ATTOM’s just released Year-End 2021 U.S. Home Sales Report reveals that home sellers nationwide realized a profit of $94,092 on the typical sale in 2021. The report noted that figure is up 45 percent from $64,931 in 2020 and 71 percent from $55,000 two years ago.

According to ATTOM’s latest home sales analysis, profits rose in more than 90 percent of housing markets analyzed, and the latest figure, based on median purchase and resale prices, marked the highest level in the U.S. since at least 2008.

The year-end 2021 report also noted the $94,092 profit on the median-priced home sale in 2021 represented a 45.3 percent return on investment compared to the original purchase price. That figure is up from 33.6 percent last year and from 30.6 percent in 2019. The report stated the latest profit margin also stood out as the largest since at least 2008.

The analysis showed that both raw profits and ROI have improved nationwide for 10 straight years, and last year’s gain in ROI – up nearly 12 percentage points – was the biggest annual increase since 2013. The year-end 2021 analysis also showed that profits shot up as the national median home price rose 16.9 percent in 2021 to $301,000, another annual record.

ATTOM’s year-end 2021 home sales report stated the largest increases in investment returns on typical home sales in 2021 came in Salisbury, MD (margin up 267.2 percent); Lafayette, LA (up 227.4 percent); Montgomery, AL (up 195.4 percent); Mobile, AL (up 179.9 percent) and Augusta, GA (up 167.7 percent).

The report noted that among metro areas with a population of at least 1 million in 2021, the largest ROI increases from 2020 to 2021 were in Raleigh, NC (ROI up 80.6 percent); Oklahoma City, OK (up 64.4 percent); Virginia Beach, VA (up 62.6 percent); Washington, DC (up 60.2 percent) and Chicago, IL (up 59.4 percent).

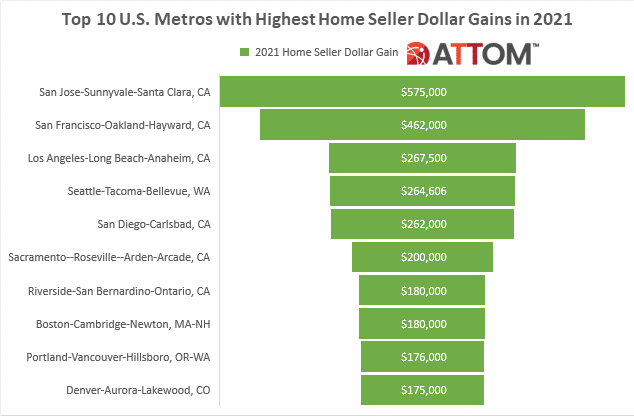

In this post, we dig deep into the data behind the ATTOM Year-End 2021 U.S. home sales report to rank the top 10 largest metros with the greatest home seller gains realized in typical profits. Among those metros with at least 1 million people, the top 10 that saw the largest dollar gains from home sales in 2021 included: San Jose-Sunnyvale-Santa Clara, CA ($575,000 dollar gain); San Francisco-Oakland-Hayward, CA ($462,000); Los Angeles-Long Beach-Anaheim, CA ($267,500); Seattle-Tacoma-Bellevue, WA ($264,606; San Diego-Carlsbad, CA ($262,000); Sacramento–Roseville–Arden-Arcade, CA ($200,000); Riverside-San Bernardino-Ontario, CA ($180,000); Boston-Cambridge-Newton, MA-NH ($180,000); Portland-Vancouver-Hillsboro, OR-WA ($176,000); and Denver-Aurora-Lakewood, CO ($175,000).

ATTOM’s latest home sales analysis also reported that nationwide, all-cash purchases accounted for 30.3 percent, or one of every three single-family house and condo sales in 2021 – the highest level since 2015. The report noted the latest figure was up from 22.8 percent in 2020 and from 25 percent in 2019, although still off the 38.5 percent peaks in 2011 and 2012.

The analysis also noted that institutional investors nationwide accounted for 6.9 percent, or one of every 14 single-family home and condo sales in 2021 in the U.S., the highest level since 2013. The reported stated the latest figure was up from 2.7 percent in 2020 and 3.6 percent in 2019.

Want to learn more about how home sales are trending in your area? Contact us to find out how!