Vacant Homes in Foreclosure Tick Upward for Seventh Straight Quarter; As Zombie Properties Increase 1.4 Percent Quarterly and 15.3 Percent Annually; But Portion of Homes Sitting Empty in Foreclosure Remains Less Than One in 11,000

IRVINE, CA – Oct. 31, 2023 —ATTOM, a leading curator of land, property, and real estate data, today released its fourth-quarter 2023 Vacant Property and Zombie Foreclosure Report showing that 1.3 million (1,294,505) residential properties in the United States are vacant. That figure represents 1.27 percent, or one in 78 homes, across the nation – virtually the same as in the third quarter of this year.

The report analyzes publicly recorded real estate data collected by ATTOM — including foreclosure status, equity and owner-occupancy status — matched against monthly updated vacancy data. (See full methodology below).

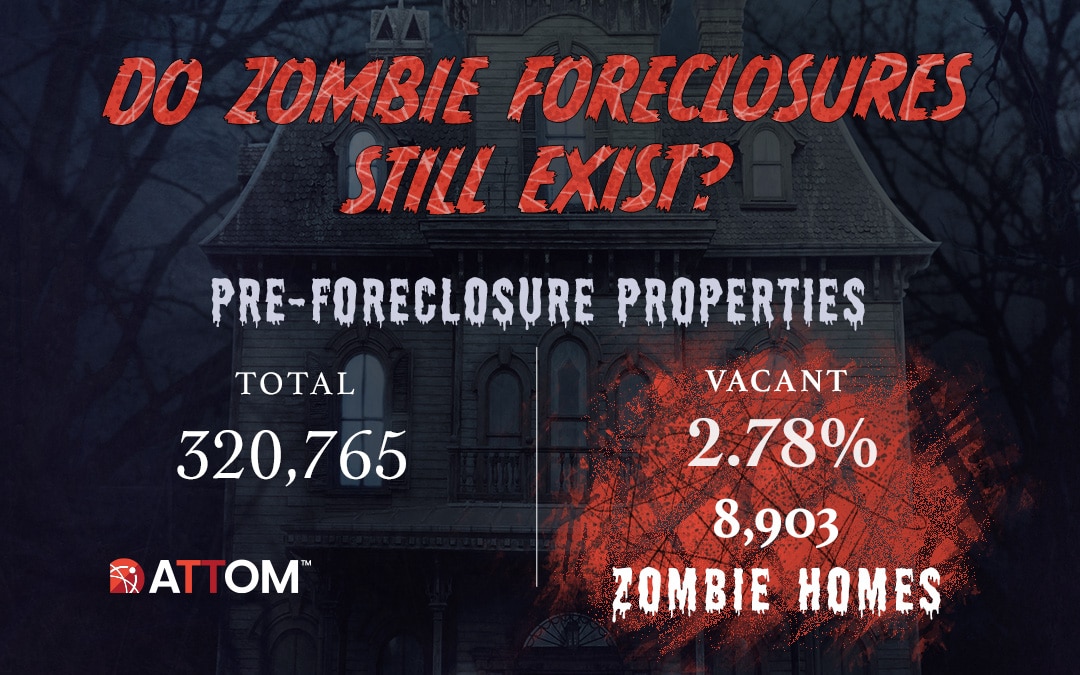

The report also reveals that 320,765 residential properties in the U.S. are in the process of foreclosure in the fourth quarter of this year, up 1.7 percent from the third quarter of 2023 and up 12.8 percent from the fourth quarter of 2022. A growing number of homeowners have faced possible foreclosure following the nationwide moratorium on lenders pursuing delinquent homeowners was imposed after the Coronavirus pandemic hit in early 2020 and was lifted in the middle of 2021.

Among those pre-foreclosure properties, about 8,900 sit vacant as zombie foreclosures (pre-foreclosure properties abandoned by owners) in the fourth quarter of 2023. That figure also is up slightly from the prior quarter, by 1.4 percent, and up 15.3 percent from a year ago. The latest increase marks the seventh straight quarterly rise.

However, the fourth-quarter count of zombie properties represents only a tiny portion of the nation’s total housing stock – just one of every 11,412 homes around the U.S.

“The ongoing strength of the U.S. housing market continues to benefit neighborhoods around the country in so many ways, with the near-total lack of zombie foreclosures standing out as one striking example,” said Rob Barber, CEO for ATTOM. “Rising equity flowing from rising home values has not only kept foreclosure cases from spiking since the moratorium was lifted. It also keeps giving delinquent homeowners a valuable resource they can use to either stave off eviction or sell their homes and move on. As a result, we continue to see none of the widespread abandonment that followed the housing market crash after the Great Recession of the late 2000s.”

The stable number of zombie properties in the fourth quarter has come as the U.S. housing market has rebounded from a temporary setback last year.

The nationwide median home value grew 11 percent during the Spring-Summer buying season this year, hitting a new record of $350,000. Those gains followed an 8 percent decline from mid-2022 into early 2023. The growth in values has helped keep homeowner wealth at historic highs, with 95 percent of mortgaged owners having at least some equity built up and about 50 percent owing less than half the estimated value of their properties.

Zombie foreclosures rise in half of states but remain mostly absent around nation

A total of 8,903 residential properties facing possible foreclosure have been vacated by their owners nationwide in the fourth quarter of 2023, up from 8,782 in the third quarter of 2023 and from 7,722 in the fourth quarter of 2022. The number of zombie properties has decreased or stayed the same quarterly in 24 states and annually in 21.

While most neighborhoods around the U.S. have few or no zombie foreclosures, the biggest increases from the third quarter of 2023 to the fourth quarter of 2023 in states with at least 50 zombie properties are in Kentucky (zombie properties up 15 percent, from 53 to 61), Connecticut (up 15 percent, from 87 to 100), Maryland (up 13 percent, from 229 to 258), Texas (up 13 percent, from 112 to 126) and California (up 12 percent, from 244 to 274).

The largest quarterly decreases among states with at least 50 zombie foreclosures are in New Mexico (zombie properties down 15 percent, from 95 to 81), New Jersey (down 8 percent, from 205 to 188), Maine (down 7 percent, from 56 to 52), Nevada (down 7 percent, from 99 to 92) and Georgia (down 4 percent, from 85 to 82).

New York continues, among the 50 states, to have the highest ratio of zombie homes to all residential properties (one of every 2,115 homes), followed by Ohio (one in 3,690), Illinois (one in 4,338), Iowa (one in 4,380) and Indiana (one in 6,114).

Overall vacancy rates also hold steady

The vacancy rate for all residential properties in the U.S. has remained virtually the same for the sixth quarter in a row. It stands at 1.27 percent (one in 78 properties), which is virtually the same as the 1.26 percent rate in both the third quarter of 2023 and the fourth quarter of last year.

States with the largest vacancy rates for all residential properties are Oklahoma (2.26 percent, or one in 44 homes, during the fourth quarter of this year), Kansas (2.18 percent, or one in 46), Michigan (2.07 percent, or one in 48), Alabama (2.04 percent, or one in 49) and Indiana (2.03 percent, or one in 49).

Those with the smallest overall vacancy rates are New Hampshire (0.33 percent, or one in 302, in the fourth quarter of this year), New Jersey (0.36 percent, or one in 280), Vermont (0.39 percent, or one in 259), Idaho (0.45 percent, or one in 221) and North Dakota (0.63 percent, or one in 158).

Other high-level findings from the fourth quarter of 2023:

- Among 166 metropolitan statistical areas in the U.S. with at least 100,000 residential properties in the fourth quarter of 2023, those with at least 100 properties facing possible foreclosure and the highest zombie foreclosure rates are Peoria, IL (12.4 percent of properties in the foreclosure process are vacant); Indianapolis, IN (9.9 percent); Cedar Rapids, IA (9 percent); Fort Wayne, IN (8.6 percent) and South Bend, IN (7.9 percent).

- Aside from Indianapolis, the highest zombie-foreclosure rates in major metro areas with at least 500,000 residential properties and at least 100 homes facing foreclosure in the fourth quarter of 2023 are in Cleveland, OH (7.3 percent of homes in the foreclosure process are vacant); Baltimore, MD (6.7 percent); St. Louis, MO (6.1 percent) and Pittsburgh, PA (6 percent).

- Among the 23.6 million investor-owned homes throughout the U.S. in the fourth quarter of 2023, about 842,400 sit vacant, or 3.6 percent. The highest levels of vacant investor-owned homes are in Indiana (6.9 percent vacant), Illinois (6.1 percent), Oklahoma (6 percent), Alabama (6 percent) and Ohio (6 percent).

- Among the roughly 15,000 foreclosed, bank-owned homes in the U.S. during the fourth quarter of 2023, 15.9 percent sit vacant. In states with at least 50 bank-owned homes, the largest vacancy rates are in Kansas (30.8 percent vacant), Michigan (25.9 percent), Ohio (24.5 percent), Missouri (23.8 percent) and Wyoming (22.6 percent).

- The highest zombie-foreclosure rates in U.S. counties with at least 500 properties in the foreclosure process during the fourth quarter of 2023 are in Peoria County, IL (15.6 percent of homes in the foreclosure process are vacant); Baltimore City, MD (14 percent); Marion County (Indianapolis), IN (13.1 percent); Broome County (Binghamton), NY (11.4 percent) and Cuyahoga County (Cleveland), OH (8.2 percent).

- Among zip codes with enough data to analyze, 82 of the top 100 where zombie properties represent the largest portions of all homes are in New York, Ohio and Illinois, including 10 in Cleveland, OH. The largest portions are in zip codes 10993 in Rockland County (West Haverstraw), NY (one in 191 homes); 73554 in Greer County (Mangum), OK (one in 222); 44108 in Cuyahoga County (Cleveland), OH (one in 223); 61605 in Peoria County, IL (one in 229) and 44112 in Cleveland, OH (one in 236).

Report Methodology

ATTOM analyzed county tax assessor data for about 101 million residential properties for vacancy, broken down by foreclosure status and owner-occupancy status. Only metropolitan statistical areas with at least 100,000 residential properties and counties with at least 50,000 residential properties were included in the analysis.

About ATTOM

ATTOM provides premium property data to power products that improve transparency, innovation, efficiency and disruption in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation’s population. A rigorous data management process involving more than 20 steps validates, standardizes, and enhances the real estate data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. The 30TB ATTOM Data Warehouse fuels innovation in many industries including mortgage, real estate, insurance, marketing, government and more through flexible data delivery solutions that include bulk file licenses, property data APIs, real estate market trends, property navigator and more. Also, introducing our newest innovative solution, that offers immediate access and streamlines data management – ATTOM Cloud.

Media Contact:

Christine Stricker

949.748.8428

christine.stricker@attomdata.com

Data and Report Licensing:

949.502.8313