This week ATTOM Data Solutions released its February 2019 foreclosure activity datasets, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 54,783 U.S. properties in February 2019, down 3 percent from the previous month and down 11 percent from a year ago – 8th consecutive annual decrease in foreclosure activity.

Foreclosure Rate Rankings

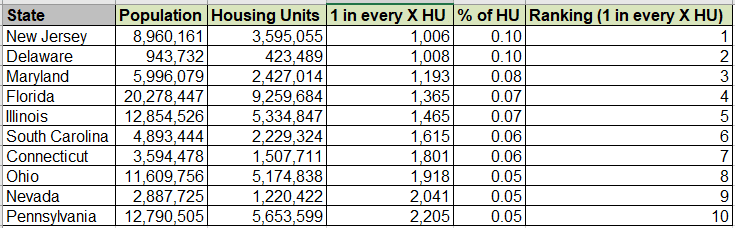

In keeping with ATTOM Data’s figures Friday posts and doing a bit of a deeper dive with the data, we wanted to uncover those top 10 states whose foreclosure activity is among the highest in the nation.

Topping the list is New Jersey with a foreclosure rate of 1 in every 1,006 housing units receiving a foreclosure filing in February 2019. Followed by Delaware (1 in every 1,008 housing units); Maryland (1 in every 1,193 housing units); Florida (1 in every 1,365 housing units); Illinois (1 in every 1,465 housing units); South Carolina (1 in every 1,615 housing units); Connecticut (1 in every 1,801 housing units); Ohio (1 in every 1,918 housing units); Nevada (1 in every 2,041 housing units); and rounding out the top 10 is Pennsylvania with 1 in every 2,205 housing units receiving a foreclosure filing in February 2019.

ATTOM Data also ranks at more granular geo levels, so if you are a real estate investor looking for areas with distressed properties…contact us now!

High Level Takeaways

A total of 29,735 U.S. properties started the foreclosure process in February 2019, up 1 percent from the previous month but still down 9 percent from a year ago.

-

- Counter to the national trend, 13 states posted year-over-year increases in foreclosure starts in February 2019, including Florida (up 68 percent); Oregon (up 46 percent); Louisiana (up 34 percent); Illinois (up 9 percent); Texas (up 9 percent); and Colorado (up 3 percent).

- Those metro areas with a population greater than 1 million that saw an annual increase in Foreclosure starts included Los Angeles, California (up 7 percent); Chicago, Illinois (up 15 percent); Houston, Texas (up 73 percent); Washington, D.C. (up 11 percent); and Miami, Florida (up 74 percent).

Banks repossessed 11,392 U.S. properties in February 2019, down 7 percent from the previous month and down 12 percent from a year ago.

Contact us now for a deeper data dive to create your own analytics.