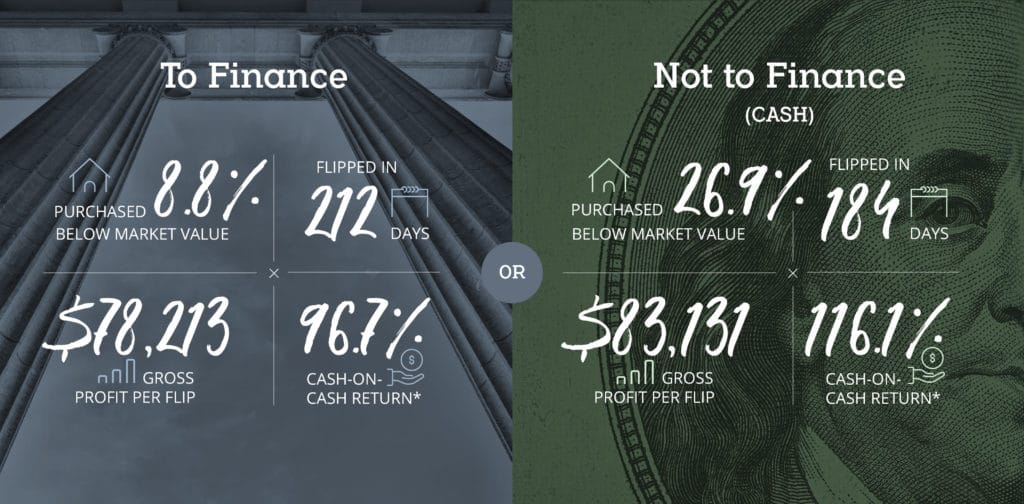

*The cash-on-cash return for financed flippers was calculated assuming a loan amount 65 percent of the purchase price of the home.

The big disparity in property purchase discounts realized by flippers using financing compared to those using cash may be explained in that cash buyers often hold a big advantage over non-cash buyers in that they can typically complete the transaction much more quickly — in days rather than weeks or months — providing the seller with extra convenience that he or she may be willing to reward with a deeper discount on the price.

Financed flippers are still achieving lofty average returns close to $80,000 per flip and close to 100 percent gross return on investment, helped by the fact that these flippers are putting down less of their own cash on the acquisition of the home. Many fix-and-flip lenders also finance the rehab portion of the investment, allowing financed flippers to leverage that portion of the investment as well.