According to ATTOM’s just released Q2 2023 U.S. Home Equity & Underwater Report, 49 percent of mortgaged homes in the U.S. were considered equity-rich in Q2 2023. The report noted that the combined estimated amount of loan balances secured by those properties was no more than half of their estimated market values.

ATTOM’s latest home equity and underwater analysis reported that the portion of mortgaged homes that were equity-rich in Q2 2023 increased from 47 percent in Q1 2023, to the highest point in at least four years. The report noted that with home prices rebounding across the U.S., the level of equity-rich mortgage-payers went up from Q1 to Q2 2023 in 45 of the nation’s 50 states.

Also according to the report, less than 3 percent of mortgaged homes in the U.S., or one in 36, were considered seriously underwater in Q2 2023. The report noted that meant they had a combined estimated balance of loans secured by the property of at least 25 percent more than the property’s estimated market value.

ATTOM’s Q2 2023 home equity and underwater report also noted that the 2.8 percent of mortgaged-homes that were seriously underwater in the second quarter of this year was also the lowest point since at least 2019. According to the report, the latest figure was down from 3 percent in Q1 2023 and 2.9 in Q2 2022.

Also as mentioned in the report, only about 255,700 homeowners were facing possible foreclosure in Q2 2023, or about one in every 250 mortgaged residential properties in the U.S. The report noted that of those facing foreclosure, about 235,500, or 92 percent, had at least some equity built up in their homes.

The analysis found that states where the largest portion of homeowners facing possible foreclosure had equity in their properties in Q2 2023, included Utah (97 percent with equity), North Carolina (96 percent), Florida (96 percent), Idaho (96 percent) and New Hampshire (95 percent).

Also according to the report, states with the lowest percentages included Louisiana (82 percent with equity), Illinois (85 percent), North Dakota (85 percent), Maryland (86 percent) and Arkansas (87 percent).

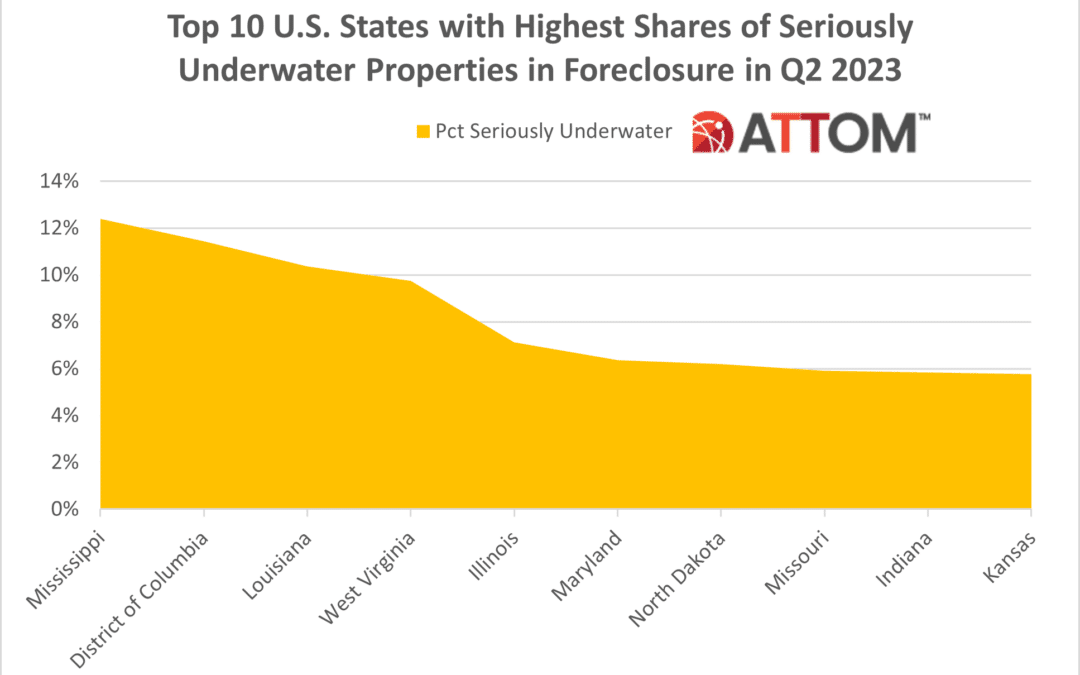

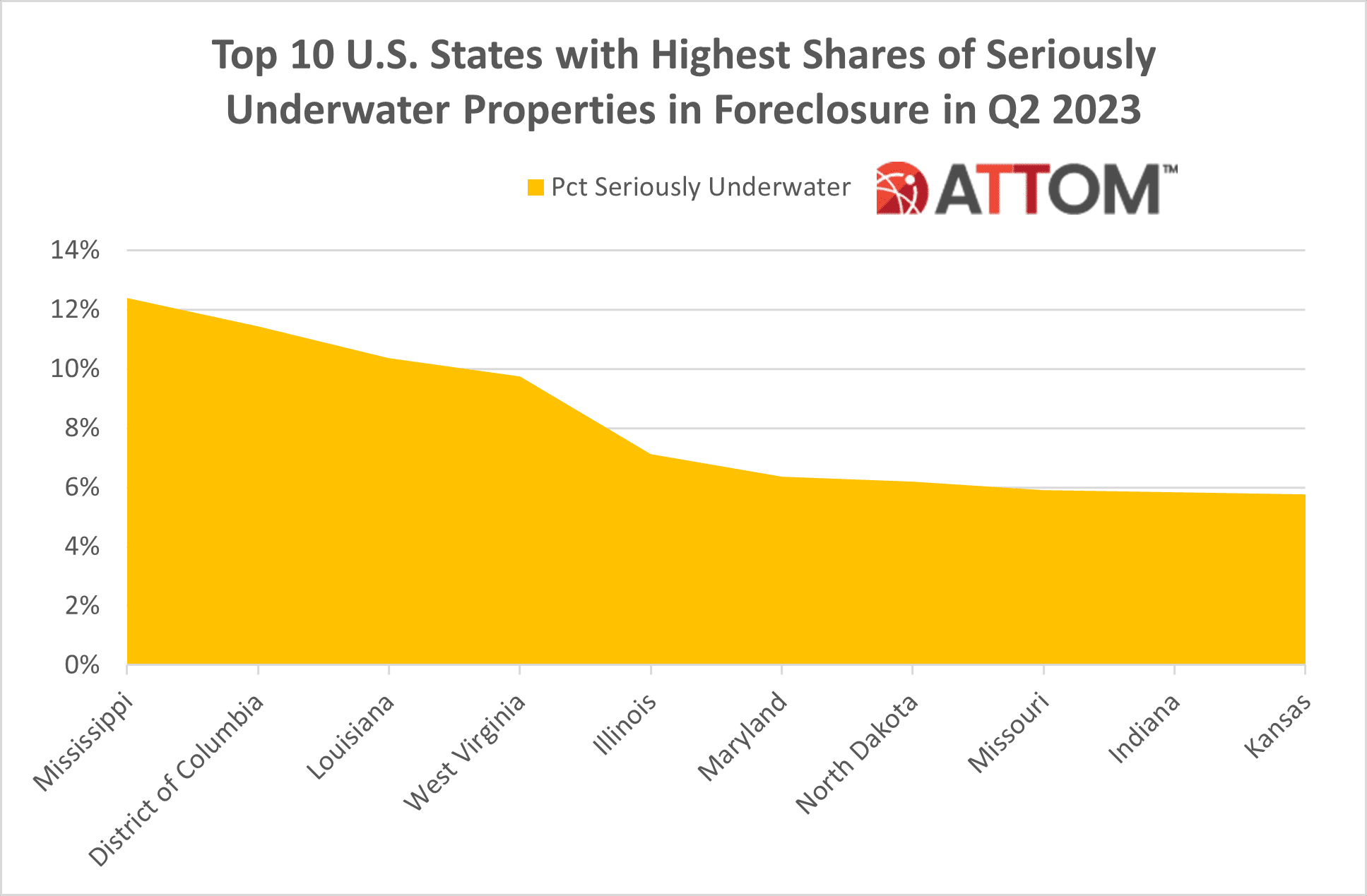

In this post, we dive deep into the data behind our Q2 2023 home equity and underwater report to uncover the top states where the largest portion of homeowners facing possible foreclosure were seriously underwater in Q2 2023.

Those states include: Mississippi (12 percent seriously underwater); District of Columbia (11 percent); Louisiana (10 percent); West Virginia (10 percent); Illinois (7 percent); Maryland (6 percent); North Dakota (6 percent); Missouri (6 percent); Indiana (6 percent); and Kansas (6 percent).

Meanwhile, ATTOM’s latest Q2 2023 U.S. home equity and underwater report noted that the West continued to have the highest levels of equity-rich mortgaged properties around the U.S., with six of the top 10 states in Q2 2023.

According to the report, those with the highest portions of equity-rich mortgaged properties were Vermont (77.5 percent of mortgaged homes were equity-rich), California (63.3 percent), Montana (60.9 percent), Florida (60.4 percent) and Idaho (59.4 percent).

While 9 of the 10 states with the lowest percentages of equity-rich properties in Q2 2023 were in the Midwest and South, led by Louisiana (23 percent of mortgaged homes were equity-rich), Alaska (29.2 percent), Illinois (29.5 percent), West Virginia (30 percent) and North Dakota (31.3 percent).

Want to learn more about home equity and underwater trends in your area? Contact us to find out how!