According to ATTOM’s just released Q2 2022 U.S. Home Affordability Report, affordability has worsened across the nation this quarter amid a renewed jump in home prices that has pushed the typical portion of average wages nationwide required for major home-ownership expenses up to 33 percent.

ATTOM’s latest home affordability analysis found that the latest portion is considered unaffordable by common lending standards, which call for a 28 percent debt-to-income ratio. The report notes that figure also marks the highest level since 2007 and remains well above the 25 percent figure from early in 2022, when a spike in home-mortgage rates had just begun to raise ownership costs.

Also according to ATTOM’s new report, the worsening picture facing home buyers reflects the second shift in the U.S. housing market in the past year, coming as the median single-family home price has shot up to a new record following three quarters of declines.

The latest report notes that nationwide, the median single-family home value has risen 10 percent from Q1 to Q2 2023, to $350,000 – one of the biggest quarterly increases in the past decade. That median price sits 2 percent above the previous peak hit a year earlier before the market stalled and prices dropped.

ATTOM’s Q2 2023 home affordability also report notes that with home values shooting up, the portion of average local wages consumed by major expenses on median-priced, single-family homes has grown from Q1 2023 to Q2 2023 in 94 percent of counties analyzed. That figure is up annually in 92 percent of them.

The latest report also found that annual wages of more than $75,000 are needed to pay for major costs on the median-priced home purchased in Q2 2023 in 51 percent of the markets in the report.

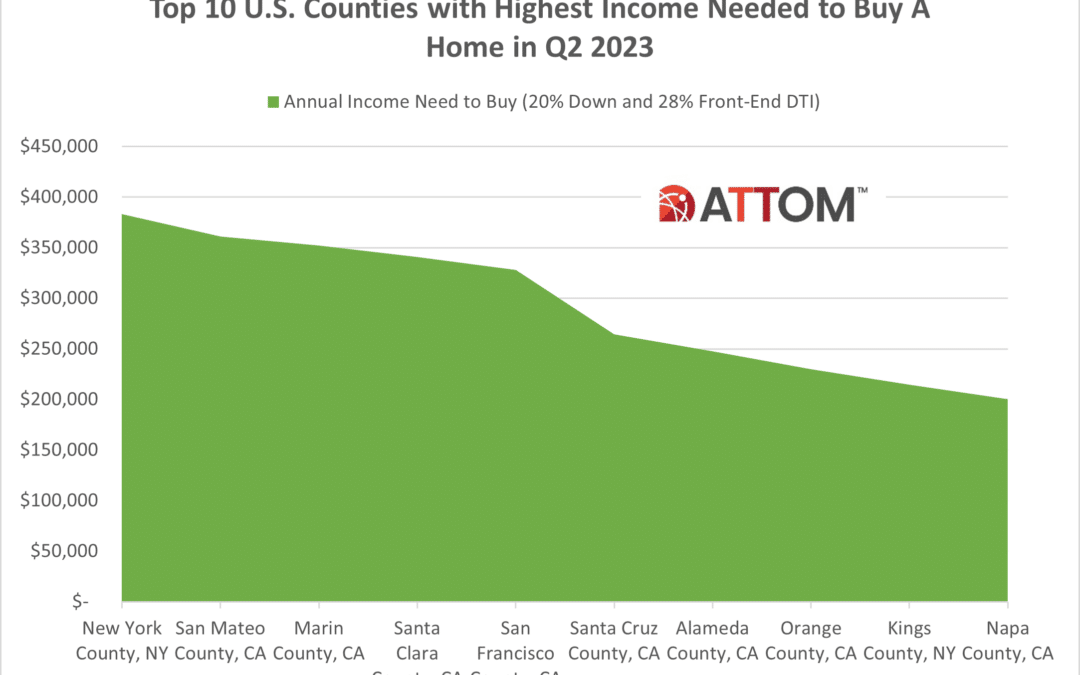

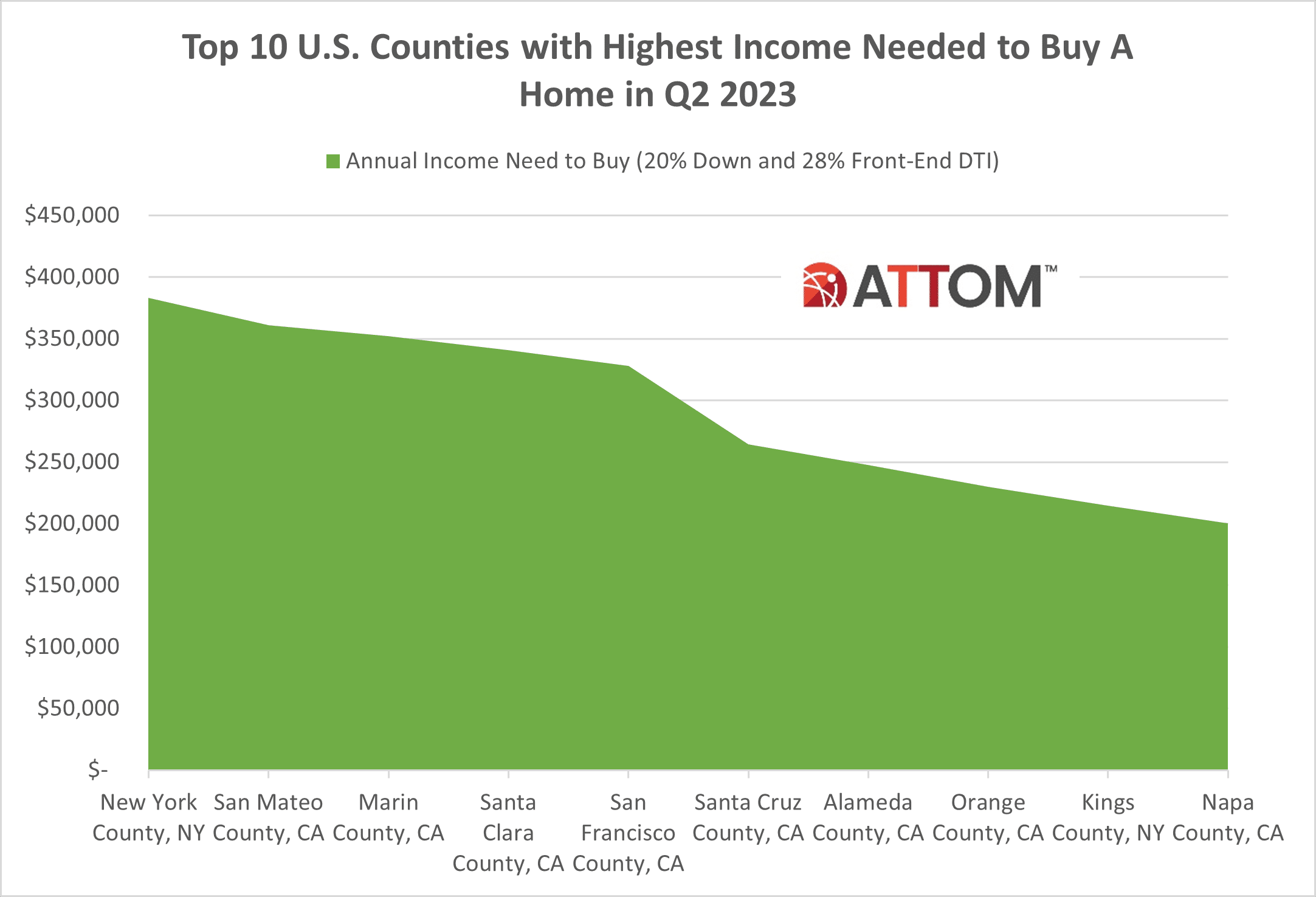

The report noted the top 25 highest annual wages required to afford typical homes are on the east or west coasts, led by New York County (Manhattan), NY ($383,062); San Mateo County (outside San Francisco), CA ($361,004); Marin County (outside San Francisco), CA ($352,153); Santa Clara County (San Jose), CA ($340,803) and San Francisco County, CA ($327,906).

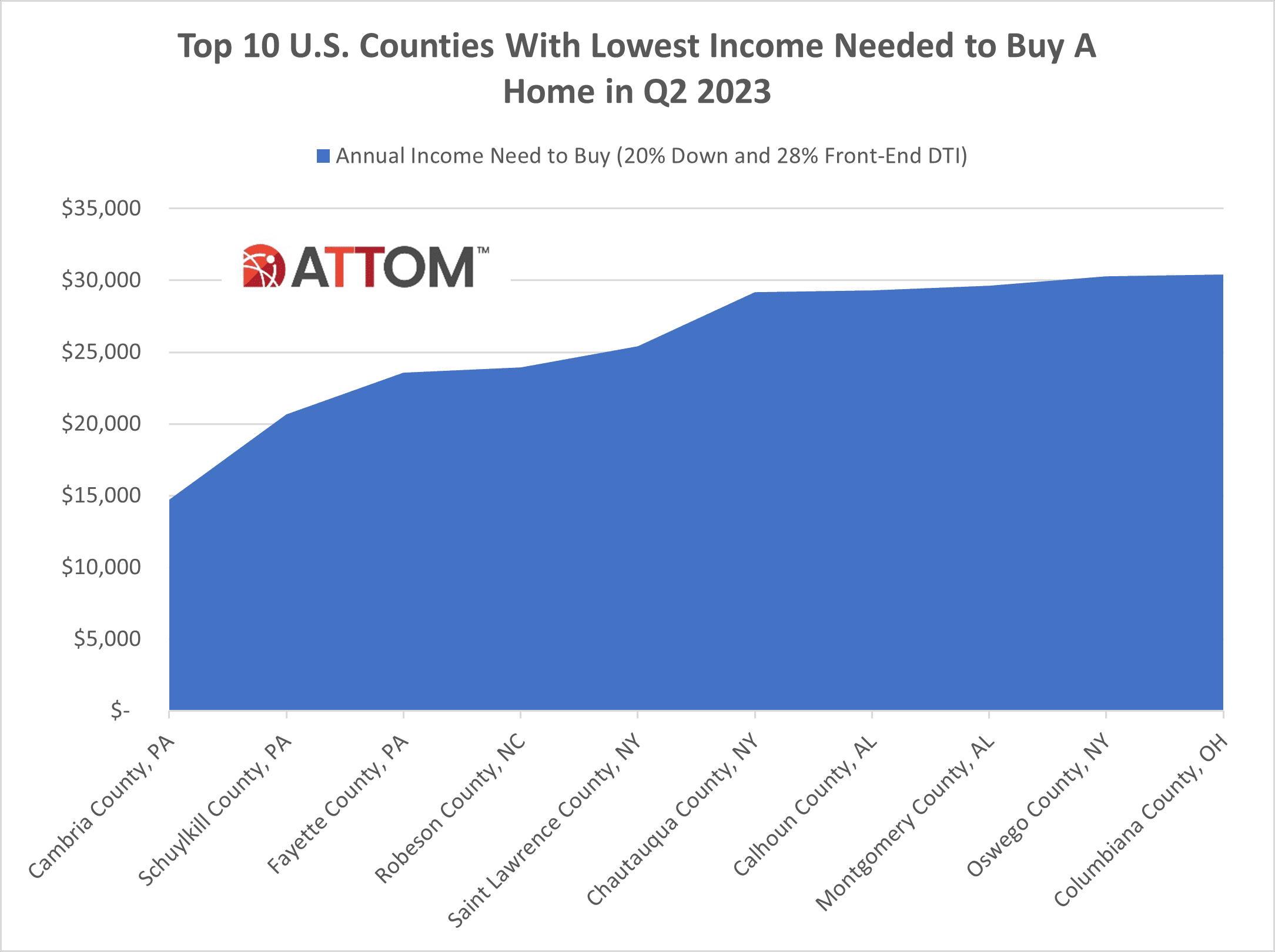

ATTOM’s new affordability report also noted the lowest annual wages required to afford a median-priced home in Q2 2023 are in Cambria County, PA (outside Pittsburgh) ($14,715); Schuylkill County, PA (outside Allentown) ($20,679); Fayette County, PA (south of Pittsburgh) ($23,555); Robeson County, NC (outside Fayetteville) ($23,937) and St. Lawrence County, NY (north of Syracuse) ($25,405).

In this post, we uncover the complete list of those top 10 U.S. counties with the highest annual wages required to afford a median-priced home in Q2 2023. Rounding out that list are: Santa Cruz County, CA ($264,439); Alameda County, CA ($247,384); Orange County, CA ($229,790); Kings County, NY ($214,396); and Napa County, CA ($200,400).

Also in this post, we uncover the complete list of those top 10 U.S. counties with the lowest annual wages required to afford a median-priced home in Q2 2023. Rounding out that list are: Chautauqua County, NY ($29,163); Calhoun County, AL ($29,304); Montgomery County, AL ($29,644); Oswego County, NY ($30,266); and Columbiana County, OH ($30,387).

ATTOM’s home affordability report determines affordability for average wage earners by calculating the amount of income needed to meet major monthly home ownership expenses — including mortgage, property taxes and insurance — on a median-priced single-family home, assuming a 20 percent down payment and a 28 percent maximum “front-end” debt-to-income ratio. That required income is then compared to annualized average weekly wage data from the Bureau of Labor Statistics.

Want to learn more about home affordability in your area? Contact us to find out how!