According to ATTOM Data Solutions’ newly released 2020 Year-End U.S. Home Sales Report, home sellers nationwide in 2020 realized a home-price gain of $68,843 on the typical sale. That figure is up from $53,700 in 2019 and $48,500 two years ago.

ATTOM’s latest home sales analysis reported that profits rose in more than 90 percent of housing markets with enough data to analyze, while the latest figure, based on median purchase and resale prices, marked the highest level in the U.S. since at least 2005.

The report noted that the $68,843 profit on median priced single-family homes and condos represented a 34.7 percent return on investment compared to the original purchase price. That figure was up from 29.4 percent last year and 27.2 percent in 2018, to the highest average home-seller return on investment since 2006.

ATTOM’s 2020 year-end analysis also showed that both raw profits and ROI have improved nationwide for nine straight years, and last year’s gain in ROI marked the largest annual increase since 2017. According to the report, profits shot up as the national median home price rose 12.8 percent in 2020 to $266,250 – a record high.

The report revealed that distressed home sales, which include bank-owned (REO) sales, third-party foreclosure auction sales and short sales, accounted for 7.8 percent of all U.S. single-family home and condo sales in 2020. That figure was down from 11.1 percent in 2019 and 12.4 percent in 2018. The report metnioned the latest figure was less than one-quarter of the peak of 38.6 percent in 2011 and marked the lowest point since 2005.

The year-end report noted the states where distressed sales comprised the largest portion of total sales in 2020 were Connecticut (15.3 percent of sales), Rhode Island (14.7 percent), Delaware (13.8 percent), Illinois (12.6 percent) and Maryland (12.6 percent). Those with the lowest were Utah (2.1 percent), Maine (2.2 percent), Idaho (2.6 percent), Montana (3.2 percent) and Mississippi (3.5 percent).

ATTOM’s 2020 year-end report also noted that among 196 metro areas with a population of at least 200,000 and sufficient data, those where distressed sales represented the largest portion of all sales in 2020 were Chico, CA (18 percent of sales); Atlantic City, NJ (17.6 percent); Peoria, IL (16.8 percent); New Haven, CT (16.2 percent) and Norwich, CT (16.2 percent).

According to the analysis, among 53 metros with a population of at least 1 million, those with the highest levels of distressed sales in 2020 were Hartford, CT (15.5 percent of sales); Providence, RI (14.9 percent); Baltimore, MD (13.9 percent); Cleveland, OH (13.5 percent) and Chicago, IL (12.2 percent).

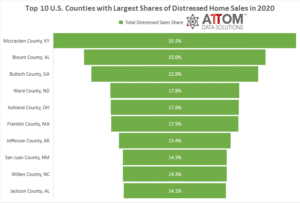

In this post, we dig deep into the data behind our 2020 year-end home sales report to uncover the top 10 U.S. counties with the largest shares of distressed home sales in 2020.

Among those counties with a population of 50,000 or more and 50 or more total distressed home sales in 2020, the top 10 were Mccracken County, KY (33.3 percent); Blount County, AL (25.0 percent); Bulloch County, GA (22.9 percent); Ward County, ND (17.8 percent); Ashland County, OH (17.6 percent); Franklin County, MA (17.5 percent); Jefferson County, AR (15.4 percent); San Juan County, NM (14.3 percent); Wilkes County, NC (14.3 percent); and Jackson County, AL (14.1 percent).

ATTOM’s 2020 year-end home sales report stated the high-level findings, including the combination of rising profits and record prices, came during a year when the national housing market fended off damage that afflicted wide swaths of the U.S. economy after the Coronavirus pandemic of 2020 began spreading across the country in February.

With unemployment levels not seen since the Great Depression, millions of businesses temporarily or permanently closed or cut back. Although, the housing market boom that began in 2012 continued into its ninth year as a spate of buyers relatively unaffected financially by the pandemic chased a declining supply of houses and pushed prices ever higher.

Want to learn more about distressed home sale trends in your area? Contact us to find out how!