According to ATTOM’s newly released Q2 2023 U.S. Home Sales Report, profit margins on median-priced single-family home and condo sales in the U.S. increased to 47.7 percent in the second quarter – the first gain in a year.

ATTOM’s latest home sales analysis reported that the improvement in typical profit margins, from 43.9 percent in Q1 2023, came amid a rebound in the U.S. housing market that pushed the median nationwide home price up 10 percent quarterly to $350,000. The report noted that both the nationwide profit margin and median home price increased after three straight quarterly drop-offs that had begun to reverse a decade-long market boom.

Also according to the report, median single-family home and condo prices increased from Q1 to Q2 2023 in 96 percent of U.S. metros analyzed and were up annually in 60 percent of those metros. The report noted that nationwide, the median home price rose from $317,000 in Q1 2023 and 2.4 percent over the previous record of $341,750, set in Q2 2022.

ATTOM’s Q2 2023 home sales analysis also reported that among metro areas, the biggest increases in median home prices from Q1 2023 to Q2 2023 were in Rochester, NY (up 20 percent); Madison, WI (up 19.1 percent); Bridgeport. CT (up 18.6 percent); St. Louis, MO (up 17 percent) and Augusta, GA (up 16.9 percent).

The report stated that aside from Rochester and St. Louis, the largest median-price increases in Q2 2023 in metro areas with a population of at least 1 million were in Detroit, MI (up 15.8 percent); Birmingham, AL (up 15.6 percent) and Grand Rapids, MI (up 14.5 percent).

The Q2 2023 report also mentioned that home prices tied or hit new highs in Q2 2023 in 57 percent of the 156 metros analyzed. Those metros with a population of more than 1 million that set or tied records in the second quarter included Chicago, IL; Miami, FL; Dallas, TX; Washington, DC, and Atlanta, GA.

ATTOM’s latest home sales report also found that the only metro areas with a population of at least 1 million where the median home price declined from Q1 to Q2 2023 were Honolulu HI (down 1.4) and Salt Lake City (down .03 percent).

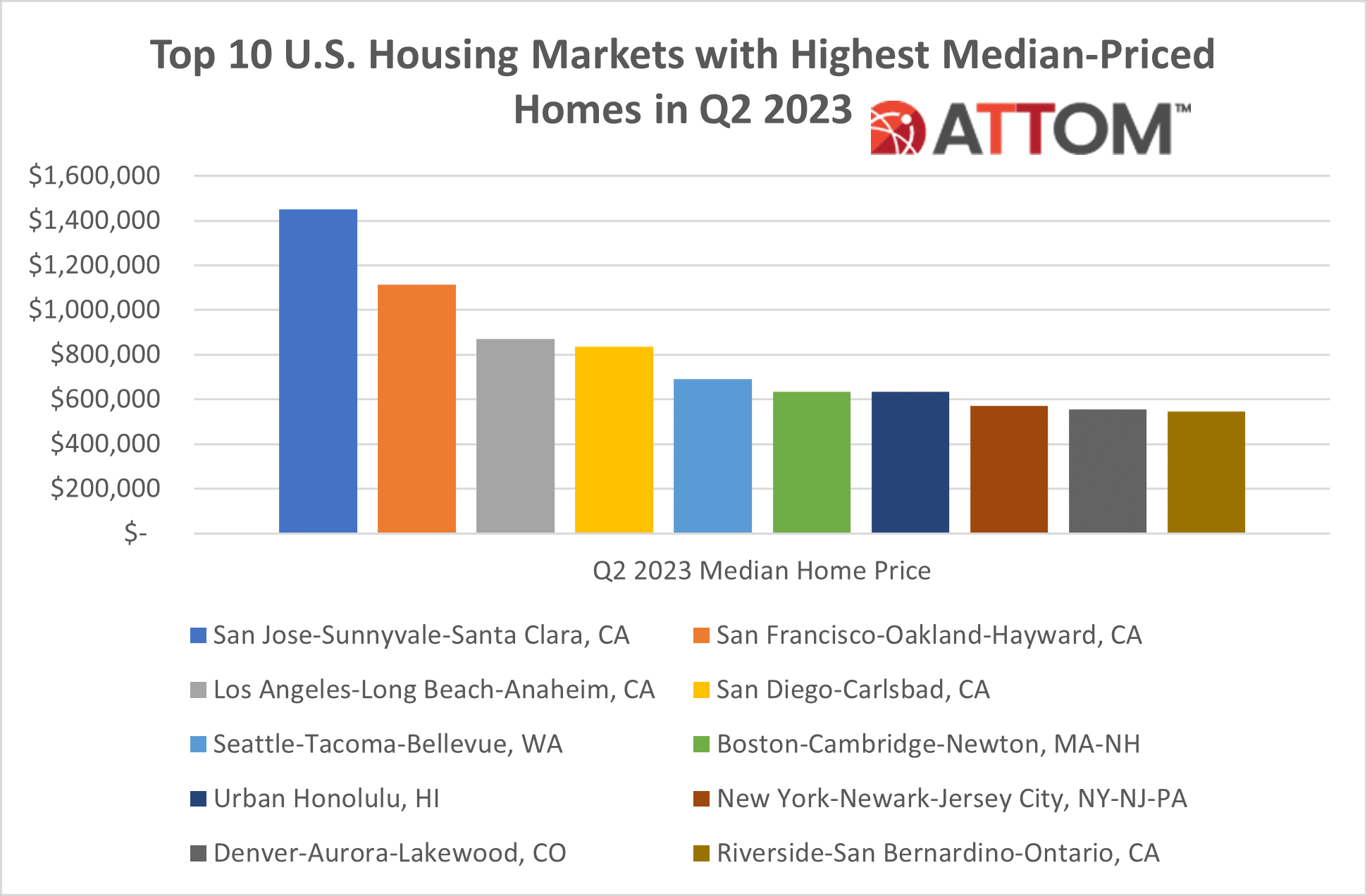

In this post, we dive deeper in the data behind the latest ATTOM home sales report to uncover the top 10 U.S. major markets with the highest median-priced single-family homes and condos in Q2 2023. Among those metros with a population of 1 million or more, those with the highest median-priced homes included: San Jose-Sunnyvale-Santa Clara, CA ($1,450,000); San Francisco-Oakland-Hayward, CA ($1,114,500); Los Angeles-Long Beach-Anaheim, CA ($871,375); San Diego-Carlsbad, CA ($835,000); Seattle-Tacoma-Bellevue, WA ($690,000); Boston-Cambridge-Newton, MA-NH ($635,000); Urban Honolulu, HI ($635,000): New York-Newark-Jersey City, NY-NJ-PA ($570,000); Denver-Aurora-Lakewood, CO ($555,000); and Riverside-San Bernardino-Ontario, CA ($545,000).

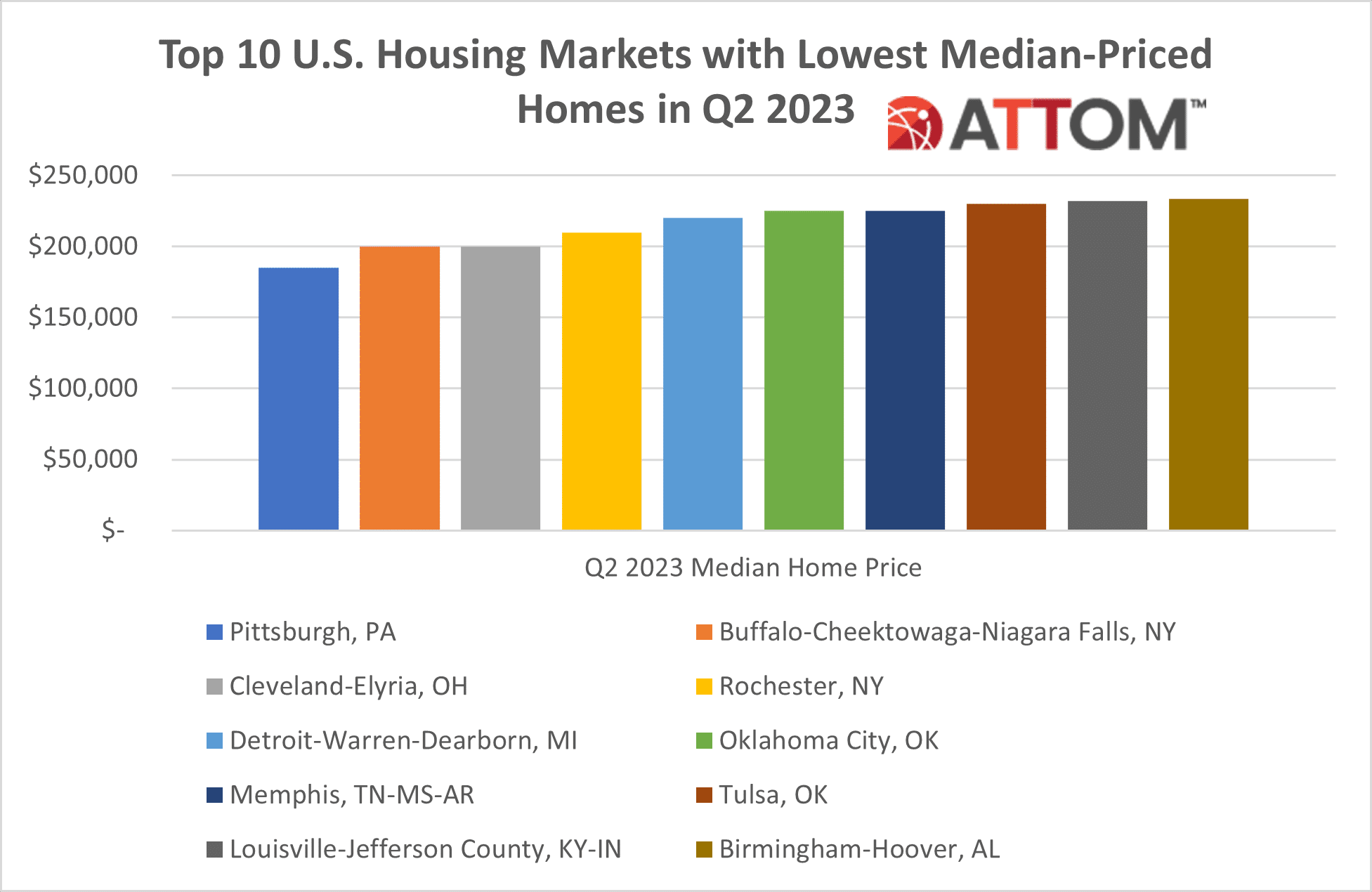

Also in this post, we dive deeper in the data behind the latest ATTOM home sales report to uncover the top 10 U.S. major markets with the lowest median-priced single-family homes and condos in Q2 2023. Among those metros with a population of 1 million or more, those with the lowest median-priced homes included: Pittsburgh, PA ($184,900); Buffalo-Cheektowaga-Niagara Falls, NY ($200,000); Cleveland-Elyria, OH ($200,000); Rochester, NY ($209,900); Detroit-Warren-Dearborn, MI ($220,000); Oklahoma City, OK ($225,000); Memphis, TN-MS-AR ($225,073); Tulsa, OK ($230,000); Louisville-Jefferson County, KY-IN ($232,250); and Birmingham-Hoover, AL ($233,500).

Want to learn more about home trends in your market? Contact us to find out how!