will expire along with their respective grace periods over the course of the next 12 months if they have not done so already.

“Everyone has a different tactic for prospering,” Veit noted. He added that in his experience, the most successful investors are the ones who “drill down” into the details of potential property acquisitions and refine the details of their targets regularly. “Real estate has always been about location,” Veit admitted, “but it is certainly arguable that location has never been so important and made such a difference as it does today.”

Many investors are using market data to refine already-niche strategies for specific markets, such as looking at data on specific property types in geographic or geo-fenced areas to determine volumes and availability of vacant homes, distressed properties, foreclosed properties, delinquent mortgage loans, or pre-foreclosure properties. “Every investor has the option to create a unique list and hone it down to fit the individual market and their individual strategies,” Veit said, noting that the same client may use very different filters and criteria for different areas of the country.

The Great Debate: Is There or Isn’t There a Correction?

Perhaps one of the biggest issues real estate investors encounter in today’s market is that specificity is extremely important when it comes to generating leads for deals, but the parameters defining the state of the housing market are vaguer than ever. It is nearly impossible to get two economists to agree on whether or not there is a housing correction coming – much less two real estate professionals. Everything depends on the criteria by which one judges a market and the market in question. There are few, if any, national trends or even tendencies to track at the present time.

For example, two major data firms, Redfin and ATTOM Data Solutions, both recently released lists of “most-at-risk” housing markets in the United States. Those lists were vastly different, with ATTOM spotlighting mainly northeastern markets (six New Jersey counties made the top 10) and Redfin identifying primarily western and southeastern metropolitan areas. Based on stated methodology, neither team of analysts was wrong in their conclusions, but the definitions of “at risk” were distinctly divergent. This left it to the investors to sort out which definitions and, by extension, which markets would be best suited for their investing strategies and goals. Those decisions require specialized, real-time, wide-ranging data in order to be effective. The capacity for divergence analysis in the present day has led to an ongoing “great debate” over whether there will be a full housing correction or even a housing crash, with some investors and other industry professionals declaring the event already underway and others insisting there are still months or even years of market heat to go.

Disputes over the nature and existence of a housing correction affect broader economic discussions, with many high-profile economists presently at clear odds with each other over whether the United States is currently in a recession. Across the spectrum, experts cite housing statistics to support their specific points of view. For those like Chris Low of FHN Financial, housing statistics indicate the market is currently in a recession. He recently told MarketWatch, “That likely means the rest of the economy will be in a recession soon.” NerdWallet analyst Holden Lewis disagreed, however, insisting a lack of overbuilding and strict lending standards will prevent a housing crash. In June, he stated, “I don’t think we are going to have a recession this year.”

Fortunately for most investors, successful real estate investing has never required consensus on the state of the economy as long as the investment strategy is working. For most investors, the more important element of making 2022 work for their real estate portfolios is to effectively identify areas of the country in which their acquisition and asset deployment strategies will be effective over the next 12 to 24 months. To achieve that, Veit said, creativity and determination will be crucial. “Everyone has their own ways of finding leads in this post-pandemic world,” he said. “People are tending toward new, unique ways of prospecting and prospering than they used in the past.” He added, “Most of the conversations I have these days are about new ways to create leads. That is how investors are generating returns in the world we are currently living in.”

What is GeoData Plus?

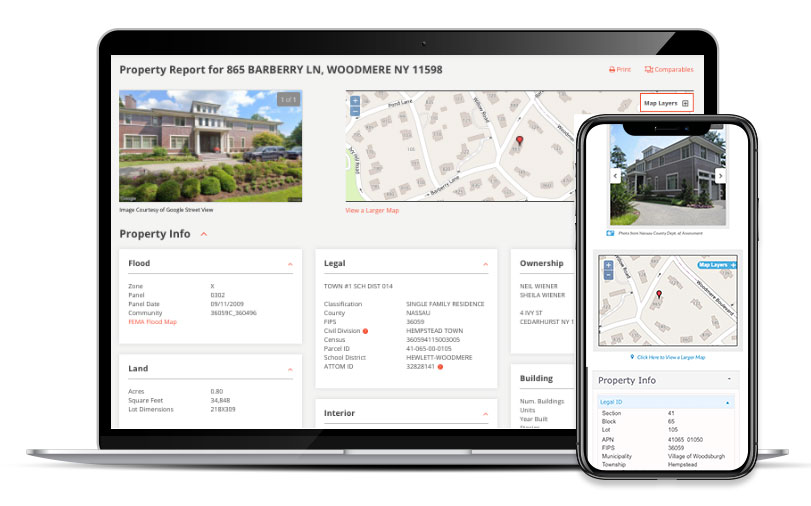

ATTOM’s GeoData Plus is the largest property database in the United States. It contains information on more than 150 million residential and commercial properties, and customizable search functionalities with a variety of filters and mapping options GeoData Plus offers access to valuations through both sales comparables and automated valuation models including a new rental AVM, and proprietary tools for leveraging this information. Property information includes occupancy, phone numbers, and a 300-point property report that may be tailored to industry needs including those of appraisers, brokers/agents, investors, and lenders.

Learn more about GeoData Plus and talk with Jonathan Veit about your investment strategies at 516-663-0790 or Jonathan.Veit@attomdata.com.